[Type here]

Your policy document ¦ Reference ACCC 1019

Classic Car

ERS POLICY DOCUMENT NUMBER ACCC 1019 2

Your policy document

Welcome to your ERS policy document. To know exactly what your insurance covers with us, please make sure to read this

If you have any questions about your cover, please contact your broker directly.

This insurance is written in English and any communications we send to you about it will be in English.

The law of England and Wales will apply to this contract unless:

▪ You and we agree otherwise or

▪ At the start date of the contract you are a resident of (or in the case of a business, the registered office or principal place

of business is in) the Channel Islands or the Isle of Man, in which case the law of that area of jurisdiction will apply

Our agreement – your insurance

This policy document, certificate of motor insurance, schedule, any schedule of endorsements form the contract of insurance

between you (the insured) and us (ERS).

You should read all parts of the contract as one document. Please remember to read the contract carefully, including all

terms, conditions and exceptions to ensure it meets your needs.

The contract does not give, or intend to give, rights to anyone else. No-one else has the right to enforce any part of this

Signed for and on the behalf of ERS

Martin Hall

Active Underwriter

About ERS

Syndicate Management Limited, which is authorised by the Prudential

Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. (Registered

number 204851).

ERS Syndicate Management Limited is registered in England and Wales number 426475. The registered office is:

21 Lombard Street, London, EC3V 9AH

ERS POLICY DOCUMENT NUMBER ACCC 1019 3

Contents

Definitions 4

What to do if you need to make a claim 5

Cover 7

Section 1 Liability to others 8

Section 2 Loss of or damage to your vehicle 10

Section 3 Medical expenses 15

Section 4 Personal accident benefits 15

Section 5 Personal belongings 15

Section 6 Loss of keys and replacing locks 16

Section 7 Child seats 16

Section 8 Foreign use 16

Section 9 Inflatable storage device 16

General terms 17

General exceptions 18

General conditions 20

Complaints 22

Important notices and information 24

ERS POLICY DOCUMENT NUMBER ACCC 1019 4

Definitions

The key words and terms that we use in this document

▪ Accessories parts added to your vehicle that do not affect its performance

▪ Agreed value the amount which represents the insured value of your vehicle.

Note: If your insurance has been accepted on an agreed value, it will be indicated on your policy schedule

▪ Approved repairer a motor vehicle repairer which is a member of our approved repairer network and is authorised by us

to repair the insured vehicle after a valid claim under Section 2 of this insurance

▪ Certificate of motor insurance a document which is legal evidence of your insurance and which forms part of this

document, and which you must read with this document

▪ Courtesy car a Group B (small standard private car) or PV1 (small car-derived van or similar) vehicle loaned to you by our

approved repairer whilst the insured vehicle is being repaired after a valid claim under Section 2 of this insurance.

Note: A courtesy car is intended to keep you mobile. It is not necessarily a like for like replacement of your vehicle. All

courtesy cars are subject to the driver meeting the terms and conditions of hire from the approved repairer.

▪ Endorsement a change in the terms of the insurance which replaces the standard insurance wording, and is printed on, or

issued with, the current schedule and current schedule of endorsements

▪ ERS

ask us for the names of the underwriters

and the share of the risk each has taken on

▪ Excess a contribution by you towards a claim under this insurance

▪ Market value the cost of replacing your vehicle with another one of the same make, model and specification and of

similar age, mileage and condition at the time of an accident or loss

▪ Period of insurance the period of time covered by this insurance (as shown on the schedule) and any further period for

which we accept your premium

▪ Private garage a permanent structure, providing an enclosed area, which is comprised of: brick, stone, concrete, timber

or steel sides, with a roof and with lockable secure entrance door(s), which is your private property or; secure locked barns,

car vaults or other secure parking facilities which have been previously declared to and accepted by us

▪ Road any place which is a road for the purpose of any compulsory motor insurance law that operates in the United

Kingdom

▪ Schedule / Policy schedule the document showing the vehicle we are insuring and the cover which applies. To be read in

conjunction with the Schedule of endorsements

▪ Schedule of endorsements the document showing endorsements that apply. To be read in conjunction with the policy

schedule

▪ Trailer a trailer, semi-trailer or container used for carrying goods but which cannot be driven itself

▪ United Kingdom England, Scotland, Wales, Northern Ireland, the Isle of Man and the Channel Islands

▪ We, us ERS

▪ You

renewal notice applying to this insurance

▪ Your vehicle, the insured vehicle any vehicle shown on the schedule or described on the current certificate of motor

insurance (and under section 1 only, an attached caravan or trailer)

ERS POLICY DOCUMENT NUMBER ACCC 1019 5

What to do if you need to make a claim

Nobody likes having to make a claim. But by following these two simple steps you can make sure it goes smoothly:

▪ You must tell us about any potential claim at the earliest opportunity. If applicable, and it is safe to do so, please call us

from the scene of the accident

▪ Take photographs of any damage to the vehicles involved

Claims and windscreen helpline 0330 123 5992

▪ Call this number if you need to report an accident, fire or theft or windscreen claim (if applicable)

▪

soon as possible

▪ If your claim is due to theft, attempted theft, malicious damage or vandalism, you should also notify the Police and obtain

a crime reference number

You can count on us for all this:

▪ A market-leading customer experience

▪ A specialist team to handle your claim

▪ A network of approved suppliers to get you back on the road quickly

▪ Fraud prevention to keep your premiums low

▪ Positive handling of third-party claims to keep costs down

▪ Sophisticated tools to help claims go smoothly

Repairing your vehicle

If your insurance covers damage to your vehicle, we can talk you through the options for getting it repaired.

▪

▪ ck to you after the repairs

▪

▪ You will be provided with a guaranteed courtesy car to ensure you can keep mobile (Comprehensive cover only)

▪ An expert claim handler will manage your claim for you.

We want to get you back on the road as soon as possible.

Keeping your vehicle safe

Please make sure your vehicle is locked and the keys are in a safe place.

unauthorised person if:

▪ It was left unlocked or

▪ It was left with the keys (or any form of keyless entry / ignition control device), in or on it or

▪ It was left with the windows, roof panel or the roof of a convertible vehicle open (if your vehicle has these) or

▪ Reasonable precautions were not taken to protect it

ERS POLICY DOCUMENT NUMBER ACCC 1019 6

If someone makes a claim against you

There are a few simple steps you can take to try to reduce the amount of any claim against you and to protect yourself

against fraudulent claims.

▪

• Their name, address and contact number

• The registration number and make and model of their vehicle

•

Take photos of:

▪ Any damage to their vehicle

▪ Any damage to your own vehicle

▪

Make a note of:

▪ Any injuries to anyone involved

▪ The number of passengers in the other vehicle

▪ The name, address and contact number of any witnesses

▪ The name and contact number of any Police officer who attends the scene of the accident

▪ Any unusual behaviour from the other person and the direction they take when they leave the scene

ERS POLICY DOCUMENT NUMBER ACCC 1019 7

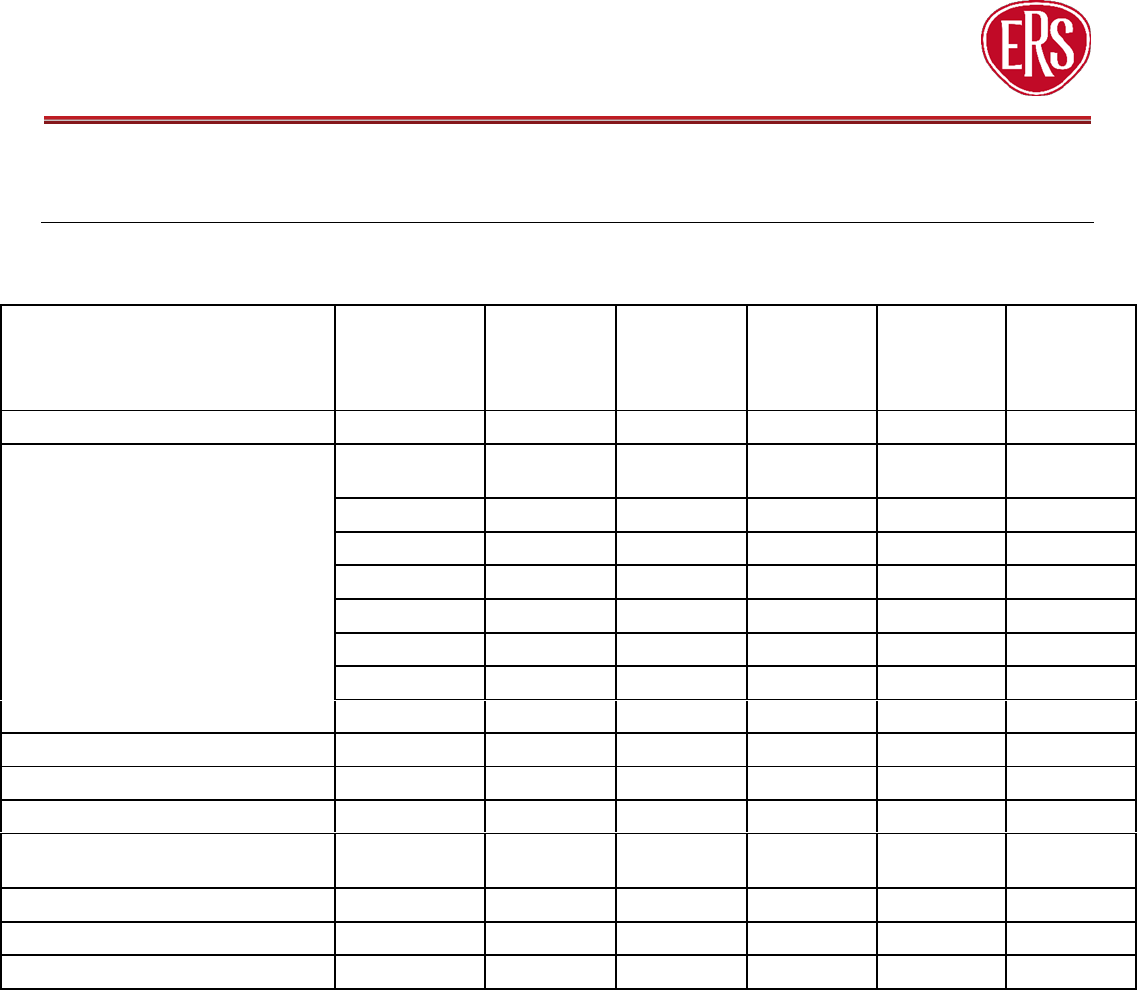

Cover

The insurance cover you have

Your schedule shows you what cover you have. The different types of cover are listed below together with the sections of the

policy that apply.

Section name

Comprehensive

Accidental

Damage Fire

& Theft

Accidental

Damage &

Third party

Only

Third party

Fire & Theft

Fire & Theft

Third Party

Only

Section 1 - Liability to others

Section 2 - Loss of or damage to

your vehicle

Accidental damage -------------------

Malicious damage ---------------------

Fire ---------------------------------------

Flood -------------------------------------

Theft -------------------------------------

Vandalism ------------------------------

Windscreen -----------------------------

Section 3 - Medical expenses

Section 4 - Personal accident

Section 5 - Personal belongings

Section 6 - Loss of keys and

replacing locks

Section 7 - Child seat

Section 8 - Foreign use

Section 9 - Inflatable storage device

The General Terms, Conditions and Exceptions apply to all sections of the policy.

IMPORTANT: - You can only have Accidental Damage Fire & Theft cover and Fire & Theft cover if your vehicle is declared SORN

(officially off the road) with the DVLA and is not being used.

ERS POLICY DOCUMENT NUMBER ACCC 1019 8

Section 1 – Liability to others

Driving your vehicle

We will provide insurance for any accident you have while you are driving, using or in charge of your vehicle or while you are

loading or unloading it.

We will insure you for all amounts you may legally have to pay for causing death or injury to other people.

The most we will pay for property damage is £20,000,000 for any claim or claims arising out of one incident.

We will pay up to £5,000,000 for any costs and expenses arising out of a claim or claims arising from one incident.

If there is a property damage claim made against more than one person covered by this insurance, we will first deal with any

claim made against you.

Driving other vehicles

We will also provide the cover shown above (if this is shown on your certificate of motor insurance), to drive any private car

that you do not own and have not hired under a hire-purchase or leasing agreement -

permission to drive the car.

You are not insured against:

▪ Any loss or damage to the vehicle you are driving

▪ Any event which happens outside of the United Kingdom

▪ Any legal responsibility if you no longer have the insured vehicle

▪ Any event which happens when this insurance is not in the name of an individual person

▪ Any legal responsibility unless the vehicle is insured against third party road risks, in its own right or

▪ Securing the release of a vehicle that has been seized by or on behalf of the police or any public or local authority

Other people driving or using your vehicle

In the same way you are insured, we will also cover the following people:

▪ Any person you allow to drive or use your vehicle, as long as this is allowed by your current certificate of motor insurance

and has not been excluded by an endorsement, exception or condition

▪ Any passenger who has an accident while travelling in or getting into or out of the insured vehicle, as long as you ask us to

cover the passenger

Legal personal representatives

After the death of an

long as the claim is covered by this insurance.

Business use

If your certificate of motor insurance allows business use, we will insure your employer or business partner against the

vehicle provided by the employer or partner unless that vehicle is shown on your schedule.

Legal costs

In respect of any event which is covered under this section, if we first agree in writing, we will arrange and pay:

▪

jurisdiction

▪ The costs for legal services to defend anyone we insure against any prosecution arising from any death

▪ All other legal costs and expenses we agree to

The most we will pay for the legal costs is £35,000 for any claim or claims arising out of one incident.

ERS POLICY DOCUMENT NUMBER ACCC 1019 9

Emergency medical treatment

Where we must provide cover under the Road Traffic Act, we will pay for emergency medical treatment that is needed after

an accident involving any vehicle which this insurance covers.

This cover only applies in the United Kingdom and where we must provide it under the Road Traffic Acts.

Towing

Under this section we will insure you while any vehicle covered by this insurance is towing a caravan, trailer or a broken-down

vehicle (as allowed by law).

We will only provide this cover if:

▪ The caravan, trailer or broken-down vehicle is properly secured to your vehicle by towing equipment made for the purpose

and

▪ The method of towing the caravan, trailer or broken- towing

limits and any other relevant law

We will not pay any claim arising from:

▪ Loss of or damage to the towed caravan, trailer or broken-down vehicle

▪ Loss of or damage to any property being carried in or on the towed caravan, trailer or broken-down vehicle

▪ A caravan, trailer or broken-down vehicle being towed for reward

▪ Towing more trailers than the number allowed by law or

▪ If more than one caravan or broken-down vehicle is being towed at any one time

Exceptions to Section 1

This section of your insurance does not cover the following:

1.

Anyone who can claim for the same loss from any other insurance

2.

Loss of or damage to property belonging to (or in the care of) anyone we insure and who is making a claim under this part

of the insurance

3.

Death of or bodily injury to any person arising out of and in the course of their employment by the policyholder or by any

other person claiming under this insurance. This does not apply if we need to provide cover due to the requirements of

relevant laws

4.

Any legal responsibility arising directly or indirectly from acts of terrorism, as defined in the UK Terrorism Act 2000,

unless we need to provide the minimum insurance required by the Road Traffic Act

5.

Any legal responsibility, unless we need to provide the minimum insurance required by the Road Traffic Act, for claims for

death, injury, illness, loss or damage to property arising directly or indirectly from pollution or contamination unless

caused by a sudden identifiable unintended and unexpected event

This exception:

▪ Relates to contamination or pollution caused directly or indirectly by any substance, liquid, vapour or gas leaking or being

released and

▪ Includes contamination or pollution of any building or other structure, water, land or the air

We will not pay for claims arising directly or indirectly from contamination or pollution if it is caused by any substance,

liquid, vapour or gas being deliberately released or leaks caused by the failure to maintain or repair your vehicle, or any part

of it.

6.

Death, bodily injury or damage arising as a result of loading or unloading your vehicle somewhere other than on the road

by anyone apart from the driver or attendant

ERS POLICY DOCUMENT NUMBER ACCC 1019 10

Section 2 – Loss of or damage to your vehicle

This cover only applies to your vehicle

We will insure your vehicle against loss or damage (less any excess that applies) caused by:

▪ Accidental or malicious damage, flood damage or vandalism

▪ Fire, lightning, self-ignition and explosion or

▪ Theft or attempted theft, or taking your vehicle away without your permission

For a claim under this section we will, at our absolute discretion, either:

▪ Pay for the damage to be repaired

▪ Pay an amount of cash to replace the lost or damaged item or

▪ Replace the lost or damaged item

The most we will pay will be either:

▪ The UK mainland market value of your vehicle (including its accessories) immediately before the loss up to the value shown

on your schedule, or, if it applies, the agreed value shown on your schedule or

▪ The amount it would cost us to repair your vehicle at an ERS approved repairer or as otherwise agreed by our appointed

engineer

whichever is less.

We will not pay the cost of any repair or replacement which improves your vehicle or accessories to a better condition than

they were in before the loss or damage. If this happens, you must make a contribution towards the cost of repair or

replacement.

We will not pay the VAT element of any claim if you are registered for VAT.

Excesses

If an excess is shown on your schedule, you have agreed to pay that amount for each incident of loss or damage.

If more than one vehicle is insured on your policy and they are involved in the same incident, the excess shown on your

schedule will apply to each vehicle separately.

Windscreen damage (comprehensive cover only)

the window or windscreen. The helpline number is 0330 123 5992.

This benefit does not apply to damaged sun roofs, roof panels, lights or reflectors whether glass or plastic.

The following excesses apply to a windscreen claim but there is no limit on the cost of the windscreen:

▪ If your windscreen is replaced by our approved supplier, you must pay the first £75 of any claim

▪ If your windscreen is repaired by our approved supplier, you must pay the first £10 of any claim

▪ If your windscreen is repaired or replaced by any other company, you must pay the first £125 of any claim

If the only claim you make is for broken

breakage.

ERS POLICY DOCUMENT NUMBER ACCC 1019 11

Extra excesses for young or inexperienced drivers

If your vehicle is damaged while a young or inexperienced driver (including yourself) is driving, you will have to pay the first

amount of any claim as shown below. This is on top of any other excess that you may have to pay.

Drivers Amount

▪ Under 21 years of age £300

▪ Aged 21 to 24 years £200

▪ Aged 25 years or over who has a £200

provisional driving licence or has

not held, for 12 months or more,

a full driving licence issued by any

country which is a member of the

European Union.

These amounts do not apply if the loss or damage is caused by fire or theft.

Recovery and redelivery

After any claim under this section we will pay the cost of moving your vehicle from the place where the damage happened to

the premises of the nearest competent repairer. We will also pay the cost of delivering your vehicle back to you in the United

Kingdom after repair.

Do not try to move your vehicle yourself if this could increase the damage. If unnecessary damage is caused as a result of

your attempts to move your vehicle, we will not pay any extra cost arising from that damage.

All arrangements for storage of a damaged vehicle must be agreed by us. If you arrange storage without our prior knowledge

and consent we will not pay any extra cost arising from that arrangement where this is greater than the cost we negotiate

with our approved supplier.

Repairs

If your vehicle is damaged in any way which is covered by this insurance, you should contact us immediately. We can, if you

wish, organise for our approved repairers to repair your vehicle.

Where using our approved repairer for the repair of your vehicle, and your vehicle does not exceed 3.5 tonne gross vehicle

weight our approved repairer will:

▪ Guarantee the repairs for 5 years

▪ Endeavour to use original equipment manufacturer parts/equipment where feasible

▪ Upon, request and subject to availability, supply you with a courtesy car for the duration of the vehicle repair or until

your policy expires, whichever is the sooner

If your vehicle cannot be driven safely, you should allow us the opportunity of moving it to the premises of an approved

repairer or repairer of your choice if previously agreed by us.

If repairs are completed without our prior knowledge and consent this may affect the amount we pay in final settlement of

your claim. In all circumstances, anyone conducting repairs to an insured vehicle should retain the following for our

inspection:

▪ A fully costed estimate

▪ All damaged parts and

▪ Images of the damaged areas of the insured vehicle

If you fail to provide all requested information, documentation and evidence of claim damage, we reserve the right not to

pay for damages under this Section.

If you choose to not use our approved repairer, we will not:

▪ Be responsible for any delays incurred by the repairer

▪ Guarantee the provision of a courtesy car

▪ Guarantee the repairs

ERS POLICY DOCUMENT NUMBER ACCC 1019 12

▪ Guarantee the use of original equipment manufacturer paint/parts

We may arrange for your vehicle to go to a repairer of our choice if we cannot reach an agreement with your chosen repairer

over costs.

It is not our policy to use recycled or non-original parts and equipment when repairing your vehicle, although on occasion it

may be necessary.

Total loss

When deciding whether your vehicle is a total loss, we use the Association of British Insurers (ABI) Code of Practice for the

Disposal of Motor Vehicle Salvage.

We alone will determine:

▪ When an insured vehicle is deemed a total loss

▪ The market value of the insured vehicle, and where applicable

▪ Any salvage value of that insured vehicle

In the event that we deem your vehicle a total loss, due to it being uneconomical to repair or subject to an unrecovered theft,

we will offer an amount in settlement of the claim.

The insurance cover for that insured vehicle will end when you accept that offer.

You will not receive a refund of premium if your insurance ends due to the total loss of your vehicle.

If your insurance covers more than one vehicle, cover will remain in force for any vehicles that have not been declared a total

loss.

If the insured vehicle is owned by someone else, we will discuss the valuation and payments directly with the vehicle owner

rather than with you.

recommended retail price received at the point of purchase.

Our offer will not exceed the amount shown on schedule.

Once we have made a payment, the insured vehicle becomes our property unless we agree otherwise.

Vehicles subject to a finance agreement

If the market value we place upon the insured vehicle is equal to or greater than the amount owed to the finance company.

We may pay the finance company first and then settle the balance with the legal owner of the insured vehicle.

If the market value placed upon the insured vehicle is less than the amount owed to the finance company.

We may pay the finance company the market value of the insured vehicle. You may be required by the finance company to

pay them the balance, subject to the terms of your agreement with them.

Vehicles subject to a lease / hire agreement no legal right to title

If the market value we place upon the insured vehicle is greater than the amount owed to the lease / hire company, we will

pay them only the amount of the outstanding finance, which will settle the claim in full.

If the market value we place upon the insured vehicle is less than the amount owed, the amount we pay to the lease / hire

company will settle the claim, and you may be required by the lease / hire company to pay them the balance, subject to the

terms of your agreement with them.

Vehicles subject to a lease / hire agreement legal right to title or proceeds of sale

We will pay the lease / hire company the market value of the vehicle, which will settle the claim in full. Any transfer of legal

title or distribution of the proceeds of the vehicle should be taken up directly with the lease / hire company in line with the

specific terms of your agreement.

ERS POLICY DOCUMENT NUMBER ACCC 1019 13

Salvage

Where applicable, your vehicle will have a salvage category placed upon it, in line with the ABI Code of Practice.

Only vehicles deemed eligible to go back on the road can be considered for retention. If retention is granted, the value of the

salvage, as determined by us, will be deducted from the settlement.

At the point of payment the vehicle will become our property unless we agree otherwise.

If your vehicle has been subject to an insurance write off (total loss), you must be able to evidence the vehicle has been

restored to a roadworthy condition.

In the event of the insured vehicle being subject to another claim, we will require documentary evidence of repairs and other

documentation as we may require, to evidence, and to satisfy us, that the insured vehicle has been maintained in a

roadworthy condition, otherwise the valuation will be affected.

If we ask, you must send us your vehicle registration document (V5c), MOT certificate (if applicable), the purchase receipt for

the vehicle, all keys and any other relevant documentation before we agree to settle the claim.

Audio, visual, communication, guidance or tracking equipment

The cover provided by this policy includes loss of, or damage to, permanently fitted audio, visual, communication, guidance

or tracking equipment that formed part of your vehicle when it was originally made.

We will pay up to £500 for any permanently fitted equipment that was not part of your vehicle when it was originally made.

When your vehicle is being serviced

The cover provided under this section will still apply when your vehicle is being serviced or repaired. While your vehicle is in

the hands of the motor trade for a service or repair, we ignore any restrictions on driving or use (as shown on your certificate

of motor insurance).

Dismantled parts

We will pay up to the value of your vehicle for parts taken from your vehicle which are kept in a locked building at the

address shown on your proposal form or statement of facts, or another address we agree to.

Registration plates

We will pay the cost of replacing the registration number plates fitted to your vehicle in the same style as those fitted

immediately before the loss.

Cherished number plate

If, as a result of a valid total loss/theft claim under this policy, you are totally and irrevocably deprived of the use of the

cherished registration number attached to the insured vehicle, we will pay (up to a maximum of £10,000) the amount equal

to the value determined by a member of the Cherished Numbers Dealers Association. We will not be liable for losses

occasioned by or happening through any of the following scenarios:

▪ Your permanent disqualification from driving

▪ Confiscation, seizure or detention by Customs or other officials or authorities

▪ If you or any company you are associated with is in liquidation or bankrupt

▪ Should the number be re-issued by the DVLA, the entitlement to use the number will transfer to us

ERS POLICY DOCUMENT NUMBER ACCC 1019 14

Exceptions to Section 2

This section of your insurance does not cover the following:

1.

The amount of any excess shown on your schedule

2.

Any amount as compensation for you not being able to use your vehicle (including the cost of hiring another vehicle)

3.

Wear and tear

4.

Failures, breakdowns or breakages of mechanical, electrical, electronic or computer equipment

5.

including loss of value as a result of damage, whether the damage is repaired or not

6.

Repairs or replacements which improve the condition of your vehicle

7.

Damage to tyres, unless caused by an accident to your vehicle

8.

Damage due to liquid freezing in the cooling system, unless you have taken reasonable precautions as laid down by the

vehi

9.

Loss of or damage to accessories unless they are permanently attached to your vehicle

10.

Any amount over the last-known list price of any part or accessory or the cost of fitting any part or accessory if the vehicle

manufacturer or its agent cannot supply it from stock held in the United Kingdom. (This exception does not apply where

any applicable part or accessory is no longer commercially available from the vehicle manufacturer or their agents in the

United Kingdom)

11.

Loss of or damage to your vehicle as a result of deception

12.

Loss resulting from repossessing your vehicle and returning it to its rightful owner

13.

Loss of or damage to your vehicle or its contents by theft or attempted theft or an unauthorised person taking and driving it

if:

▪

It has been left unlocked

▪

It has been left with the keys (or any form of keyless entry / ignition control device), in it or on it

▪

It has been left with the windows, roof panel or the roof of a convertible vehicle open or

▪

You have not taken reasonable precautions to protect it

14.

Loss of or damage to your vehicle resulting from a member of your immediate family, or a person living in your home,

taking your vehicle without your permission, unless that person is convicted of theft

15.

Loss of or damage to any vehicle which you are driving or using that does not belong to you, is not being bought by you

under a hire-purchase agreement or is leased to you (unless that vehicle is shown on your schedule)

16.

Loss of fuel

17.

Loss or damage due to confiscation, requisition or destruction by or under the order of any government, public or local

authority

ERS POLICY DOCUMENT NUMBER ACCC 1019 15

Section 3 – Medical expenses

We will pay up to £500 for each person for the medical expenses of anyone who is injured while they are in your vehicle as a

result of an accident involving your vehicle.

You will not have to pay an excess for any claim under this section.

Section 4 – Personal accident benefits

We will pay the following amounts if you, named driver or your husband, wife or civil partner is involved in an accident and

within three months of that accident it is the only cause of death or injury.

▪ Death £7,000

▪ Loss of any limb £5,000

▪ Permanent loss of sight in one or both eyes £5,000

The most we will pay in any period of insurance is £7,000.

To get a payment, the injury or death must:

▪ Be directly connected with the accident involving your vehicle or

▪ Have happened when you or your husband, wife, civil partner were travelling in, or getting into or out of, any other private

motor vehicle

We will make the payment to you or your legal personal representative.

If you or your husband, wife or civil partner have any other insurance with us, we will only pay out under one contract.

This personal accident benefit does not apply to:

▪ Anyone who is 70 or older at the time of the accident

▪ Death or bodily injury caused by suicide or attempted suicide

▪ Any in

You will not have to pay an excess for any claim under this section.

Section 5 – Personal belongings

We will pay up to £300 for personal belongings (including tools which you use to maintain or repair your vehicle) in or on

your vehicle if they are lost or damaged because of an accident, fire, theft or attempted theft.

This personal belongings cover does not apply to:

▪ Money, stamps, tickets and documents

▪ Goods or samples connected with the work of any driver or passenger

▪ Property insured under any other contract

▪ Child seats or child booster seats

▪ Wear and tear

▪ Theft of any property which is in an open or convertible vehicle, unless it is kept in a locked luggage compartment or loss or

damage where the property was not reasonably protected

You will not have to pay an excess for any claim under this section.

ERS POLICY DOCUMENT NUMBER ACCC 1019 16

Section 6 – Loss of keys and replacing locks

We will pay up to £500 if the keys for your vehicle are lost or stolen and have not been recovered. We will pay the cost of

replacing the entry key and transponders, ignition and steering locks that can be opened or operated with the lost items. This

applies as long as:

▪ You let the Police know about the loss as soon as it is discovered and

▪ The address where your vehicle is kept would be known to any person who has your keys or lock transponder

You will not have to pay an excess for any claim under this section and it will not affect your no claims bonus.

Section 7 – Child seats

We will pay up to £150 to replace a child seat or child booster seat that was in your vehicle at the time of an accident or theft

covered under section 2 of this policy. We will provide this cover even if there is no visible damage to the seat.

You will not have to pay an excess for any claim under this section.

Section 8 – Foreign use

We will provide the minimum insurance needed by the relevant law to allow you to use your vehicle:

▪ In any country which is a member of the European Union and

▪ In any other countries which have made arrangements to meet the insurance conditions of, and are approved by, the

Commission of the European Union

▪ While your vehicle is being transported (including loading and unloading), between ports in countries where you have

cover, as long as your vehicle is being transported by rail or by a recognised sea route of not more than 65 hours

We will provide the cover shown on your schedule when you visit any country which is a member of the European Union,

Andorra, Iceland, Norway, Serbia or Switzerland (including Liechtenstein). There is no limit on the number of trips you make

in any period of insurance but each trip must be for no more than 90 days.

This cover only applies if your visit to these countries is temporary and your permanent home is in the United Kingdom.

Extra cover

If you want to travel to any other country, or want to extend the 90-day limit on any one trip, you must contact your broker.

If we agree to extend your cover, and you pay any extra premium that we ask for; we will extend your insurance to apply in

any country for which we have agreed to provide cover.

Customs duty and other charges

If your vehicle suffers any loss or damage covered by this insurance, and your vehicle is in any country for which we have

agreed to provide cover, we will:

▪ Refund any customs duty you have to pay after temporarily importing your vehicle into any of the countries where you

have cover

▪ Refund any general average contributions and salvage charges you may have to pay while your vehicle is being transported

by a recognised sea route and

▪ Pay the cost of delivering your vehicle to you at your address in the United Kingdom after the repairs have been made if

your vehicle cannot be driven because of any loss or damage

Section 9 – Inflatable storage device

We will pay up to £500 if your inflatable storage device is lost or damaged because of a fire, theft or attempted theft.

An inflatable storage device is a protective cover for your vehicle which is inflated by battery or mains power.

ERS POLICY DOCUMENT NUMBER ACCC 1019 17

General terms

Extra matters to bear in mind

No claim bonus

This insurance does not use a No Claims Bonus scale for the purposes of rate setting.

A no claims bonus cannot be earned under this insurance.

Changing or adding a vehicle to this insurance

If you change the vehicle covered by this insurance or need cover for an extra vehicle (including a temporary vehicle), please

contact your broker to discuss your requirements. If cover is agreed, your broker will let you know about any change in

premium and arrange for a new set of policy documents to be issued.

Limited mileage condition

The cover for your vehicle is based on the annual mileage which you chose on your proposal form or the annual mileage

shown on your statement of facts. You must tell us if the annual mileage will be more than this figure because it may affect

the cover provided.

Agreed value

If your vehicle is stolen and not recovered or is a total loss, we agree to pay you the agreed value as shown on your schedule

and not the market value of the vehicle. If your insurance has been accepted on an agreed value, it will be indicated on your

schedule.

Payments for journeys (car sharing)

You can accept payments from passengers in your vehicle if you are giving them a lift for social or other similar purposes.

Accepting these payments will not affect your insurance cover if:

▪ Your vehicle cannot carry more than nine people (including the driver)

▪ You are not carrying the passengers in the course of a business of carrying passengers and

▪ The total of the payments you receive for the journey does not provide a profit

ERS POLICY DOCUMENT NUMBER ACCC 1019 18

General exceptions

These general exceptions apply to the whole insurance

Your insurance does not cover you for:

Drivers and use

Any legal responsibility, loss or damage (direct or indirect) arising while any vehicle covered by this insurance is being:

▪ Used for a purpose for which your vehicle is not insured

▪ Driven by or is in the charge of anyone (including you) who is not mentioned on the certificate of motor insurance as a

person entitled to drive or who is excluded by an endorsement

▪ Driven by or is in the charge of anyone (including you) who is disqualified from driving, does not hold a valid driving licence

in line with current law or has never held a licence to drive your vehicle, does not keep to the conditions of their driving

licence or is prevented by law from having a licence (unless they do not need a licence by law)

▪ Used on any race track, race circuit or toll road without a speed limit (such as the Nurburgring)

▪ Used for racing or pace-making, used in any contest (apart from treasure hunts, road safety and non-competitive rallies) or

speed trial or is involved in any rigorous reliability testing

Drugs and alcohol

Any legal responsibility, loss or damage (direct or indirect) arising while any vehicle covered by this insurance is being driven

by or is in the charge of anyone (including you) and is convicted of:

▪ Driving over the legal limit for alcohol or

▪ Driving under the influence of drugs, prescribed or otherwise

If convicted (which includes a conviction for failure to provide a breath, blood or urine sample) this shall be deemed to be

conclusive evidence that the driver at the time of the loss or damage was under the influence of alcohol or drugs.

We will provide the minimum insurance required by the Road Traffic Act but we reserve the right to seek recovery of any such

amounts from you or the driver of your vehicle.

Construction and use

Any legal responsibility, loss or damage (direct or indirect) arising while any vehicle covered by this insurance is being used

to carry:

▪ More passengers than the maximum seating capacity for the insured vehicle as set by the vehicle manufacturer or

▪ Passengers in a manner likely to affect the safe driving and control of your vehicle or

▪ Any load which is greater than the maximum carrying capacity as set by the vehicle manufacturer of if applicable; any

plated weight limit of the insured vehicle

Airfields

Any legal responsibility, loss or damage (direct or indirect) arising while any vehicle covered by this insurance is being used

in or on a restricted area (areas to which the public do not have free vehicular access) of an airport, airfield or aerodrome. We

will not pay for any claim concerning an aircraft within the boundary of the airport, airfield or aerodrome except where we

need to provide the minimum insurance required by the Road Traffic Act.

Hazardous goods

Any legal responsibility, loss or damage (direct or indirect) caused by, contributed to or arising from carrying any dangerous

substances or goods for which you need a licence from the relevant authority (unless we need to provide cover to meet the

minimum insurance needed by law).

Criminal acts

Any legal responsibility for loss or damage (direct or indirect) caused whilst your vehicle is used by anyone insured under

this insurance:

▪ In the course or furtherance of a crime or

▪ As a means of escape from, or avoidance of lawful apprehension

ERS POLICY DOCUMENT NUMBER ACCC 1019 19

Deliberate acts

Any legal responsibility for the death of or injury to any person or loss or damage (direct or indirect) caused by a deliberate

act or omission to act by anyone insured under this insurance.

Excess

The amount of any excess shown within this policy document and / or on your schedule.

Other contracts

Any legal responsibility, loss or damage (direct or indirect) that:

▪ Is also covered by any other insurance or

▪ You have accepted under an agreement or contract unless you would have had that responsibility anyway

▪ Happens outside the United Kingdom, other than where we have agreed to provide cover (please refer to the Foreign Use

section of this policy document)

Jurisdiction

Any proceedings brought against you, or judgment passed in any court outside the United Kingdom, unless the proceedings

or judgment arises out of your vehicle being used in a foreign country which we have agreed to extend this insurance to

cover.

Earthquake, riot, war and terrorism

Any legal responsibility, loss or damage (direct or indirect) caused by, contributed to or arising from:

▪ An earthquake

▪ The result of war, riot, civil commotion, revolution or any similar event elsewhere than in Great Britain, the Channel Islands

or the Isle of Man (unless we need to provide cover to meet the minimum insurance needed by law)

▪ Acts of terrorism, as defined in the UK Terrorism Act 2000, unless we need to provide the minimum insurance required by

the Road Traffic Act

Nuclear / radioactive contamination

Any legal responsibility, loss or damage (direct or indirect) caused by, contributed to or arising from:

▪ Ionising radiation or contamination from any radioactive nuclear fuel, or from any nuclear waste from burning nuclear fuel

▪ The radioactive, toxic, explosive or other dangerous property of any explosive nuclear equipment or nuclear part of that

equipment

Sonic bangs

Any legal responsibility, loss or damage (direct or indirect) caused by, contributed to or arising from pressure waves caused

by aircraft or other flying objects.

ERS POLICY DOCUMENT NUMBER ACCC 1019 20

General conditions

What we expect for your cover to be valid

Your responsibilities

Your premium is based on the information you gave at the start of the insurance and when it is renewed.

You are responsible for the information you or your appointed representative has provided to us. You should ensure that the

information provided is, as far as you know, correct and complete.

If you have failed to give us complete and accurate information, this could lead to us changing the terms of your policy,

refusing your claim or the insurance not being valid.

You must, if requested, provide us with all relevant information and documentation in relation to this insurance.

The vehicle must have an MOT (unless exempt), be taxed (unless exempt), insured and registered in the UK and you must:

▪ Take all reasonable steps to protect your vehicle from loss or damage

▪ Maintain your vehicle in a roadworthy condition and

▪ Let us examine your vehicle at any reasonable time

If the above requirements are not met, we may reject or reduce your claim, and/or cancel your policy or declare your policy

null and void.

Changes to your details

You must tell us immediately about any changes to the information you have already provided. Please contact your broker if

you are not sure if information is

fully, or at all.

Here are some examples of the changes you should tell us about:

▪ A change of vehicle (including extra vehicles and any temporary vehicles)

▪ All changes

specification (whether the changes are mechanical or cosmetic)

▪ A change of address

▪ A change in the vehicle s value

▪ A change of job, including any part-time work by your named drivers, a change in the type of business or having no work

▪ A new main user of your vehicle

▪ Details of any driver you have not told us about before, or who is not specifically entitled to drive by the certificate of motor

insurance or is excluded by an endorsement, but who you now want to drive

▪ Details of any motoring conviction, disqualification or fixed-penalty motoring offence of any person allowed to drive or of

any prosecution pending (where a case is being investigated but there is no conviction yet) for any motor offence

▪ Details of any non-motoring conviction or prosecution pending (where a case is being investigated but there is no

conviction yet) for any person allowed to drive

▪ Details of any accident or loss (whether or not you make a claim) involving your vehicle or that happens while you (or

anyone who is entitled

▪ If any driver suffers from a disability or medical condition that must be revealed to the DVLA, whether or not the driving

licence has been restricted

Claim notification

After any loss, damage or accident you must give us full details of the incident as soon as possible.

You must send every communication about a claim (including any writ or summons) to us without delay and unanswered.

covered by this insurance.

You must give us any information, documentation and help we need to help us deal with your claim. We will only ask for this

if it is relevant to your claim.

You must notify us of a claim at the earliest opportunity of it occurring. If you fail to comply with this section, or otherwise

prejudice our position, we reserve the right to seek recovery of any additional costs incurred due to your action or failure to

act.

ERS POLICY DOCUMENT NUMBER ACCC 1019 21

Claim requirements rights and obligations

If a claim is made which you or anyone acting on your behalf knows is false, fraudulent, exaggerated, or provides false or

stolen documents to support a claim we will not pay the claim and cover under this insurance will end.

If there are a number of claims for property damage arising out of any one cause, we may pay you up to the maximum

amount due under Section 1. (We will take from this amount any amounts we have already paid as compensation.) When we

pay this amount, we will withdraw from any further action connected with settling these claims. We will cover any legal costs

and expenses paid with our permission, up to the time we withdraw from dealing with the claims.

You must not admit to, negotiate on or refuse any claim unless you have our permission.

We can:

▪ Take-over, carry out, defend or settle any claim and

▪ Take proceedings (which we will pay for, and for our own benefit) to recover any payment we have made under this

insurance

We will take this action in your name or in the name of anyone else covered by this insurance.

You, or the person whose name we use, must co-operate with us on any matter which affects this insurance.

If we refuse to provide cover because you have failed to provide information or provided incorrect information, but we have a

legal responsibility to pay a claim under the Road Traffic Acts, we can settle the claim or judgment without affecting our

position under this policy. We can recover any payments that we make from you.

If you fail to provide all requested information, documentation and evidence of claim damage, we reserve the right not to

pay for damages under Section 2 of this policy document.

Compulsory Insurance laws

If we are required to settle a claim in order to comply with the law applying to any country in which this policy operates, and

which we would not otherwise be required to pay because of a breach of policy conditions, we shall be entitled to recover the

amount paid and any associated costs, from either yourself or the person who incurred the liability.

Arbitration

If we accept your claim, but disagree with the claim amount, the matter will be passed to an independent arbitrator (to

whom we must both agree). When this happens, the arbitrator must make a decision before you can start proceedings

against us.

Cancellation

If this insurance does not meet your needs, you may cancel it, without giving reason, by contacting your broker within 14

days of the policy start date and declare your requirement to cancel.

We will make a charge equal to the period of cover you have had but this will be subject to a minimum amount of £25 (plus

insurance premium tax (IPT) where applicable), except if any claim has been made in the current period of insurance, in

which case the full annual premium will be payable to us.

The 14-day period applies to new policies and the renewal of existing policies.

ERS POLICY DOCUMENT NUMBER ACCC 1019 22

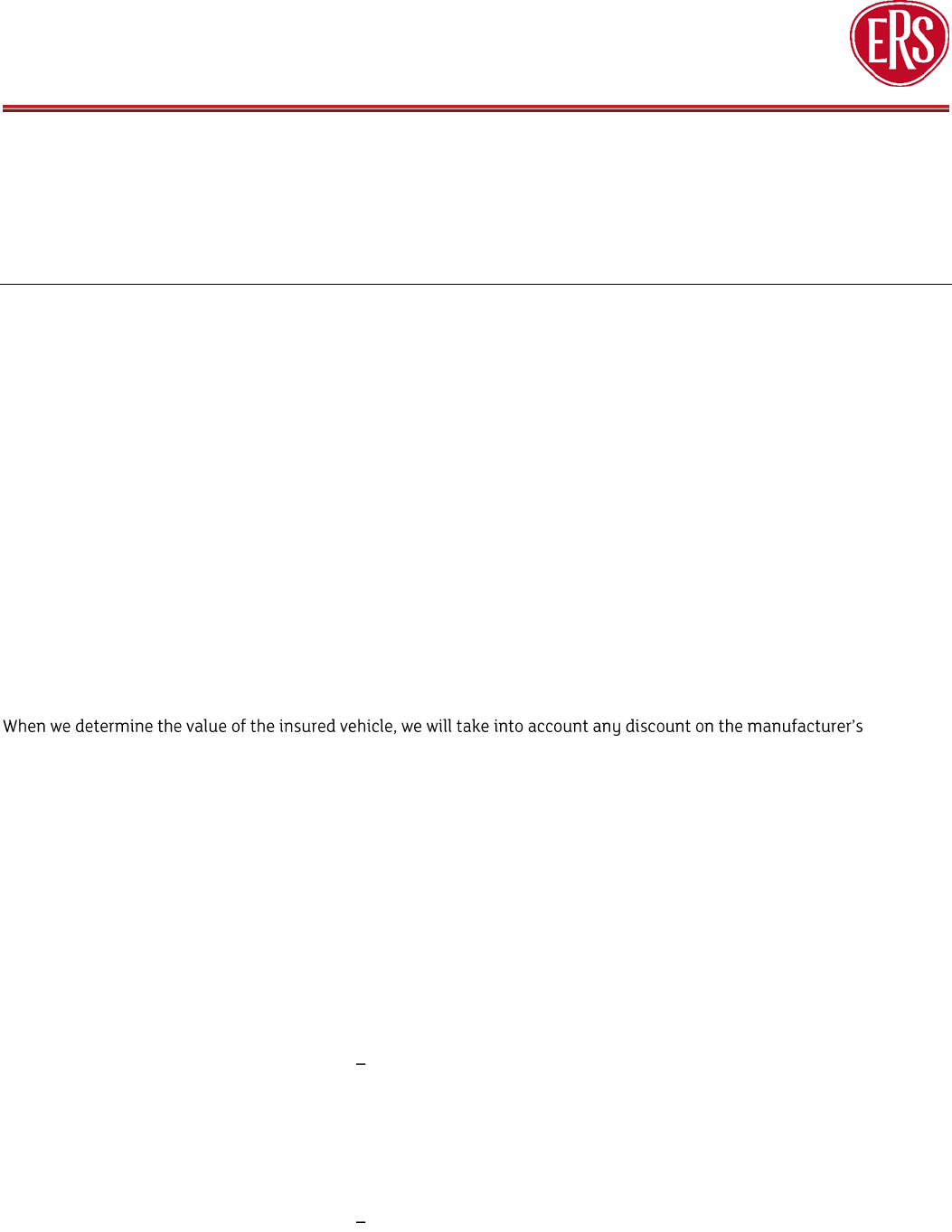

If no claims have been made during the current period of insurance, we will refund a percentage of the premium according to

the period which you have had cover for, as detailed in the table below.

The amount retained by us will be subject to a minimum amount of £25 (plus insurance premium tax (IPT) where applicable.

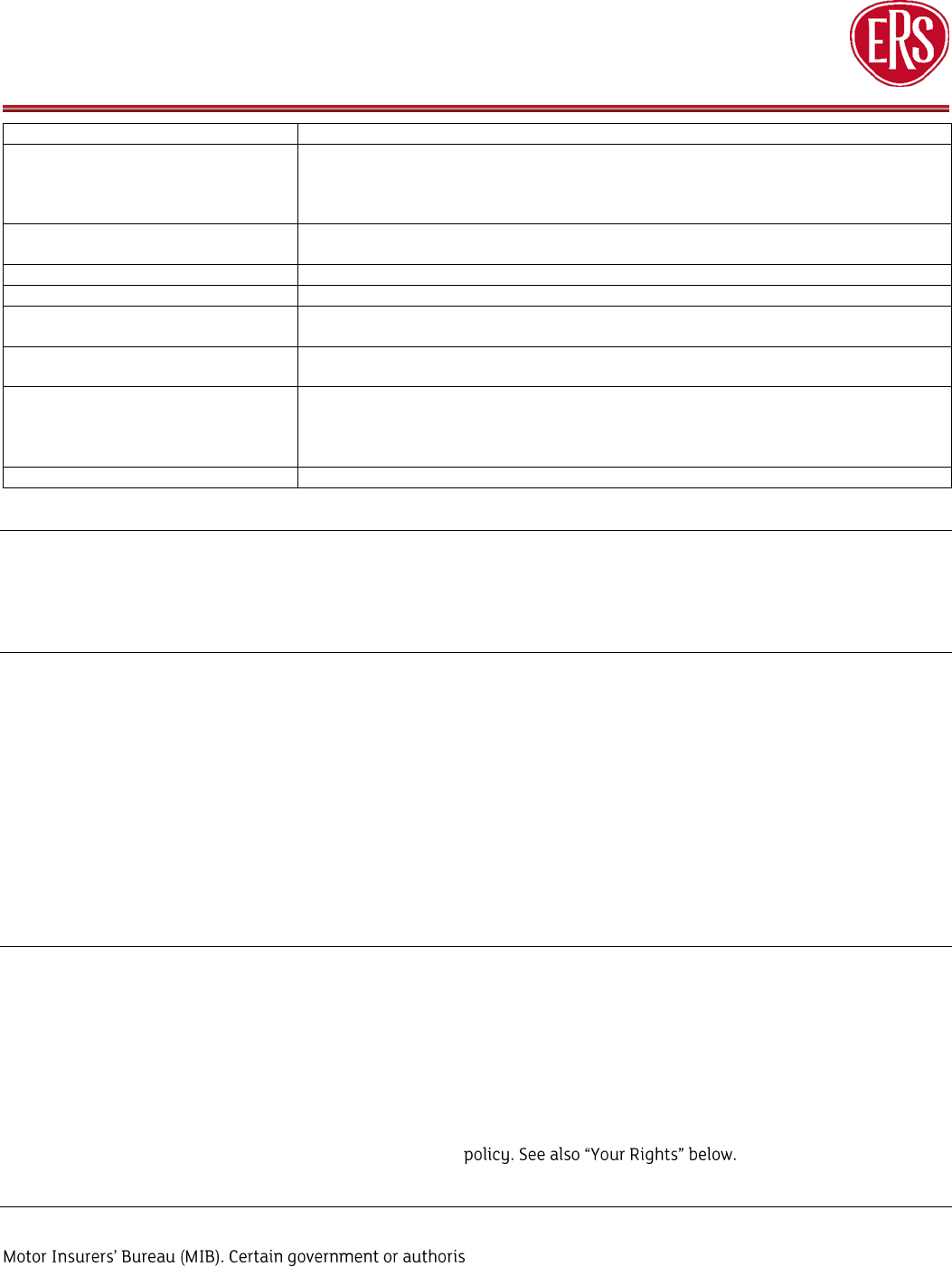

Period you have had cover for

Percentage amount to be refunded

to you

Percentage amount to be retained

by us

Over 14 days 30 days

70%

30%

31 days 60 days

55%

45%

61 days 90 days

40%

60%

91 days 120 days

25%

75%

121 days 150 days

10%

90%

Over 150 days

Nil

100%

Refunds will be passed to your broker.

If any claim has been made in the current period of insurance, you must pay the full annual premium and you will not be

entitled to any refund.

You may cancel this insurance by declaring to your broker, your requirement to cancel.

.

Your insurance may be cancelled because:

▪ You have not paid when due, a premium on an instalment plan

▪ You or anyone else covered by this insurance has not met the terms and conditions of the insurance

▪ You have not provided documentation requested by us or your broker (such as a copy of your driving licence or evidence of

no claim bonus)

▪ A change in your circumstances means we can no longer provide cover

▪ You misrepresent or fail to disclose information that is relevant to your insurance

▪ We identify fraud on another associated policy with ERS or

▪ You harass any member of our staff or show abusive or threatening behaviour towards them

This is not an exhaustive list.

Misrepresentation

Where we identify: misrepresentation, non-disclosure, fraud, or any attempt to gain an advantage under this insurance to

which you are not entitled, we will apply, at our absolute discretion, one or more of the remedies listed below:

▪ Agree with you to: amend your policy to record the correct information, apply any required change in premium, policy

terms and conditions

▪ Apply any administration costs

▪ Reject or pay only a proportion of your claim

▪ Not return to you any premium paid

▪ Cancel the policy

▪ Void the policy (which means to treat the policy as though it never existed)

ERS POLICY DOCUMENT NUMBER ACCC 1019 23

Complaints

How to make a complaint if things go wrong

Our promise to you

We aim to provide a first class service. If you have any reason to complain about your insurance policy, or us, the complaints

procedure is as follows.

The first step is to contact our dedicated complaint handling department who will review your case on behalf of our Chief

Executive.

Address: ERS Customer Relations, PO Box 3937, Swindon, SN4 4GW

Tel: 0345 268 0279

Email: complaints@ers.com

If you are not satisfied with our response you eview your case.

Address: Complaints Department, London EC3M 7HA

Tel: 020 7327 5693.

Email: complaints@lloyds.com

Website: lloyds.com/complaints

inancial Ombudsman Service (FOS)

Address: The Financial Ombudsman Service, Exchange Tower, London E14 9SR

Tel: 0800 023 4567

Email: complaint.info@financial-ombudsman.org.uk

Website: financial-ombudsman.org.uk

This does not affect your right to take legal action.

If you ask someone else to act on your behalf we will require written authority to allow us to deal with them.

If you have any questions, about complaints please contact the Company Secretary at:

ERS Insurance Group Limited, 21 Lombard Street, London, EC3V 9AH

ERS POLICY DOCUMENT NUMBER ACCC 1019 24

Important notices and information

Data Protection Notice

This section contains important information about your personal details. Please make sure to show it to anyone covered by

the policy and ensure they are aware that their personal details may be provided to us.

ERS Syndicate Management Limited is the data controller in respect of your personal information. We will process the details

organisations and service providers who are located in other countries, and as a result your information may be processed

outside the European Economic Area. In all cases we will make sure that your information is adequately protected. Any

transfers of personal information outside Europe will be subject to the provisions of the US Privacy Shield, standard

contractual clauses approved by the European Commission or other contracts which provide equivalent protection.

You can find more information about how we use your personal information on our website: www.ers.com/policy-

pages/privacy-policy

Where we collect your personal information

We might collect personal information about you from:

▪ You

▪ Your family members

▪ Your employer or their representative

▪ Other companies in the insurance market

▪ Anti-fraud databases, sanction lists, court judgement and similar databases

▪ Government agencies such as the DVLA and HMRC

▪ The publicly available electoral register

▪ In the event of a claim, third parties including the other party to the claim, witnesses, experts, loss adjusters, legal advisers

and claims handlers

How we use and disclose your personal information

To assess the terms of your insurance contract, or to deal with any claims, we may need to share information like your name,

address, date of birth and details such as medical conditions or criminal convictions. The recipients of this information could

include (but are not limited to) credit reference agencies, anti-fraud databases, brokers / reinsurance brokers, other insurers /

reinsurers, underwriters and other group companies who provide administration or support services. For claims handling, the

recipients could include (but are not limited to) external claims handlers, loss adjusters, legal and other expert advisers, and

third parties who are involved in the claim. More information about these disclosures is set out below.

ERS purchases reinsurance to protect against the most significant claims made against motor insurance policies issued.

Should such a claim arise under this contract of insurance, ERS reserves the right to disclose to its reinsurance broker and

reinsurers, the details of the claim, including all personal and special category data related to the claim. That disclosure is

necessary for the management of any reinsurance claim made by ERS and this practice of spreading risk is standard practice

in the insurance market.

The Data Protection laws classify information about your medical conditions, disabilities

to

administer your insurance contract or deal with any claims, or for anti-fraud purposes and will only be used in accordance

with appropriate laws and regulations.

Most of the personal information you provide to us is needed for us to assess your request for insurance, to enter into the

insurance contract with you and then to administer that contract. Some of the information is collected for fraud prevention

purposes, as described below. If we need your consent to use any specific information, we will make that clear at the time we

collect the information from you. You are free to withhold your consent or withdraw it at any time, but if you do so it may

impact upon our ability to provide insurance or pay claims. Further details about the legal basis for our processing of

personal information, and the disclosure we may make, can be found on our website: www.ers.com/policy-pages/privacy-

policy

ERS POLICY DOCUMENT NUMBER ACCC 1019 25

Types of Personal Data

Details

Individual details

Name, address (including proof of address), other contact details such as email and

phone numbers, gender, marital status, date and place of birth, nationality,

employment status, job title, details of family members including their relationship

to you

Identification detail

National insurance number, passport number, driving licence number, other

relevant licences

Financial information

Bank account and/or payment details, income and other financial information

Policy information

Information about the quotes you receive and policies you take out

Telematics

(where you use this technology)

Details of journeys made, locations, times and dates, driving behaviours and driving

patterns

Credit and anti-fraud information

Credit history, credit score, sanctions and criminal offences, including information

received from external databases about you

Previous and current claims

Information about previous and current claims (including under other insurance

policies) which may include data relating to your health, disabilities, criminal

convictions (including motoring offences) and in some cases surveillance reports;

also dashcam recordings where this technology is used

Special categories of personal data

Health, disability, criminal convictions (including motoring offences)

Accepting and administering your policy

If you pay your premiums via a credit facility, we may share your information with credit reference agencies and other

companies for use in credit decisions, to prevent fraud and to find people who owe money. We share information with other

insurers, certain government organisations and other authorised organisations.

Insurance underwriting

We look at the possible risk in relation to your prospective policy (or anyone else involved in the policy) so that we can:

▪ Consider whether to accept a risk

▪ Make decisions about providing and dealing with insurance and other related services for you and members of your

household

▪ Set price levels for your policy

▪ Confirm your identity to prevent money laundering

▪ Check the claims history for you or any person or property likely to be involved in the policy or a claim at any time. We may

do this:

• when you apply for insurance

• if there is an accident or a claim or

• at the time you renew your policy

Profiling

When calculating insurance premiums, we may compare your personal details against industry averages. Your personal

information may also be used to create the industry averages going forwards. This is known as profiling and is used to ensure

premiums reflect risk. Profiling may also be used to assess the information you provide so we can understand risk patterns.

Special categories of personal data may be used for profiling where this is relevant, such as medical history or past motoring

convictions (including motoring offences).

We may also make some decisions (for example about whether to offer cover or what the premiums will be) without any

intervention by our staff. These are known as automated decisions. You can find out more about how we make these

decisions on our website: www.ers.com/policy-pages/privacy-

Motor Insurance Database (MID)

Information about your insurance policy will be added to the Motor Insurance Database (MID) which is managed by the

ed organisations including the Police, DVLA, DVLNI, Insurance

Fraud Bureau and other organisations allowed by law may use the MID and the information stored on it for purposes

including:

▪ Continuous Insurance Enforcement (you can get information about this from the Department of Transport)

▪ Electronic vehicle licensing

▪ Law enforcement for the purposes of preventing, detecting, catching or prosecution offenders and

ERS POLICY DOCUMENT NUMBER ACCC 1019 26

▪ Providing government services or other services aimed at reducing the level of uninsured driving

If you are involved in a road-traffic accident (either in the UK, the EEA or certain other territories), insurers or the MIB (or

both) may search the MID to gather relevant information. Anyone making a claim for a road-traffic accident (including their

appointed representatives and citizens of other countries) may also gather relevant information which is held on the MID.

It is vital that the MID holds your correct registration number. If it is not shown correctly on the MID, you are at risk of having

your vehicle seized by the police. You can check that your correct registration number details are shown on the MID at

askmid.com.

Managing claims

If you make a claim, we may need to release information to another person or organisation involved in that claim. This

includes, but is not restricted to, others involved in the incident, their insurer, their solicitor or representative and medical

teams, authorised repairers, the police or other investigators. We also may have to investigate your claim and conviction

history. This may involve external claims handlers, loss adjusters, legal and other expert advisers.

Under the conditions of your policy, you must tell us about any incident (such as an accident or theft) which may or may not

result in a claim. When you tell us about an incident, we will pass information relating to it to Insurance Database Services

Limited (IDSL).

Call recording

You should note that some telephone calls may be recorded or monitored, for example calls to or from our claims

department, customer services team or underwriting department. Call recording and monitoring may be carried out for the

following purposes:

▪ Training and quality control

▪ As evidence of conversations

▪ For the prevention or detection of crime (e.g. fraudulent claims)

Preventing or detecting fraud

We will check your information against a range of registers and databases for completeness and accuracy. We may also

share your information with law enforcement agencies, other organisations and public bodies.

If we find that false or inaccurate information has been given to us, or we suspect fraud, we will take appropriate action. If

fraud is identified, details will be passed to fraud prevention agencies including the Claims Underwriting Exchange Register

and the Motor Insurance Anti-Fraud and Theft Register run by Insurance Database Services Limited (IDSL). Law enforcement

agencies may access and use this information.

We and other organisations, including those from other countries, may also access and use this information to prevent fraud

and money laundering, for example, when:

▪ Checking details on applications for credit and credit related or other facilities

▪ Managing credit and credit related accounts or facilities

▪ Recovering debt

▪ Checking details on proposals and claims for all types of insurance

▪ Checking details of job applicants and employees

Details of the registers, databases and fraud prevention agencies we use may be requested from the Company Secretary at:

ERS Insurance Group Limited, 21 Lombard Street, London, EC3V 9AH

Cheat line

To protect our policyholders, we are members of the Insurance Fraud Bureau (IFB). If you suspect insurance fraud is being

committed, you can call them on their confidential cheat line on 0800 422 0421.

Retention

We will keep your personal data only for as long as is necessary for the purpose for which it was collected. In particular, we

will retain your information for as long as there is any possibility that either you or we may wish to bring a legal claim under

or relating to your insurance, or where we are required to keep your information for legal or regulatory purposes.

ERS POLICY DOCUMENT NUMBER ACCC 1019 27

Your rights

You have rights under the Data Protection laws including the right to access the information we hold about you (subject to

any legal restrictions that may apply), to have the information corrected if it is inaccurate, and to have it updated if it is

incomplete. In certain circumstances you may have the right to restrict or object to processing, to receive an electronic copy

that affect your insurance or premiums.

If you wish to exercise any of your rights, please contact us at:

Data Protection Officer

Address: 21 Lombard Street, London, EC3V 9AH

Email: [email protected]

Further details about all the rights available to you may be found on our website: www.ers.com/policy-pages/privacy-policy

If you are not satisfied with our use of your personal data or our response to any request by you to exercise your rights in

relation to your personal data, please contact dp[email protected]

You also have a right to make a complaint to the Information Commissioner:

Address: , Wycliffe House, Water Lane, Wilmslow, Cheshire SK9 5AF

Tel: 0303 123 1113 (local rate) or 01625 545745 (national rate)

Email: [email protected].uk

Financial Services Compensation Scheme (FSCS)

As we are members of the Financial Services Compensation Scheme (FSCS), you may be entitled to compensation under the

scheme if we cannot pay out all valid claims under this insurance. This depends on the type of policy you have and the

circumstances of the claim. The scheme will cover 90% of the claim with no upper limit. For types of insurance you must

have by law (such as third party insurance for motor claims), the scheme will cover the whole claim. You can get more

information about the scheme from the FSCS via:

Address: Financial Services Compensation Scheme, 10

th

Floor, Beaufort House, 15 St Botolph Street, London EC3A 7QU

Tel: 0800 678 1100 or 0207 741 4100

Email: [email protected].uk

Web: fscs.org.uk

ERS POLICY DOCUMENT NUMBER ACCC 1019 28

01

Phone us immediately, preferably from the scene of

the incident, using the 24 hour helpline number

02

Take photographs of damage to all vehicles and the

scene of the accident, if safe to do so

03

Note the number of occupants in the other

vehicle(s)

Phone us using the 24 hour helpline number on 0330 123 5992 which will allow us to

arrange the following:

• Roadside recovery for immobile vehicles

• Collection and repair if cover is comprehensive

• A free loan car or car derived van (subject to policy terms)

Following the instructions above will help us protect you from fraudulent claims and keep costs to

a minimum

IN THE EVENT OF AN ACCIDENT