4

A. AGENCY BANK ACCOUNTS AND INVESTMENTS

Marina Verba, Division Chief - Bank Reconciliation

E-mail: [email protected]

Critical Dates:

• July 1, 2024- Electronic distribution of Active Bank Accounts Report

• July 31, 2024 - Submit June Bank

Reconciliations, and completed Active

Bank Accounts Report with Representation letter

• July 31, 2024 -

Agencies with Demand Accounts should submit J2I

Document ID number

• August 30, 2024 - Submit July Bank Reconciliations

1. Cash in Agency Bank Accounts

The City is required to record the cash in Agency bank accounts within its financial statements.

To accomplish this, we have prepared from our records a year-end report of your Agency’s active

bank accounts (Active Bank Accounts Report) for you to review and update (if needed). This

report will be distributed to each Agency via email on July 1, 2024.

If the information we have provided on the form is incomplete or incorrect, please correct or update

it by making the appropriate notation, and submit corrections via our File Transfer Portal (FTP) or

by email to [email protected]

. If there are new or existing accounts that

are not listed on our report, please add them to the listing; explain the purpose and source of the

funds. Please indicate the date the account was opened and attach a copy of the letter requesting

the opening of the account.

If a listed account has been closed please mark it “account closed” and indicate the date when it

was closed. Attach a copy of the final bank reconciliation, bank statement reflecting zero balance

in the account and letter to the bank requesting the closing of the account.

Continued receipt of bank statements showing zero balances for accounts, that are considered

closed, indicates that the accounts have not been closed by the bank. A request must be sent to

the Department of Finance to officially close these accounts. Requests to close a bank account

or to open a new bank account must be submitted to the Department of Finance, Bureau of

Treasury, Division of Banking Operations, 66 John Street, 12

th

Floor New York, N.Y. 10038 or via

email at [email protected]

.

2. Bank Statements/Reconciliations

Bank reconciliations must be prepared on a monthly basis for all Agency bank accounts. Refer

to the simplified bank reconciliation template provided at the end of this section for guidance on

submitting FY 2024 reconciliations.

Bank reconciliations (including reconciliations for Imprest Funds) for the month of June 2024

should be submitted via FTP or email to [email protected]

by July 31,

2024 to the attention of Ms. Marina Verba. Please upload each reconciliation as a separate

file with the last 4 digits of the account number as a file name. In cases where bank

reconciliations contain outstanding checks as of June 30, 2024, reconciliations for the month of

July 2024 should be submitted by August 30, 2024. If there are checks still outstanding,

submission of bank reconciliations for subsequent months are expected to be sent in until all of

the outstanding checks as of June 30, 2024 have cleared the bank. Please note that checks

5

with an issuance date of over 180 days must be stopped with the bank and cancelled on

the books; they cannot be carried on the reconciliation.

All copies of bank statements and reconciliations must be legible; especially the name of the

bank, the account number, and the book balance as of June 30, 2024. The name and the email

address of the preparer must appear on the bank reconciliation or Active Bank Account Report.

It is important to remember that the Supervisor must sign the completed reconciliation to

indicate that the document was reviewed. Electronic signature is an acceptable form of

certification.

If your Agency bank statements are not normally prepared by the bank as of the end of the month,

request a June 30, 2024 cutoff bank statement from the bank in advance.

In addition to reconciling monthly to internal records, Agencies with Pool and Satellite

Bank Accounts must also reconcile to the Central Pool Worksheet Balances Computerized

Report of the Department of Finance, Bureau of Treasury.

Bank reconciliations, which are revised after the initial submission, must be immediately

forwarded to the Bank Reconciliation Division. Upon submission, please indicate that it is the

revised bank reconciliation and ensure that the Supervisor’s signature is on the

resubmitted reconciliation.

3. Investments

The City is required to record outstanding investments as of June 30, 2024 on its financial

statements. Therefore, all monies transferred, disbursed or otherwise withdrawn from Agency

bank accounts for investment purposes (certificates of deposit, insured money market accounts,

etc.) which were outstanding as of June 30, 2024 must be reported to our office for each

investment.

The following information must be provided via email in Excel format by July 31, 2024:

Description of Investment;

Cost;

Maturity Value;

Fair Market Value at June 30, 2024;

Indication whether the monies are City Funds or Non-City Funds;

Indication whether the monies were invested by your Agency, the Department of Finance

or another entity; and

Name of the bank account, bank account number, code and sub-code from which the

monies were withdrawn for the investment.

4. Agency Representation

We require one representation letter per Agency to be signed by the Agency Head, (i.e.

Commissioner, Fiscal Officer, Director or authorized designee), stating that all the Agency’s bank

accounts and outstanding investments have been reported to the Comptroller's Office. As

mentioned above, electronic signature is acceptable. Please complete the attached Bank

Accounts and Investments Representation letter which can be downloaded from the Comptroller’s

website, and return it by July 31, 2024 via email to [email protected]

or

upload to the FTP along with the following documentation:

Agency Active Bank Account Report;

Copies of bank statements and bank reconciliations as of June 30, 2024;

Outstanding checks lists (include: check number, date issued and amount of check); and

Schedule of outstanding investments as of June 30, 2024.

6

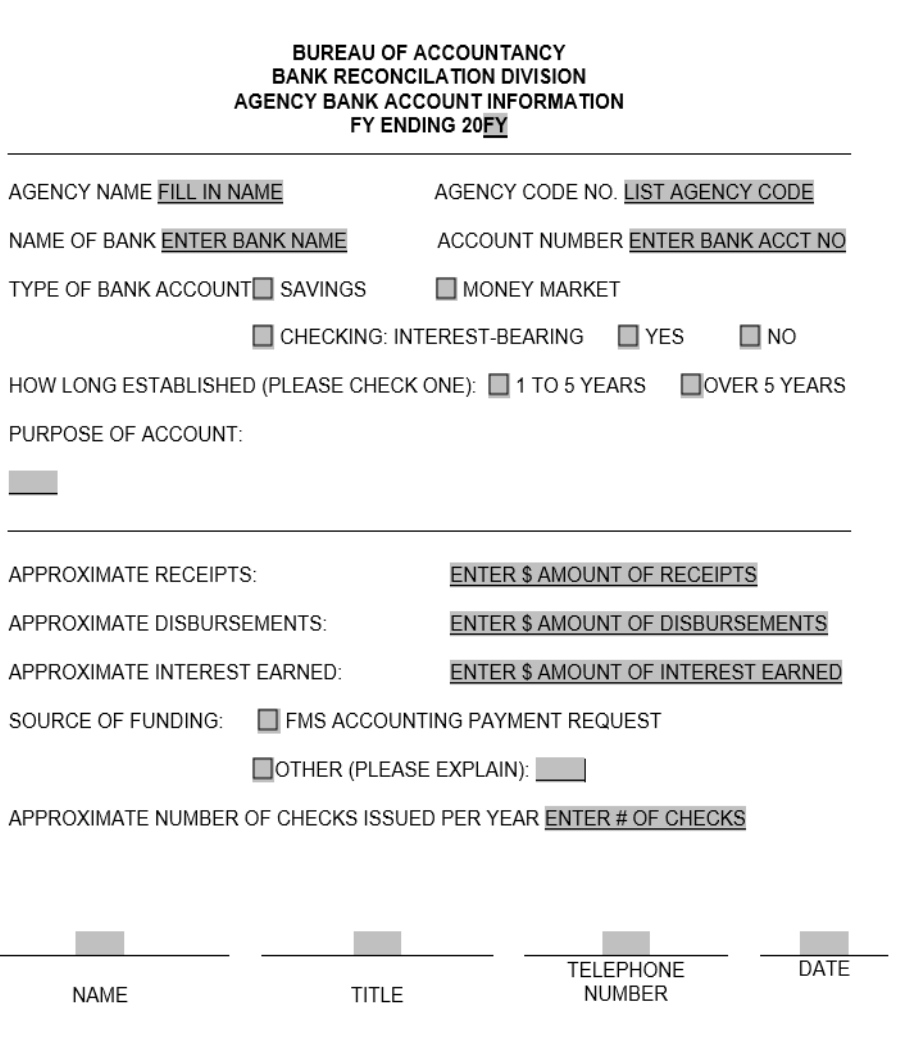

5. Agency Bank Account Information

For all new bank accounts opened during Fiscal Year 2024 that have not been registered with the

Department of Finance, a revised Agency Bank Account Information form must be included as

part of the June 2024 bank reconciliation package. Complete a separate form for each new bank

account and return the form along with the 2024 bank reconciliation package to the attention of

Ms. Marina Verba at the Bank Reconciliation Division via email to

[email protected]. The form can be downloaded from the Comptroller’s

Website. A sample of the form is included at the end of this section.

6. Interest-Bearing Accounts

All City Agencies holding City monies in Interest-Bearing Accounts are responsible for remitting

the interest earned during the Fiscal Year to the City Treasury. The interest earned should be

posted to “Fund 001 Agency 015 Budget Code 1001 Revenue Source 56001” on the CRE (Cash

Receipt) related to your City Treasury deposit. Once the CRE is created contact the Revenue

Monitoring Unit at [email protected]

for approval. Be sure to attach supporting

documentation to the CRE.

Please have the breakdown of all such remissions (clearly stated as an attachment) on the June

bank reconciliation, and submit it to Ms. Marina Verba via email to

.

7. Expense Demand Accounts

Agencies with Expense Demand Accounts (identified as “ED” on the Active Agency Bank

Account report) must create a J2I entry in FMS Accounting to transfer charges to expenditures,

not exhausted by the end of the Fiscal Year, from Fiscal Year 2024 to Fiscal Year 2025. For the

purpose of calculating the J2I entry amount please use the ending book balance (that does not

include the outstanding checks) from the reconciliation and add cash withdrawn from the account

and not spent as of June 30, 2024. Correct budget and detail object codes need to be used when

creating J2I entries in FMS Accounting.

The following items must be submitted in addition to the items listed in section #4 to

or via FTP to the attention of Ms. Marina Verba by July

31, 2024:

J2I Document ID Number in the form of either a screenshot of the header page in FMS or

a memo indicating the J2I document ID number.

Note: At the point of submitting the information to the Comptroller’s Office the J2I

should have the agency level 3 approval applied to the document.

An accountability statement signed by the Agency Head, (i.e. Commissioner, Fiscal

Officer, Director or authorized designee) verifying the book balance in the account at

June 30, 2024.

8. Inactive Accounts

Agencies should carefully review and identify all inactive accounts maintained by the agency and re-

evaluate the need for them. Any account, which is determined to no longer be required, should be

closed in accordance with the procedures established by the Bureau of Treasury, Department of

Finance.

7

BANK ACCOUNTS AND INVESTMENTS REPRESENTATION

Date: ___________

Ms. Marina Verba

Bank Reconciliation Division

Bureau of Accountancy

Office of the Comptroller

One Centre Street– Room 200 South

New York, NY10007

Dear Ms. Verba:

We represent to you that the attached listing of bank accounts and schedule of

investments at June 30, 2024 is a full and complete list of all bank accounts and

outstanding investments maintained by our Agency for the City of New York.

Name: _________________________________

Title: _________________________________

Agency Name: _________________________________

Cordially,

Signature

THIS FORM CAN BE DOWNLOADED FROM THE COMPTROLLER'S WEBSITE, COMPLETED AND RETURNED

ELECTRONICALLY.

8

THIS FORM CAN BE DOWNLOADED FROM THE COMPTROLLER'S WEBSITE, COMPLETED AND RETURNED

ELECTRONICALLY

.

9

Bank Reconciliation Template

CITY OF NEW YORK "AGENCY NAME" - "ACCOUNT NAME" “BANK NAME”

ACCOUNT NUMBER

ACCOUNT RECONCILIATION

JUNE 30, 2024

BEGINNING BOOK BALANCE (06/01/2024)

ADD:

$0.00

(1) June Cash Receipts

$0.00

(2) BANK INTEREST

$0.00

(3) VOID/STOPPED CHECK

$0.00

Sub-total:

$0.00

SUBTRACT

(4) June Disbursements

$0.00

(5) BANK CHARGES

$0.00

(6) NSF CHECKS DEPOSIT

$0.00

Sub-total:

$0.00

ENDING BOOK BALANCE (06/30/2024)

$0.00

ADJUSTMENTS TO THE ENDING BOOK BALANCE:

ADD:

(7) OUTSTANDING CHECKS (UNPRESENTED)

$0.00

Sub-total:

$0.00

ADJUSTED BOOK BALANCE (06/30/2024)

$0.00

BALANCE AS PER BANK STATEMENT (06/30/2024)

$0.00

ADD

(8) DEPOSIT IN TRANSIT

$0.00

(9) CASH ON HAND

$0.00

ADJUSTED BANK BALANCE (06/30/24)

$0.00

Difference in Reconciliation (must be $0 zero)

$0.00

Prepared by (print)

Reviewed by (print)

Title : Title :

Signature (preparer)

Signature (reviewer)

Date :

Date :

References:

(1) Funds received in books

(2) Interest received from bank

(3) Checks written but subsequently stopped or voided

(4) Checks written

(5) Bank service charges

(6) Checks received, recorded in your books, deposited in bank, but subsequently returned by bank for reasons

(7) Checks written by agency, payee has not cashed the checks

(8) Checks written to agency, recorded in your books, but not yet cleared in the bank

(9) Cash withdrawn from the account and not yet spent

THIS FORM CAN BE DOWNLOADED FROM THE COMPTROLLER'S WEBSITE, COMPLETED AND RETURNED

ELECTRONICALLY

.