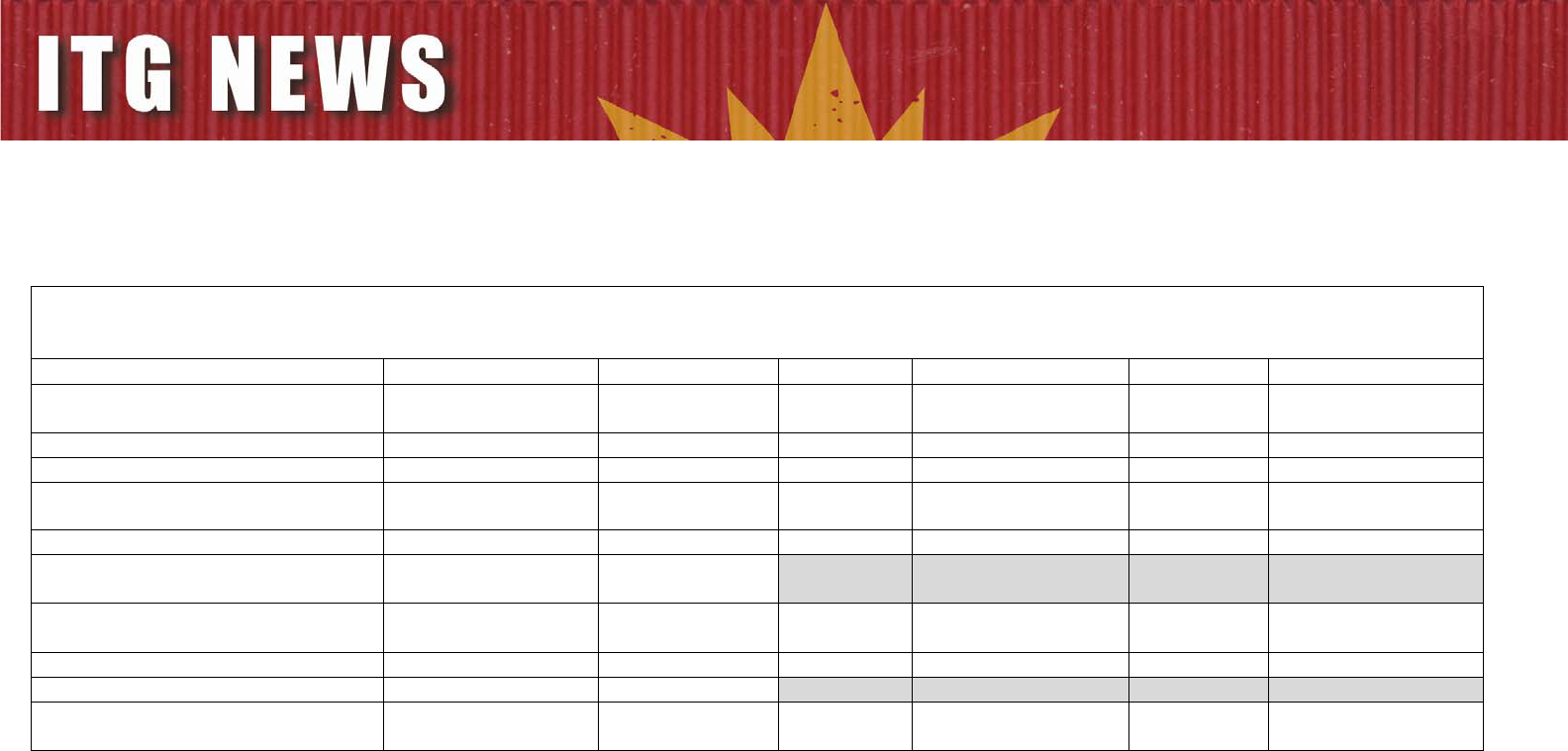

Year-end Reconciliation Worksheet for Forms 941, W-2, and W-3

• Annual amounts from payroll records should match the total amounts reported on all Forms 941 for the year.

• Total amounts reported on all Forms 941 for the year should match the sum of the same data fields shown in W-2/W-3 totals.

• If these amounts do not match, recheck records and identify necessary adjustments.

a b c d e f (c-e)

Comparison Area 941 Line# Form 941

(all 4 quarters)

W-2, W-3

Box #

W-2s

(total of all forms)

Amount on

W-3

Difference

(col c minus col e)

Compensation Line 2 1

Federal Income Tax Line 3 2

Social Security Wages Line 5a Column 1 3

Social Security Tips Line 5b Column 1 7

Social Security Tax

Line 5a + 5b

Column 2

Social Security Tax Comparison

Computation

Line 5a + 5b x

(4.2/10.4)

4

Medicare Wages Line 5c Column 1 5

Medicare Tax Line 5c Column 2

Medicare Tax

Comparison Computation

Line 5c divided by 2 6