Banking for GL

September 2014

Icebreaker

Class Format

• Presentation

• Demonstrations

• Exercises

• Questions. Ask them! We’ll either:

– answer immediately

– put them on a “Parking Lot” and get an answer

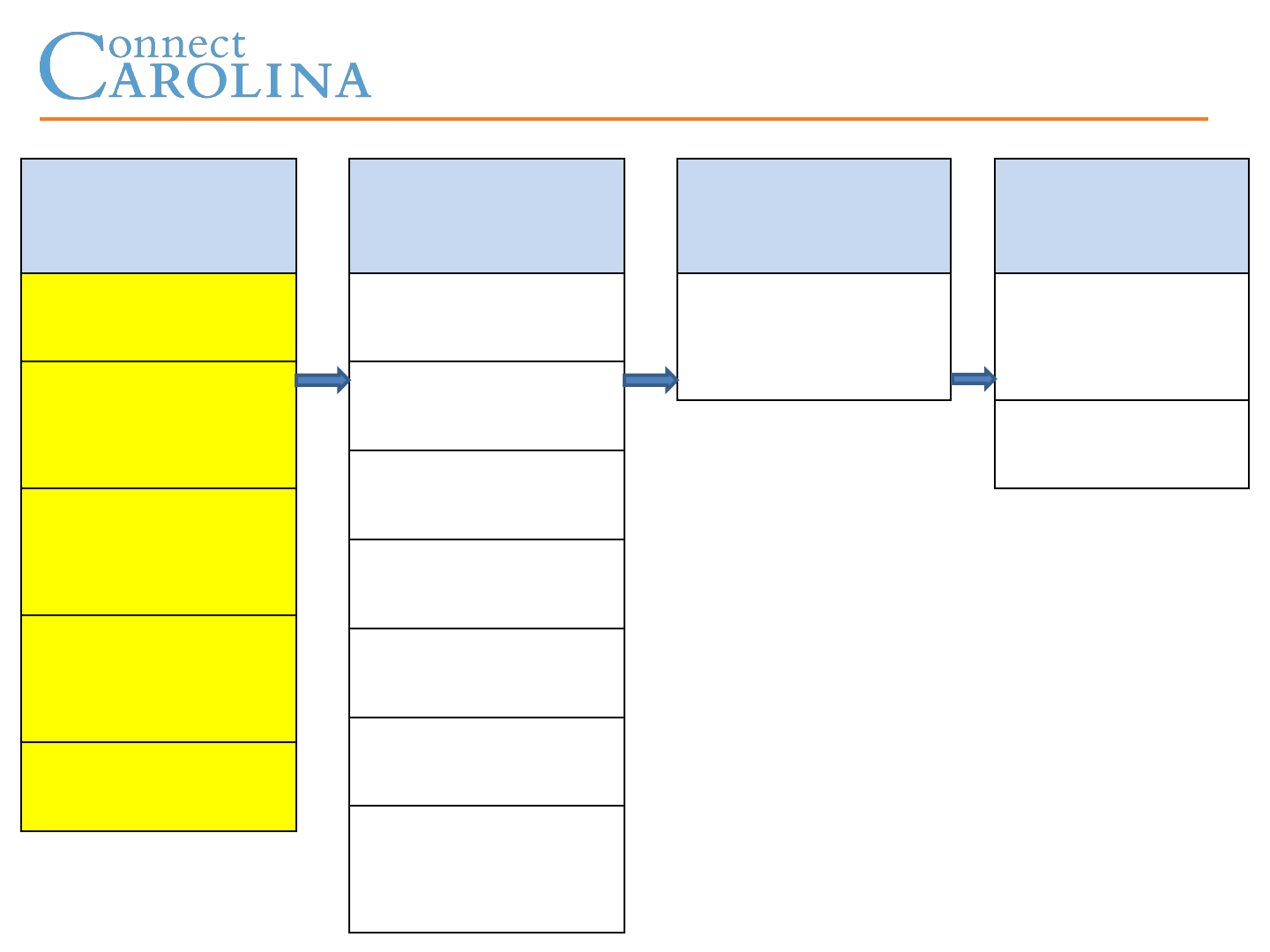

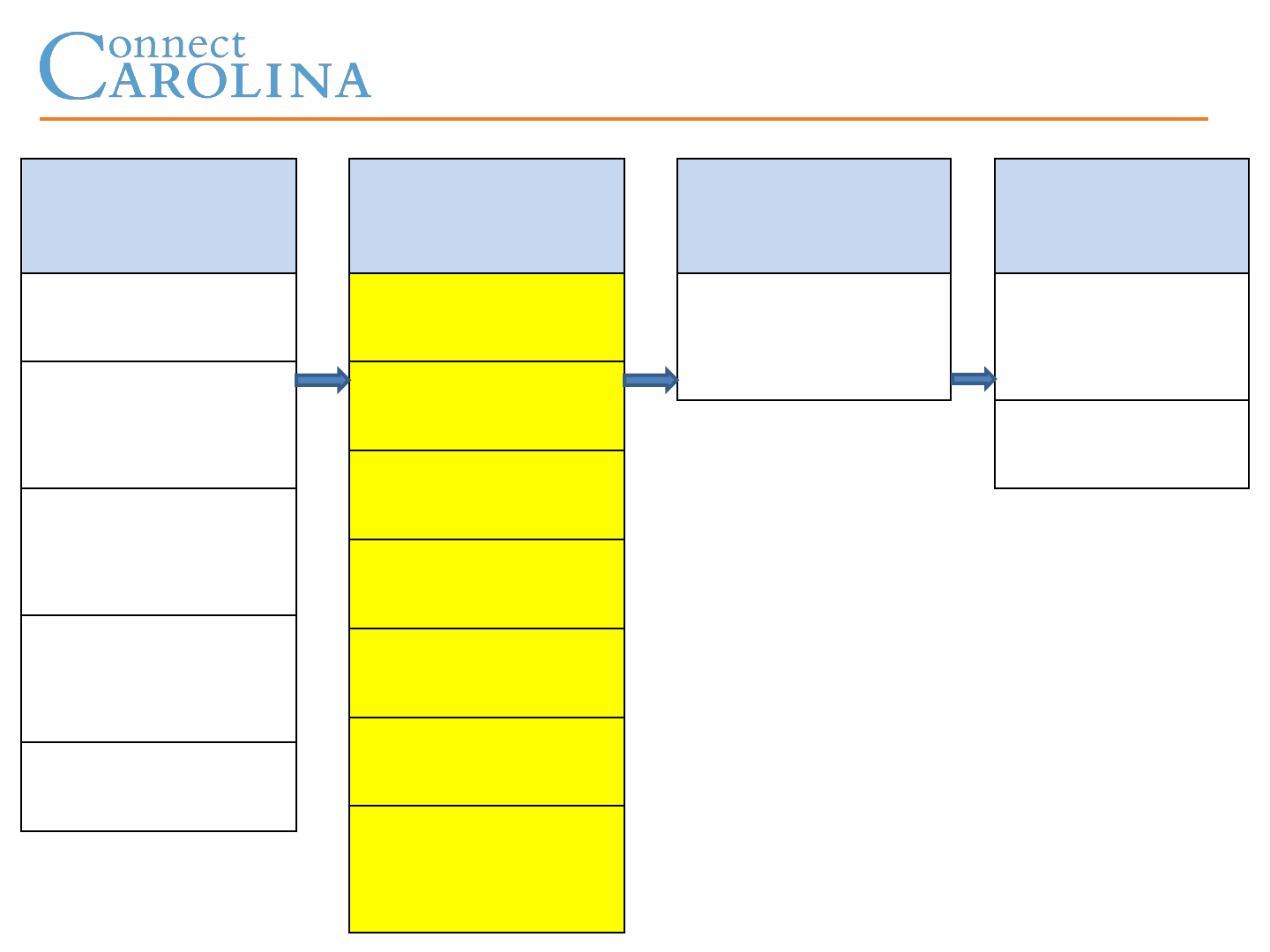

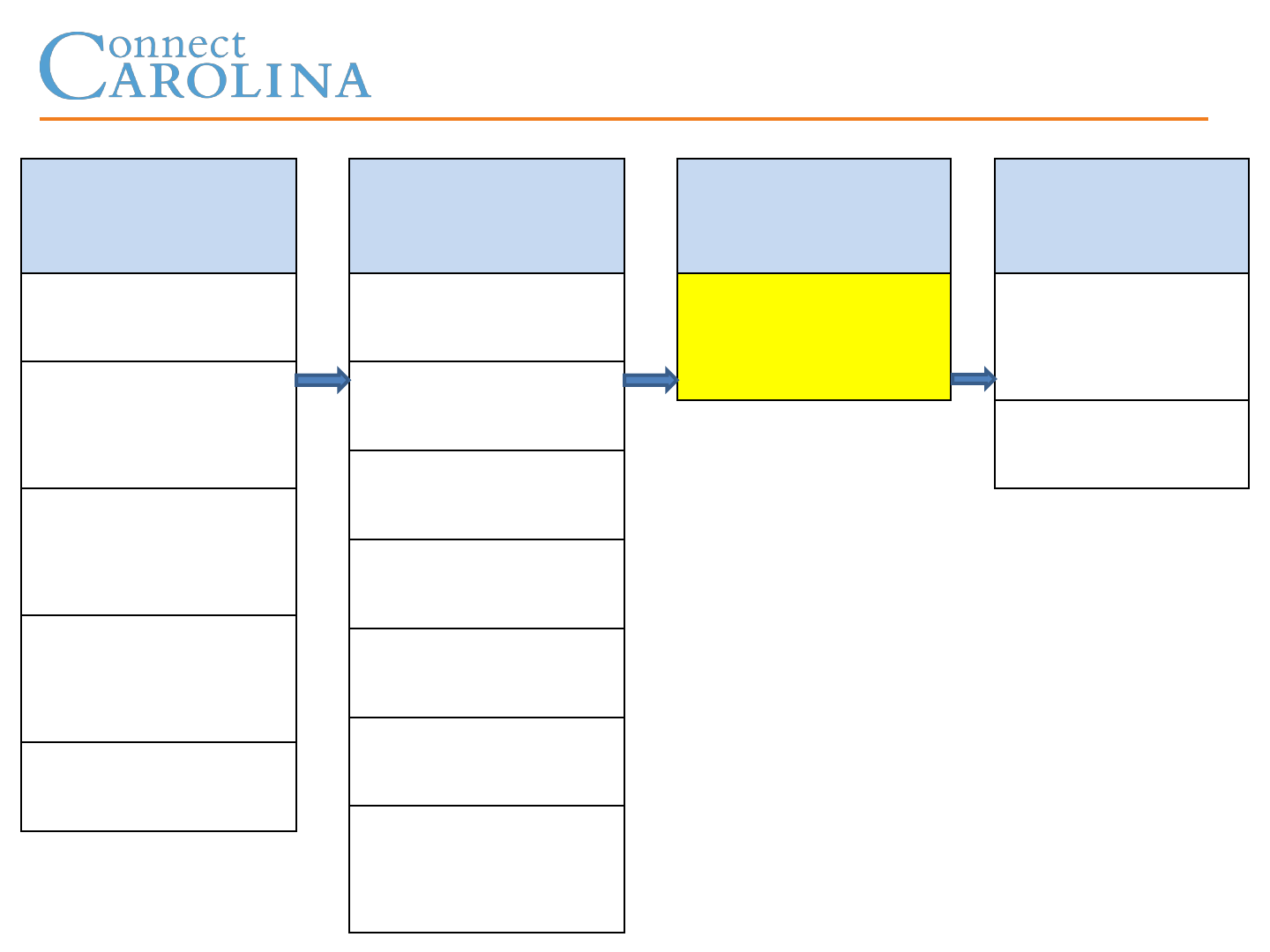

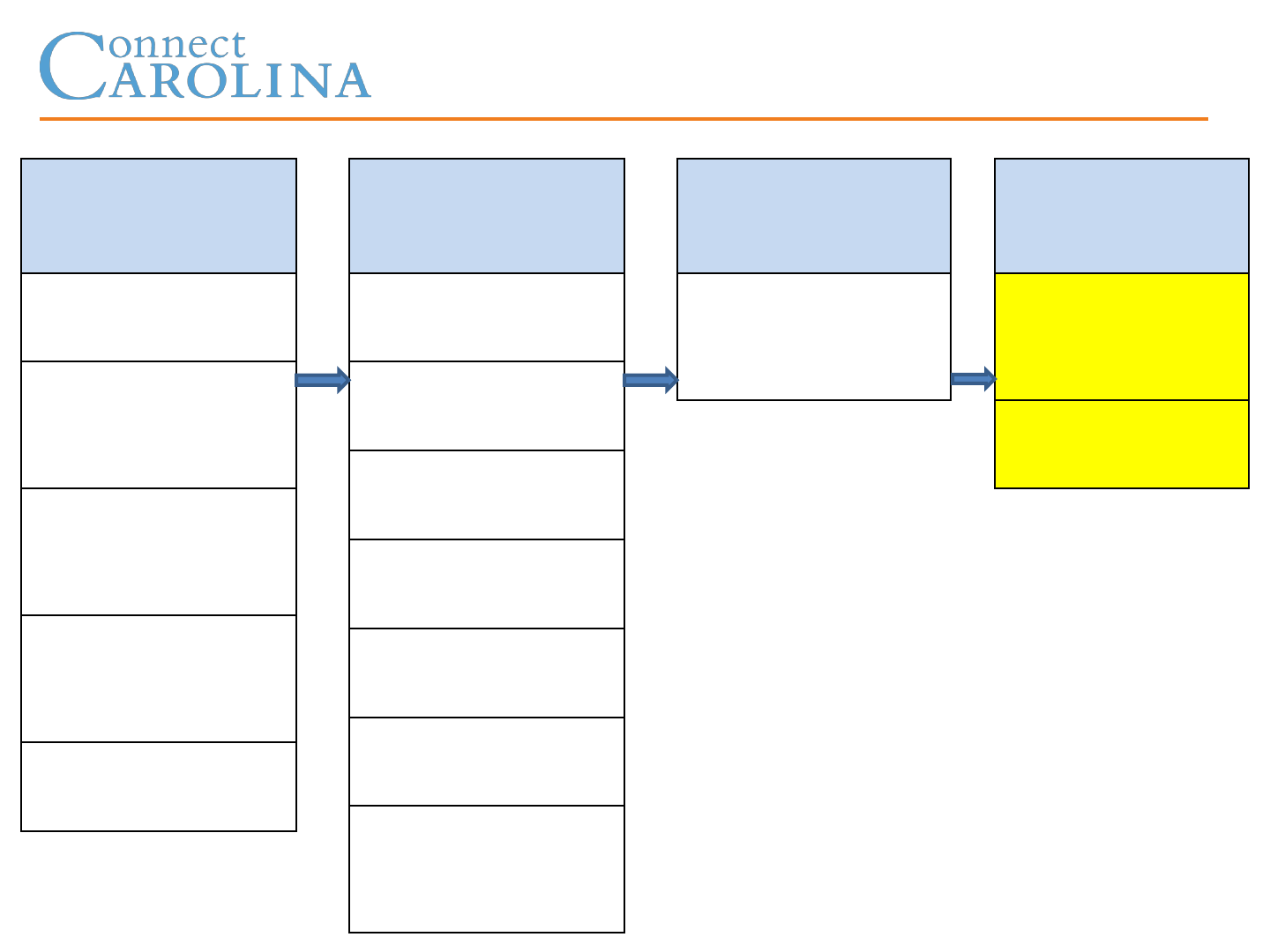

Course Map

Bank

Reconciliation

Overview of Bank

Reconciliation

Entering Bank

Statement

Information

Running

Automated Bank

Reconciliation

Running Semi-

Manual Bank

Reconciliation

Recording Interest

& Fees

Bank

Transfers

Overview of Bank

Transfers

Creating a Transfer

Template

Approving a

Transfer Template

Entering a Bank

Transfer

Selecting a

Settlement

Approving a

Settlement

Running

Automated

Accounting

Wire

Transfers

Dispatching a

Payment in

Financial Gateway

Memo Bank

Balancing

Understanding

Memo Bank

Balancing

Running the Re-

balancing Query

Bank Reconciliation Overview

• The primary reasons for performing bank reconciliations

include:

– Identifying timing differences and imbalances between bank and

system transactions

– Identifying potential accounting or banking errors

– Detecting instances of fraud or other unauthorized activity

• Bank reconciliations play a vital role in managing cash at the

university

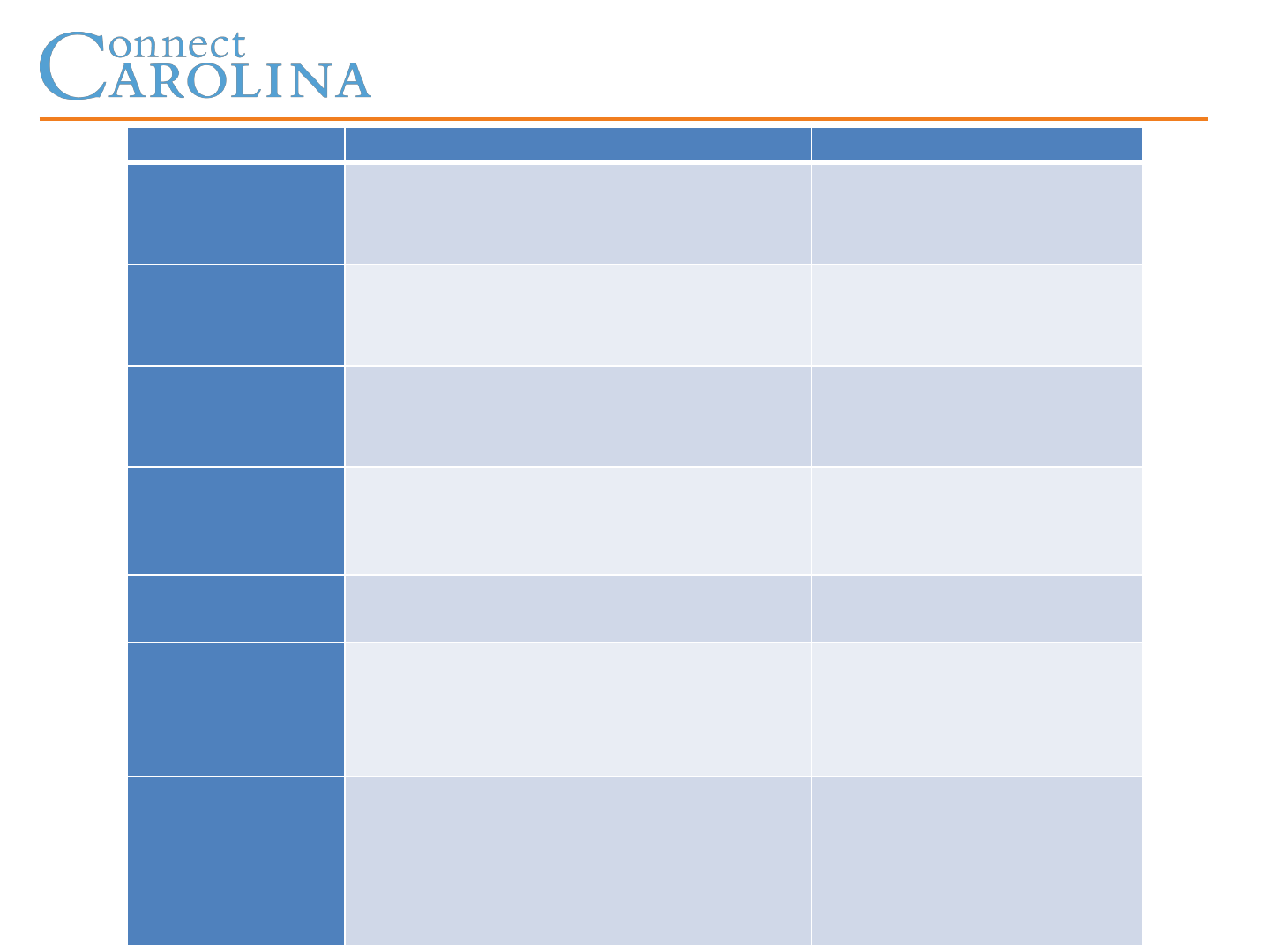

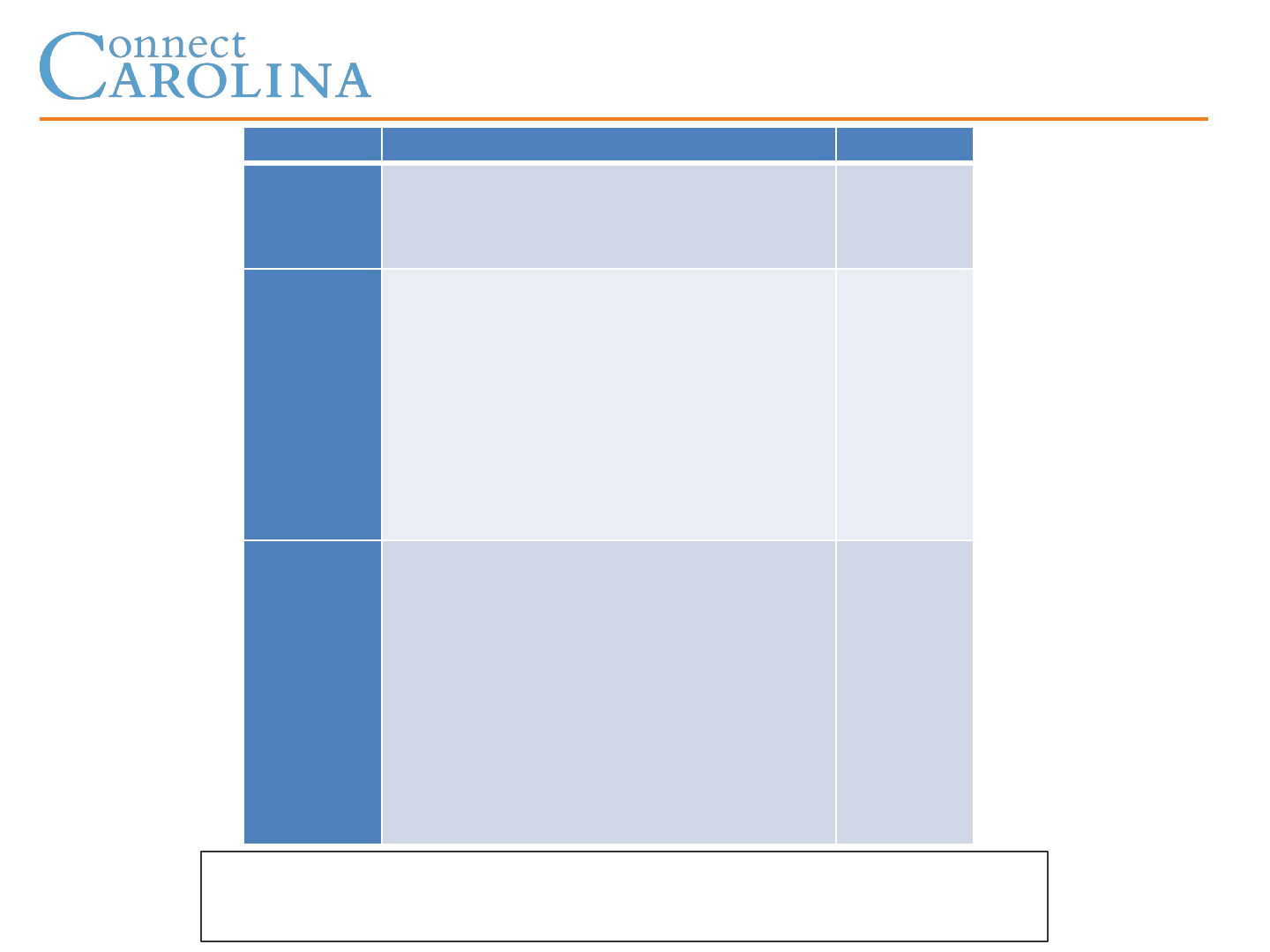

Banking Definitions

Field

Description

Example

External

Bank

ID

Code that identifies the bank. It is the

bank’s routing number. It is assigned

by the bank's regulatory agency.

053110594

Bank

Account

#

Assigned by the bank.

It is a number

or code that identifies the bank

account.

1000720

Bank Code

A code that is used to group together

more than one bank account. It is

assigned

by the banking team.

BK802

Bank Account

The bank account is the last four

digits of the bank account number.

0720

Statement date

Statement date from

the bank

statement.

9/22/2014

Transaction

date

The date the system transaction

occurred in

ConnectCarolina

8/25/2014

Bank Date

The date the bank recorded the

transaction

on the bank statement

8/25/2014

Note:

The Bank date

cannot be greater than

the Statement date.

Bank Reconciliation Process Steps

1. Enter or Import Bank Statement Information

2. Run Automated Bank Reconciliation Process

3. Run Semi Manual Bank Reconciliation Process

4. Record Interest and Fees

5. Query system for relevant reconciliation information

6. Compile bank reconciliation information in Excel

Bank Reconciliation

• Step 2: Running Automated Bank Reconciliation:

• Key steps:

A. Search for the entered bank statement

B. Select the bank statement

C. Click on the Run Recon button

• Demonstration and Exercise 1-2: Running Automated Bank

Reconciliation

– Reference:

• Running the Automated Reconciliation Process

Exercise

Bank Reconciliation

• Step 3: Running Semi-Manual Bank Reconciliation:

• Key steps:

A. Search for unreconciled bank and system transactions

B. Select the unreconciled bank and system transactions that are a

match

C. Click on the Reconcile button

• Demonstration and Exercise 1-3: Running Semi-Manual Bank

Reconciliation

– Reference:

• Running the Semi-Manual Bank Reconciliation Process

Exercise

Bank Reconciliation

• Step 4: Recording Interest and Fees:

• Key steps:

A. Enter the external bank interest or bank fee transaction header

information

B. Enter the external bank interest or bank fee transaction detail

information

C. Click on the Save button

• Demonstration and Exercise 1-4: Recording Interest and Fees

– Reference:

• Recording Interest and Fees

Exercise

Course Map

Bank

Reconciliation

Overview of Bank

Reconciliation

Entering Bank

Statement

Information

Running

Automated Bank

Reconciliation

Running Semi-

Manual Bank

Reconciliation

Recording Interest

& Fees

Bank

Transfers

Overview of Bank

Transfers

Creating a Transfer

Template

Approving a

Transfer Template

Entering a Bank

Transfer

Selecting a

Settlement

Approving a

Settlement

Running

Automated

Accounting

Wire

Transfers

Dispatching a

Payment in

Financial Gateway

Memo Bank

Balancing

Understanding

Memo Bank

Balancing

Running the Re-

balancing Query

Bank Transfers Overview

• The primary reasons for executing bank transfers include:

– funding bank accounts used for disbursements

– balancing memo banks

• Bank transfers are executed at the university’s various

external banking institutions

• The Manual Check (MAN) payment method is the generic

form of payment used for the bank transfer

• The MAN payment method is a recording of a transaction that

has already occurred outside the system

• System automatically creates a generic chartfield string to

conduct all bank transfers

Bank Transfer Process Steps

1. Create a Transfer Template

2. Approve a Transfer Template

3. Enter a Bank Transfer

4. Select a Settlement

5. Approve a Settlement

6. Run Automated Accounting

7. Manually Run Journal Generator

Bank Transfers

• Step 4: Selecting a Settlement:

• Key steps:

A. Search for unselected bank transfer transactions

B. Select the bank transfer transaction

C. Click on the Select Payments button

• Demonstration and Exercise 2-4: Selecting a Settlement

– Reference:

• Selecting a Settlement

Bank Transfers

• Step 6: Reviewing Treasury Accounting Entries:

• Key steps:

A. Enter Business Unit

B. Click on the Search button

C. Select the Bank Transfer Source ID

D. Click on the Chartfields tab under the accounting entries section

• Demonstration and Exercise 2-6: Reviewing Treasury

Accounting Entries

– Reference:

• Running Automated Accounting

Exercise

Course Map

Bank

Reconciliation

Overview of Bank

Reconciliation

Entering Bank

Statement

Information

Running

Automated Bank

Reconciliation

Running Semi-

Manual Bank

Reconciliation

Recording Interest

& Fees

Bank

Transfers

Overview of Bank

Transfers

Creating a Transfer

Template

Approving a

Transfer Template

Entering a Bank

Transfer

Selecting a

Settlement

Approving a

Settlement

Running

Automated

Accounting

Wire

Transfers

Dispatching a

Payment in

Financial Gateway

Memo Bank

Balancing

Understanding

Memo Bank

Balancing

Running the Re-

balancing Query

Dispatching a Wire Payment

• Financial Gateway is part of the system where wire transfer

vouchers are dispatched to bank

• Currently only Domestic wire vouchers and foreign wire

vouchers paid in US Dollars are dispatched through Financial

Gateway

• Foreign wire vouchers paid in foreign currency are handled

outside the system and are recorded with a Manual payment

method when the voucher is created. These types of vouchers

are not dispatched through Financial Gateway

• Disbursement Services creates and posts the wire transfer

vouchers. Accounting Services dispatches the wire transfer

vouchers to the bank

• There will be a communication between AP Disbursement

Services and Accounting Services when a wire transfer

voucher is created and posted

Dispatching a Wire Payment

• Navigation: Main Menu > Finance Menu > Financial

Gateway > Process Payments > Payment Dispatch

• Key steps:

A. Choose Awaiting Dispatch = Dispatch Status

B. Choose Wire Transfer = Payment Method

C. Enter the start and end date of the payment date range

D. Click on the Search button

E. Mark the wire payment transaction(s) that need to be

dispatched

F. Click on the Dispatch Settlements button

G. Click OK

• Demonstration: Dispatching a Wire Payment

– Reference:

• Dispatching a Payment in Financial Gateway

Course Map

Bank

Reconciliation

Overview of Bank

Reconciliation

Entering Bank

Statement

Information

Running

Automated Bank

Reconciliation

Running Semi-

Manual Bank

Reconciliation

Recording Interest

& Fees

Bank

Transfers

Overview of Bank

Transfers

Creating a Transfer

Template

Approving a

Transfer Template

Entering a Bank

Transfer

Selecting a

Settlement

Approving a

Settlement

Running

Automated

Accounting

Wire

Transfers

Dispatching a

Payment in

Financial Gateway

Memo Bank

Balancing

Understanding

Memo Bank

Balancing

Running the Re-

balancing Query

Memo Bank Balancing Overview

• Memo bank balancing is conducted on a daily basis

• GL cash account balance indicates where the amount of the

actual funds were booked in the system

• Memo bank number indicates the account the money should

have been booked to

• Run the NC_MEMO_BANK_UNCCH or

NC_MEMO_BANK_UNCGA Re-balancing query to identify

discrepancies between GL cash accounts and memo bank

balances

• The memo bank balance is always the correct balance that the

user reconciles to. The user is trying to make the GL balance

reflect the Memo Bank balance. Bank transfers need to be

made to increase or reduce the GL amount to match the

Memo Bank balance

Memo Banking Definitions

Field

Description

Example

Bank

Account

The bank account is the last four

digits of the bank account number it

represents.

0720

GL

Cash

Account

A unique six

-

digit GL cash account has

been setup for all bank accounts.

UNC

-Chapel Hill cash accounts begin

with 111 and UNC General

Administration cash accounts begin

with 110. All GL cash accounts end

with their assigned three digit memo

bank number.

111002

Memo

Bank

Number

Each bank account is assigned a

unique three

-digit memo bank

number. The memo bank number is

the last three digits of the GL cash

account. All fund codes are assigned a

memo bank number in the system.

The memo bank number indicates

the account that fund code’s money

should be held in.

002

In the system, there is a one-to-one relationship between bank

accounts, memo bank numbers, and GL cash accounts.

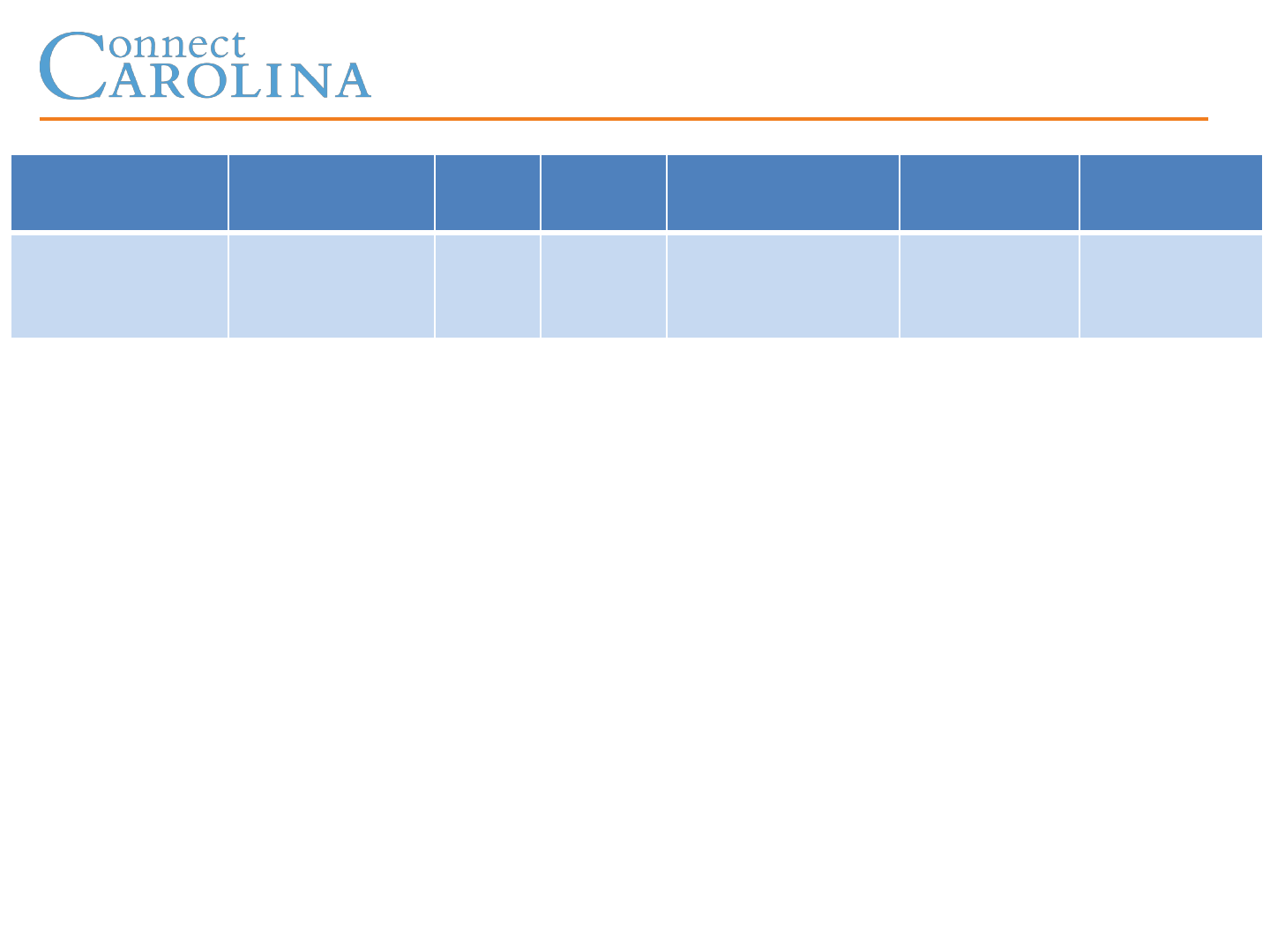

External Accounts Example

External

Bank ID

Bank

Account #

Bank

Code

Bank

Account

GL Cash

Account

Memo

Bank

Bank

053110594

1000720

BK802

0720

111002

002

NC State

Treasurer

Memo Bank Balancing

• Key Steps:

1. Run the re-balancing queries (NC_MEMO_BANK_UNCCH or

NC_MEMO_BANK_UNCGA)

2. Perform rebalancing analysis to determine necessary bank transfers

3. Perform necessary bank transfers, run automated accounting, and run

journal generator

4. Re-run re-balancing query

5. Verify GL cash account balances equal their respective memo bank

balances

6. Post GL journals

7. Save rebalancing query results in Excel

• Demonstration: Memo Bank Balancing

– Reference:

• Understanding Memo Bank Balancing

• Running the Re-balancing Query

Questions & Answers

Now What?

• Training Website

http://cctraining.web.unc.edu/

• ConnectCarolina Website

http://ccinfo.unc.edu/