Motor Insurance

Insurance Product Information Document

Company: Geo Underwriting Services Limited

Product: Cherished Car Insurance

This document is a summary of the insurance contract. Please see the policy document for the full cover, terms, conditions and limits of

the insurance contract.

What is this type of insurance?

The Cherished Car policy offers Comprehensive Road Risks or Laid Up cover as selected by you. This is an annual private car insurance

policy designed for owners of cherished vehicles over 10 years old and driven for no more than 5000 miles each year (7,500 if over 24

years old).

It also offers additional benefits (as set out below) depending on the cover you choose.

£

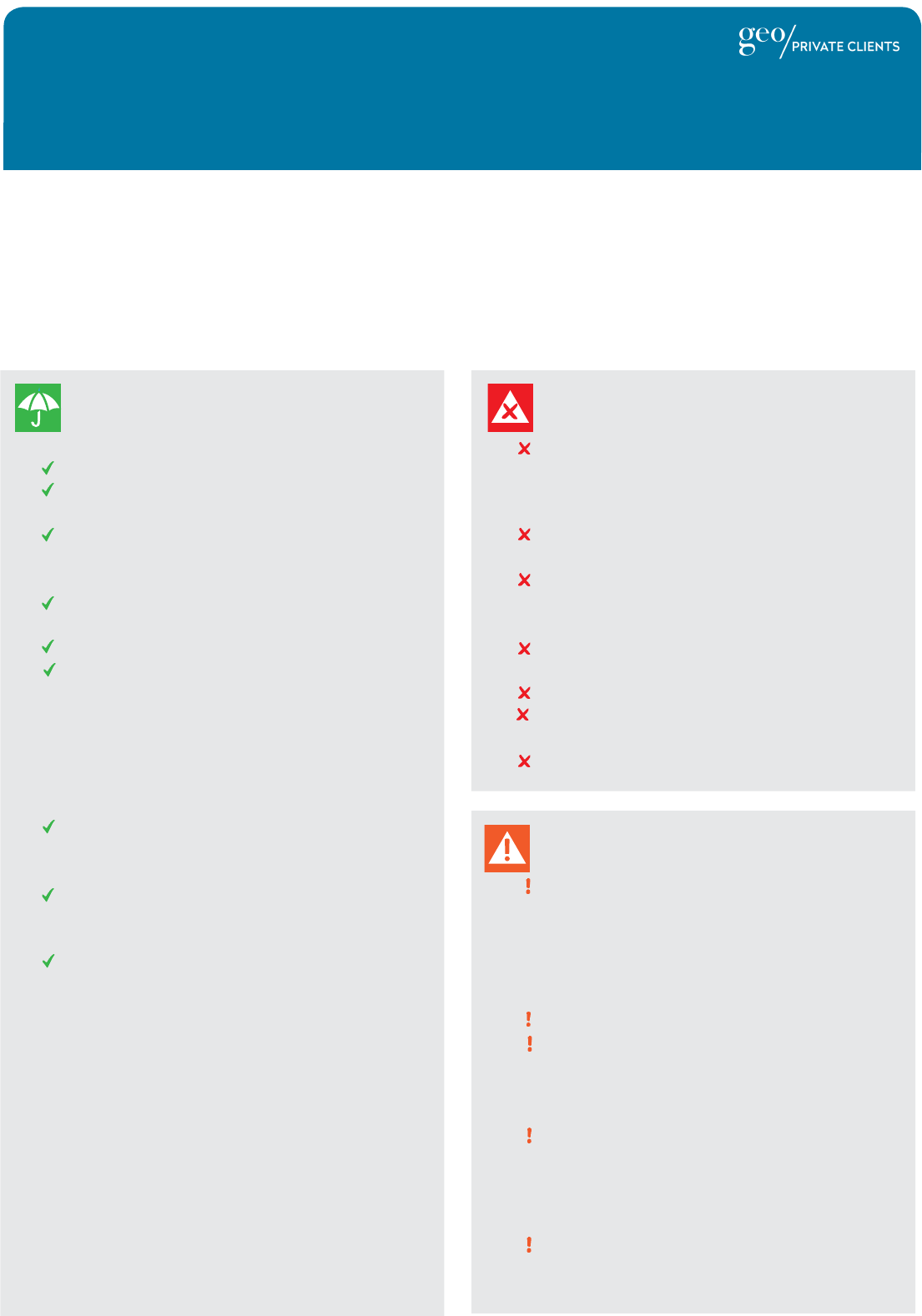

What is insured?

£

What is not insured?

£

£

£

£

Registered in England No. 4070987. Registered Address: 2 Minster Court, Mincing Lane, London, EC3R 7PD. Authorised and

regulated by the Financial Conduct Authority. FCA Register Number 308400.

GPC/CC/AV/07.20

Laid Up Cover

Accidental damage cover for your car.

Loss of (or damage to) your car, including fitted

accessories, following fire or theft.

Third Party Liability – up to £20,000,000 for damage to other

people’s property, and compensation for other people’s

death or injury, if you are at fault.

Legal costs – up to £5,000,000 (if incurred with our consent)

in connection with a claim made against your policy.

Glass – up to £1,000 to replace or repair the glass in your car.

Replacement locks – up to £100 towards the cost of

replacing the vehicles door, boot, ignition & steering lock,

lock transmitter or central locking interface in the event of

your vehicle keys or lock transmitter are lost or stolen.

Comprehensive

All of the above, plus:

Personal belongings – we will cover you for up to £150 for

any personal belongings that are lost, damaged or stolen as a

result of an accident, fire or theft.

Personal accident – up to £5,000 per claim (or

£10,000 per insurance year) if you or a partner suffer death or

the loss of limbs/sight following a motor accident.

Continental use up to 90 days in one period of insurance and

the visits do not exceed 30 continuous days.

Reinstatement Repair - (Optional)

Where the vehicle is insured on an Agreed Value basis, this

value can be increased by either 25% or 50% (as chosen by

you) in respect of repairs to the insured vehicle.

Cherished Car Number Plate Cover - (Optional)

Provision to cover the financial loss of a number plate up to

the value stated in your current schedule if it is withdrawn by

DVLA in the event of a total loss of the vehicle.

Any accident, injury, loss or damage while any car is being

used for purposes not described on your certificate of motor

insurance, or while being driven by somebody not permitted

to drive (or not having a correct and valid driving licence).

Any consequence as a result of war or terrorism – except

where cover must be provided under Road Traffic Acts.

Loss or damage if your car has been left with ignition keys or

left unattended with the engine running. Driving other

vehicles is automatically excluded.

Damage arising from wear and tear, electrical and

mechanical breakdown, or gradual deterioration.

Loss of value following a repair.

Claims under personal accident cover as a result of a suicide

or attempted suicide.

Courtesy car is not provided.

Are there any restrictions on cover?

For loss or damage claims, the maximum amount the insurer

will pay will be the Agreed Value unless the schedule has the

words Market Value or Endorsement MV1 has been applied,

where the maximum amount payable will be the reasonable

market value immediately prior to the theft or damage, but

not exceeding your estimate of value shown in our records.

An excess will apply to most claims.

An excess of £60 (increased to £80 if the non-approved

windscreen company used) will apply to glass replacement

claims –and we may not use glass supplied by the original

manufacturer. An excess will apply to most claims.

The Cherished Car policy is a limited mileage policy. Cover

will be prejudiced if you exceed the annual mileage

limitation you have requested. Please refer to your policy

schedule and policy wording for the limitation applying to

your policy.

Overnight Garaging if your vehicle exceeds £15,000, it may

be subject to a garaging requirement between 10.00 pm and

6.00 am. Your policy schedule will confirm if this applies.

Main exclusions only

Where am I covered?

The UK, Channel Islands, Isle of Man and Republic of Ireland – plus Andorra, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech

Republic, Denmark, Estonia, Finland, France (including Monaco), Germany, Gibraltar, Greece, Hungary, Iceland, Italy

(including San Marino and the Vatican City), Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal,

Romania, Serbia, Slovakia, Spain, Sweden and Switzerland (including Liechtenstein)

What are my obligations?

• You must take reasonable care to give us complete and accurate answers to any questions we ask – whether you are taking out,

renewing or making changes to your policy.

• You must tell us about any changes to the car(s) insured (or to be insured) that may increase the amount that needs to be insured

or change the limits on your schedule.

• You must also tell us about any changes to the people on the policy (including convictions) that may require us to change the

terms.

• You must observe and fulfil the terms, provisions, conditions and clauses of this policy – failure to do so could affect your cover.

• You must tell us about any accident, injury, loss or damage as soon as possible – so we can tell you what to do next and help

resolve any claim.

• If you need to make a claim, you must give us all the information we need to achieve a settlement or pursue a recovery.

When and how do I pay?

Depending on your choice of insurance broker you may have several options with regards to how you pay for your insurance (such as

monthly or annually). The choices available to you will determine when you pay. Please discuss with your insurance broker.

When does the cover start and end?

This policy is an annually renewable contract and starts from the date specified by you (shown on your schedule) and ends

12 months from that date.

H

ow do I cancel the policy?

• You can cancel your policy within 14 days of purchase or renewal (or on the day you receive the policy documents, if that is

later) we will refund any money paid, providing the cover has not started.

• If you cancel after your policy has started, we will reduce your refund to pay for the time we provided cover – we will also charge

a fee of £25 to cover our administration costs.

• You can also cancel at any time during your period of cover.

• To cancel, contact your insurance broker.

After the 14 day cooling off period, you will be entitled to a refund of any premium paid, subject to a

deduction for any time for which you have been covered unless you have made a claim on this insurance.

GPC/CC/AV/11.19