.

Counterpoint Global Insights

Cost of Capital

A Practical Guide to Measuring Opportunity Cost

CONSILIENT OBSERVER | February 15, 2023

Introduction

Time preference is a core concept in economics and finance. The

idea is that most people place greater value on a dollar today than

a dollar in the future. Spending money now allows you to consume

with certainty. Saving money allows someone else to consume

now. The rate of return on your savings compensates you for

deferring consumption.

Edward Chancellor, a financial journalist, asks his readers to

imagine the present and future as two countries separated by a

river. Finance is the bridge that connects them. Interest is the toll

that those who want to consume now must pay and, equivalently,

the fee earned by those willing to defer their consumption. The

level of the interest rate regulates the movement of capital.

1

For example, assume that you decide to invest your savings by

buying a bond issued by a company. The company, in turn,

spends the proceeds seeking to earn an attractive rate of return.

If everything works out, the company pays you interest on a timely

basis and returns the principal when the bond matures. The

company gets to invest today and you get to earn a return for

waiting to use the money.

The value of any financial asset is the present value of the future

cash flows. Valuation starts with an assessment of the magnitude,

timing, and riskiness of cash flows. You then discount tomorrow’s

cash flows at an appropriate interest rate, or cost of capital, to

determine the value today. Investors determine the cost of capital

based on their opportunity cost, or the value of the next best

alternative.

The cost of capital is a measure of both expected return, which

takes us from the present to the future, and the discount rate,

which takes us from the future to the present. Expected returns

come with varying degrees of certainty, but in all cases a single

number reflects a distribution of potential outcomes.

AUTHORS

Michael J. Mauboussin

michael.mauboussi[email protected]om

Dan Callahan, CFA

dan.callahan1@morganstanley.com

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

2

Table of Contents

Introduction .......................................................................................................................................................... 1

High-Level View of the Cost of Capital ............................................................................................................... 5

Estimating the Cost of Debt ................................................................................................................................. 9

Estimating the Cost of Equity ............................................................................................................................. 13

Risk-Free Rate ........................................................................................................................................... 14

Equity Risk Premium .................................................................................................................................. 15

Beta ............................................................................................................................................................ 20

Adjusted Beta ....................................................................................................................................... 23

Industry Beta ......................................................................................................................................... 23

Winsorized Beta .................................................................................................................................... 24

Weighted Average Cost of Capital ..................................................................................................................... 26

Other Forms of Financing .................................................................................................................................. 29

Convertible Bonds ...................................................................................................................................... 29

Preferred Stock .......................................................................................................................................... 29

Optimal Capital Structure ................................................................................................................................... 31

Trade-Off Theory ....................................................................................................................................... 31

Pecking Order Theory ................................................................................................................................ 33

Conclusion ......................................................................................................................................................... 36

Checklist for Estimating the Cost of Capital ....................................................................................................... 37

Appendix A: Adjusted Present Value ................................................................................................................. 38

Appendix B: Fama-French Three-Factor Model ................................................................................................ 40

Definitions of Terms ........................................................................................................................................... 42

Endnotes ............................................................................................................................................................ 43

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

3

Introduction

The cost of capital varies over time. Periods when the cost of capital is high are followed by periods of returns

that are above normal, on average, and a low cost of capital tends to precede subpar returns.

2

Companies access external capital from investors, primarily in the form of debt and equity, and invest it with the

intention of earning a return in excess of the cost of capital. The expected risk and return are lower for debt

holders than for equity holders because debt has a senior claim on cash flows. Debt holders get paid before

equity holders do.

The terms of debt financing, the magnitude and timing of cash flows, are established by contract. Investors are

left to determine only the risk that the company will fail to fulfill its obligations and what they might recover in the

case of default. Changes in interest rates, inflation, and overall economic conditions influence the cost of debt,

but the rights of the debt holders are stated plainly.

You can think of equity as a residual claim, or what’s left over after subtracting the claims of debt holders and

preferred shareholders. Companies that earn a return on investment in excess of the cost of capital create value

for shareholders because other claims have been satisfied and the additional value accrues to the equity holders.

This report is a practical guide to estimating the weighted average cost of capital (WACC) for a company.

Academic approaches to estimating the cost of capital have been criticized in recent decades, and we will

discuss some of the issues of concern.

3

Our goal is to find a figure that reflects opportunity cost sensibly, is

economically sound, and provides the investor and businessperson with a solution to apply to the problem.

Estimating the cost of debt is relatively straightforward because the details of the agreement between the

company and the investor are clear. Investors may disagree with the market’s assessment of a bond price, but

the company’s obligations are in plain view.

Estimating the cost of equity is more difficult because none of the determinants of value are explicit. Dividends,

which do reflect elements of the magnitude and timing of cash flows, are at best a quasi-commitment to return

cash to shareholders. And unlike a measure such as yield to maturity on a bond, there is no transparent method

to observe a stock’s expected return. Equity investors need to assess the expectations for the magnitude, timing,

and riskiness of future cash flows. Ascribing a value to equity is almost always harder than to debt for this reason.

Methods to assess the cost of equity are commonly based on a model of asset pricing. The capital asset pricing

model (CAPM) is the most popular among financial executives and investors.

4

Despite its widespread use, the

CAPM has come under fire in recent decades. The focal point is beta, which attempts to capture risk by

measuring the sensitivity of a stock’s returns relative to those of the market. Beta does a poor job of predicting

actual reward. Academics have introduced additional factors in an attempt to better reflect the relationship

between risk and reward.

5

We are not defenders of the faith in the CAPM. But we believe the model, especially with methods to reduce the

error in beta, is a useful complement to other indicators of risk and reward that have market prices, including

bond yields and implied volatility in option prices. These measures can provide guidance and context for

establishing a reasonable cost of capital.

Nearly all investors acknowledge that the present value of future cash flows determines the value of a stock, but

many believe a discounted cash flow (DCF) model is unreliable. For example, they point out that predicting cash

flows is challenging, much of the value commonly resides beyond the explicit forecast period and has to be

captured in the continuing value, and the overall output is very sensitive to small changes in the cost of capital.

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

4

One common solution is to avoid DCF models altogether and to default to multiples. These include price/sales

(P/S), price/earnings (P/E), enterprise value/earnings before interest, taxes, depreciation, and amortization

(EV/EBITDA), and price/book (P/B). Indeed, a survey of almost 2,000 professional equity analysts found that

“market multiples” were “[b]y far the most popular approach to valuation.” Analysts use P/E and EV/EBITDA

multiples most frequently.

6

The problem is that multiples are at best a proxy for the process of valuation. Using a multiple does not

circumvent the problems with forecasting cash flows and discount rates but rather buries them. We believe that

it is better to make the assumptions explicit, debate them, and consider alternative scenarios.

There is not a lot of upside in coming up with a sensible cost of capital but there is a lot of downside in applying

a figure foolishly. The goal is to blend the economic logic of an asset pricing model with market prices in order

to estimate intelligently the opportunity cost of capital. The danger is applying formulas without thought. Charlie

Munger, vice chairman of Berkshire Hathaway, has said, “People calculate too much and think too little.”

7

A

sound estimate of the cost of capital requires some thinking.

Successful investing is ultimately about properly anticipating revisions in expectations about future cash flows.

The rate at which those cash flows are discounted is important but is overwhelmed in the long run by getting the

cash flows right. We recommend settling on a practical cost of capital and then allocating the bulk of analytical

time and attention to thinking about the potential paths of cash flows.

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

5

High-Level View of the Cost of Capital

The cost of capital for a company is the opportunity cost for investors in the setting of a diversified portfolio.

The cost of capital is based on the economic principle of substitution. An investor will not invest in an asset if a

comparable asset exists that is more attractive, including consideration for risk. This means that an investor will

buy the asset with the highest return for a given level of risk, or the lowest risk for a given level of return. This

presumes that more risk is associated with more reward.

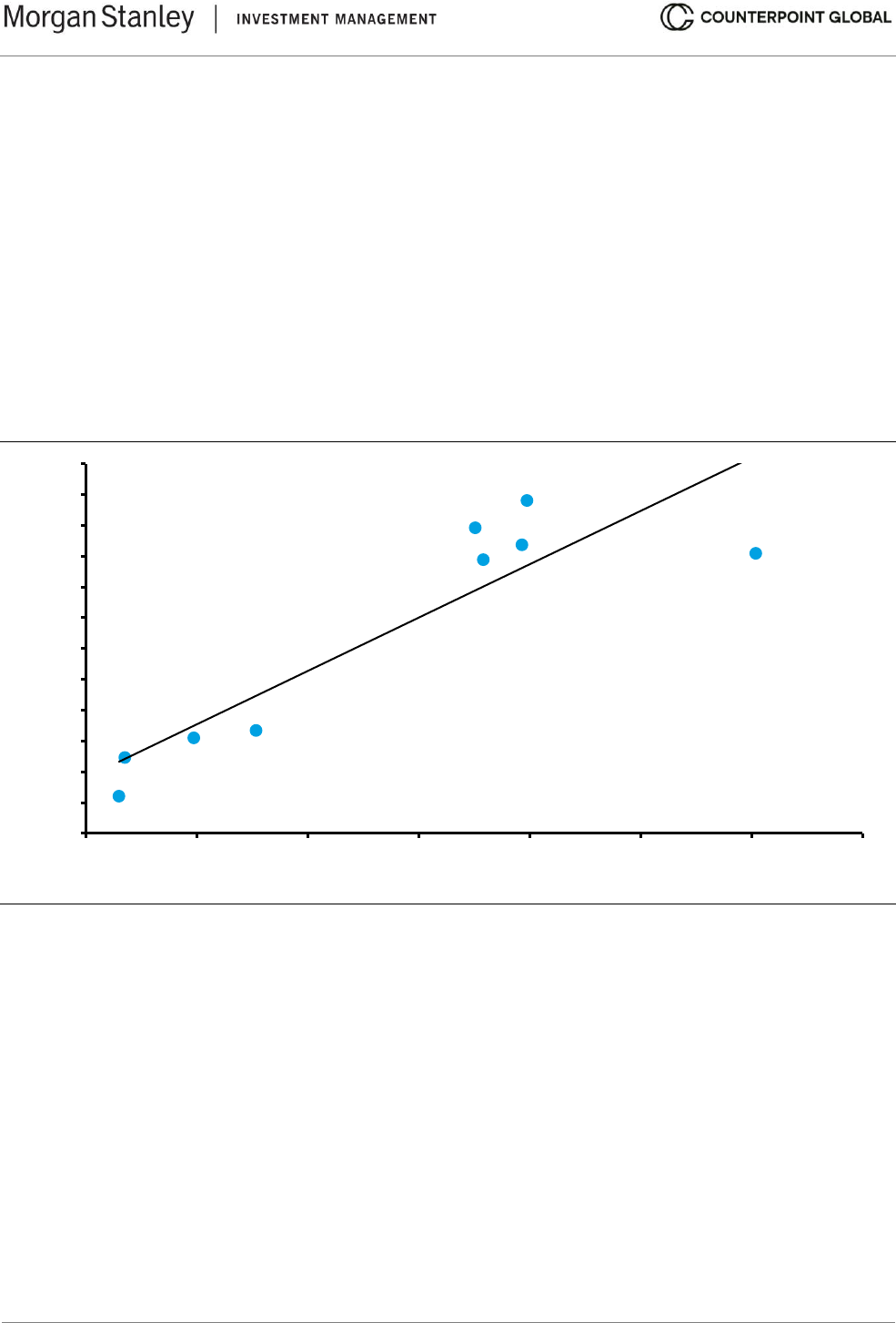

Exhibit 1 shows this relationship over 20 years for 8 asset classes (5 in equities and 3 in credit) and inflation.

Standard deviation, a measure of variation for a set of values, is the proxy for risk, and total shareholder return

(TSR) reflects reward.

Exhibit 1: Risk and Reward for Eight Asset Classes and Inflation, 2003-2022

Source: FactSet; U.S. Bureau of Labor Statistics; Counterpoint Global.

Note: Indexes: MSCI Emerging Markets, Russell 1000, Russell Midcap, Russell 2000, MSCI World, Bloomberg 7-10 Year

U.S. Treasury, Bloomberg U.S. Aggregate Bond, Bloomberg 1-3 Month U.S. Treasury Bills, and U.S. Consumer Price Index.

Portfolio diversification reduces the specific risk of an individual stock, or asset class, but even a portfolio that is

fully diversified is exposed to market risk. What matters for a particular security or asset class is its contribution

to the risk of a diversified portfolio. For instance, the standard deviation of returns for the stock of WD-40

Company, a producer of oil for lubrication, is much higher than that of the market, but adding the stock to a

portfolio reduces risk because the stock tends to zig when the market zags.

8

The focus is not on the risk of the

stock but rather how that security affects the risk of the overall portfolio.

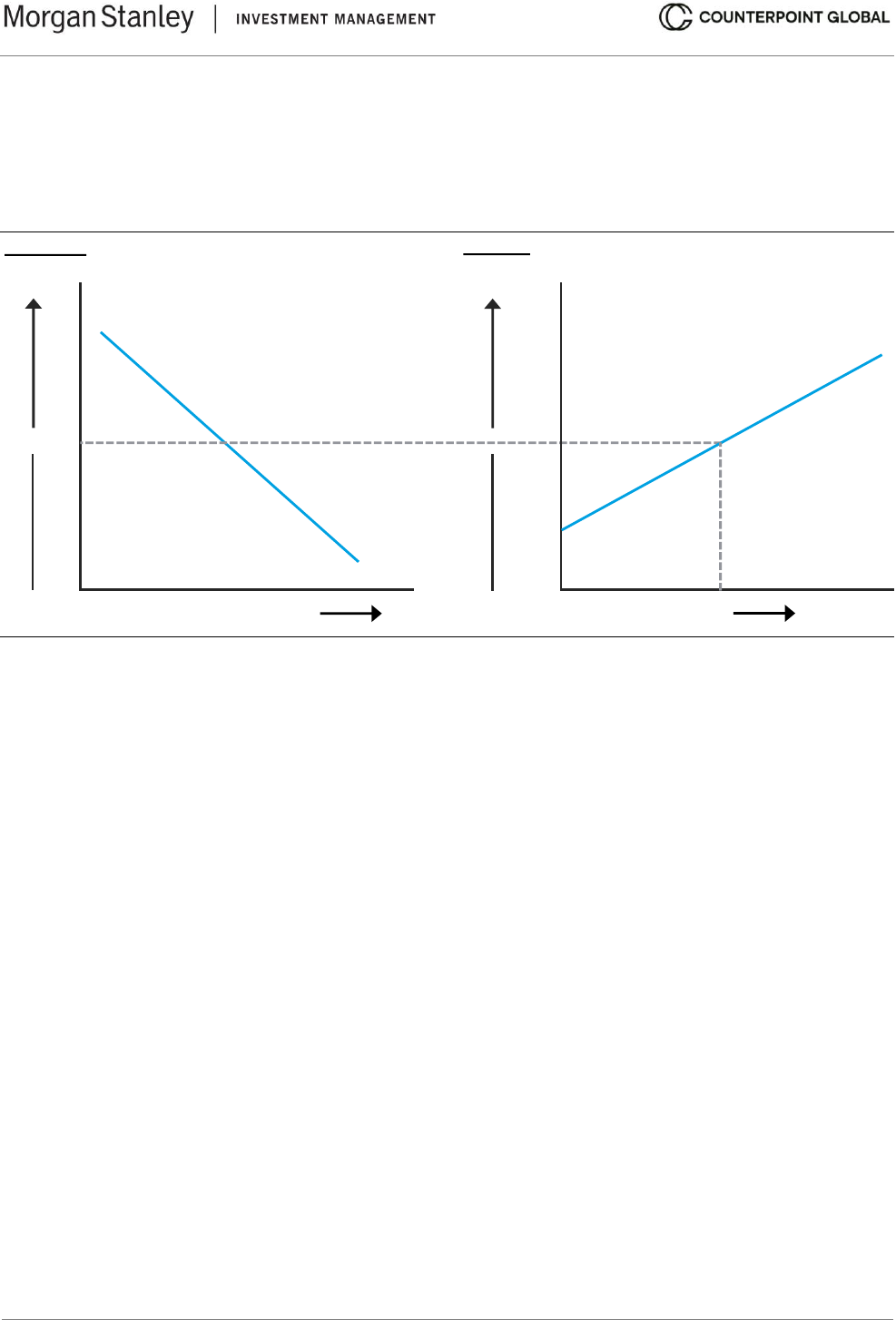

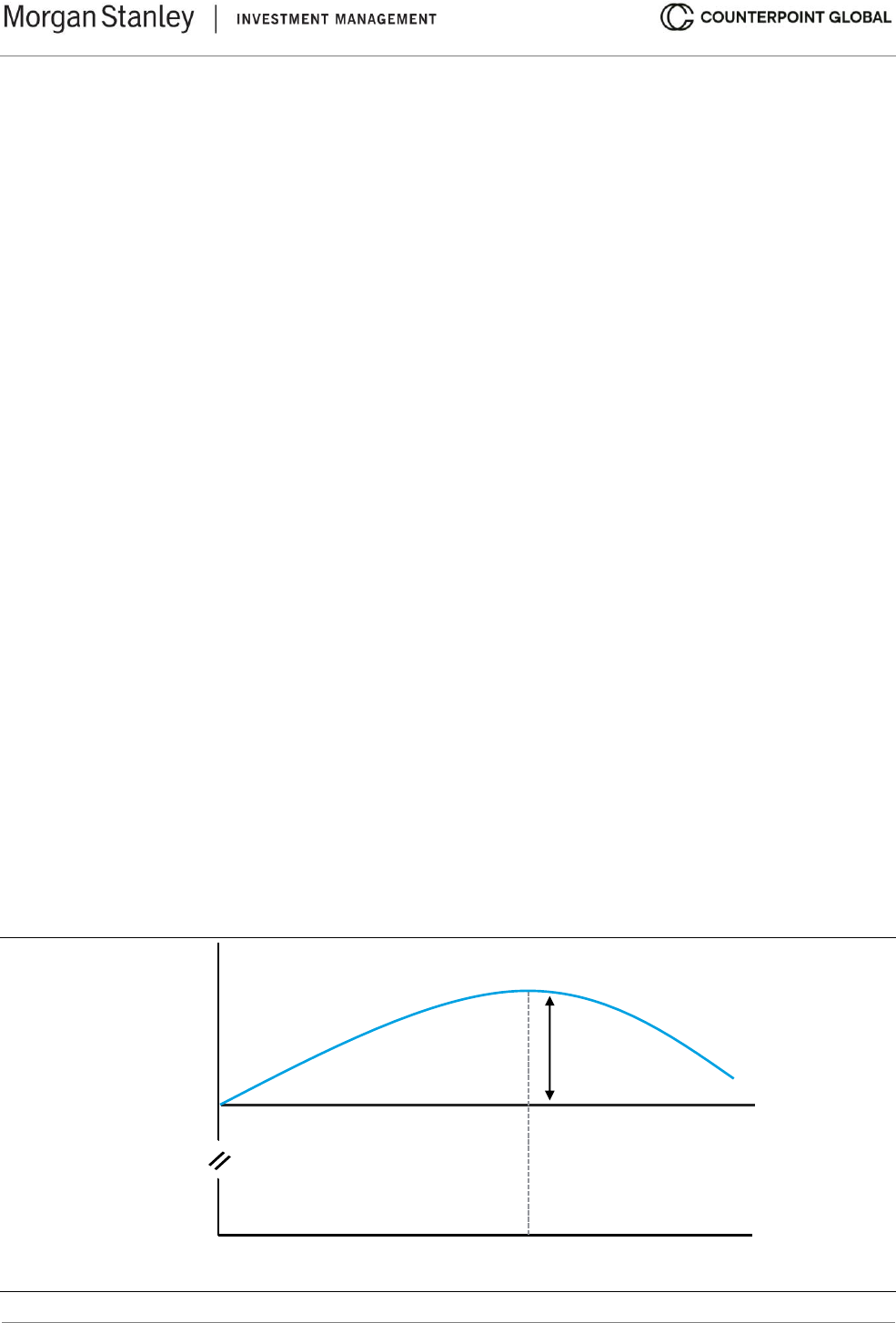

The cost of capital is a link between corporate finance and investing (see exhibit 2). Companies use the capital

that investors save. Companies seek to invest capital, which includes funds generated by the business, at a rate

of return above the cost of capital in order to create value. These capital allocation decisions apply to mergers

and acquisitions (M&A), internally-generated intangible investments, capital expenditures, and working capital.

9

Companies can only invest so much before the return on investment drops below the cost of capital.

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

11%

12%

0% 5% 10% 15% 20% 25% 30% 35%

TSR (Annual)

Standard Deviation

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

6

The cost of capital for a company is the opportunity cost of the investor. Investors must evaluate investment

opportunities with an eye toward making sure there is an appropriate reward for the risk they take. Investors

vary in their risk appetites but all seek to earn a proper payoff.

Exhibit 2: The Link between Companies and Capital Markets

Source: Based on G. Bennett Stewart, III, The Quest for Value: A Guide for Senior Managers (New York: HarperCollins,

1991), 83.

A company’s balance sheet has assets on the left and liabilities and equity on the right. Assets are the resources

a company employs to generate cash flows. Liabilities and equity are the way a company finances those

resources. Debt and equity are the most popular forms of financial capital.

Debt is a contractual obligation between a company and its lenders, in which the company pledges to make

timely payments of interest and to return principal at the end of a period that is specified by contract. Equity is

technically a contract between a company and its shareholders that confers limited rights to shareholders, which

include the right to vote, transfer ownership, and collect dividends.

10

Practically, common equity represents a claim on future residual cash flows. The claim is on cash flows after a

company has paid other stakeholders, including creditors (interest and principal), suppliers (accounts payable),

the government (taxes), and employees (wages).

We have so far used the standard deviation of asset price changes as a measure of risk. But you can think of

risk more fundamentally as a combination of business risk and financial risk:

11

Corporate risk = business risk + financial risk

Business risk, or asset risk, reflects the variability of operating cash flows. Operating leverage, which measures

changes in operating profit as the result of changes in sales, is an important determinant of business risk.

12

The

ratio of fixed to variable operating costs helps explain operating leverage, especially in the short run. Firms with

high fixed and low variable costs have more operating leverage than those with low fixed and high variable costs.

Financial risk is determined by the amount of debt a company assumes. The interest expense from debt

effectively adds a fixed cost and makes the earnings more volatile.

Return

Prospective Investments

Corporate

WACC

Reward

Risk

Investor

Risk-

Free

Rate

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

7

To see how this works, consider two companies with $100 in operating profit. The first has no debt, so pre-tax

profit and operating profit are the same. The second has debt that incurs $20 in interest expense, which means

that its pre-tax profit is $80.

Now assume that both companies increase their operating profit to $120. The first company will enjoy a 20

percent increase in pre-tax profit (from $100 to $120), while the second company will realize 25 percent growth

in pre-tax profit (from $80 to $100). Naturally, the math also has a similar effect on the downside. Even with the

same operating income, profits are more volatile for the second company than they are for the first. Empirically,

companies with high business risk tend to have low financial risk, and companies with low business risk benefit

from having some financial risk.

13

Franco Modigliani and Merton Miller (M&M), economists who received the Nobel Memorial Prize in Economic

Sciences, developed a theorem in the late 1950s showing that the value of a firm is independent of its capital

structure.

14

Their point, which ran against the conventional wisdom of the time, was that a change in the capital

structure does not change risk overall but rather simply transfers risk from one stakeholder to another.

The cost of debt also goes up when a company adds debt because the size of the contractual obligation grows.

The cost of equity also goes up because the magnitude of the senior claims on assets is higher, making the

return on the residual claim riskier. But overall risk is preserved since debt is less costly than equity due to its

seniority in the capital structure.

A simple illustration can help make the point. Assume a company that has $100 in annual operating profit. We

can observe what happens as we add debt to the capital structure.

A B C

Operating profit $100 $100 $100

Debt 0 200 400

Cost of debt 0.00% 5.00% 6.25%

Cash flow for equity 100 90 75

Equity 1,000 800 600

Cost of equity 10.00% 11.25% 12.50%

Value of the firm $1,000 $1,000 $1,000

In scenario A, the firm is financed solely with equity that has a cost of 10 percent. Provided the company will

earn $100 into perpetuity with no growth, the value of the firm is $100 divided by 10 percent, or $1,000.

In scenario B, the company issues $200 of debt at a cost of 5 percent. As a result, the cash flow for equity

holders drops $10, from $100 to $90 ($10 = $200 × 5 percent). Shareholders now require a return of 11.25

percent because the addition of debt increases their risk. The debt is $200, the equity is now worth $800 ($800

= $90 ÷ 11.25 percent), and the value of the firm remains $1,000 ($1,000 = $200 debt + $800 equity).

In scenario C, the company adds more debt, bringing the total to $400. The additional debt increases the risk

for debt holders. As a consequence, the cost of debt goes from 5 to 6.25 percent. The higher interest payment,

now $25 ($25 = $400 × 6.25 percent), means that only $75 is left over for equity holders. The risk for equity

holders also rises, going from 11.25 to 12.5 percent. Here again, the cost of debt and equity are higher but the

value of the firm does not change. The debt is worth $400 and the equity is valued at $600 ($600 = $75 ÷ 12.5

percent), leaving the total at $1,000.

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

8

M&M’s invariance proposition offers insight because it is true only under very specific conditions, including no

taxes, bankruptcy costs, or effects on managerial incentives. It also assumes markets are perfect and complete.

Since none of these conditions prevail in the real world, we can conclude capital structure does matter.

15

To see why, we focus on the assumption of no taxes. Many tax codes, including that of the U.S., treat some

percentage of interest expense as a deduction from income before paying taxes. That means some debt adds

value to the firm up to a point because more cash flow is going to stakeholders and less is going to the

government.

Debt’s impact on the cost of capital is based on the role of taxes and other factors rather than on how a company

slices and dices its capital structure. Further, too much debt is problematic because it introduces the risk of

financial distress.

We are about to roll up our sleeves and get into the details. But to summarize, the cost of capital is the opportunity

cost of the investors who provide capital. It serves as a crucial link between corporate finance and investing, as

it sets the minimum rate of return a company should be willing to accept to invest in its business.

Risk can be disaggregated into business risk, which reflects the volatility of a firm’s cash flows, and financial

risk, how much debt the company takes on. M&M shows that capital structure does not matter under conditions

that are unrealistic. When we introduce realistic conditions, we can see that capital structure does matter and

that it affects the cost of capital.

Some investors prefer to discount cash flows at a required rate of return that reflects the minimum threshold of

expected return they want to earn. In cases when that rate of return exceeds the cost of capital, the approach is

equivalent to discounting at the cost of capital and insisting on paying a price that is sufficiently less than value.

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

9

Estimating the Cost of Debt

The cost of debt is the effective after-tax rate a company has to pay on its long-term debt.

The yield to maturity on a company’s long-term, option-free bonds is a good estimate for the pre-tax cost of debt

for a company with securities that are rated as investment grade. This is debt that is deemed to have a relatively

low risk of default and hence receives a higher rating from the credit agencies (Baa or above from Moody’s and

BBB or above from S&P Global and Fitch). You can observe this rate directly for most firms.

For companies that have only short-term or illiquid debt, you can take some steps to estimate the cost of debt

indirectly. First, determine the credit rating on the company’s unsecured long-term debt. Second, look at the

average yield to maturity on a portfolio of bonds with a similar credit rating. Bond investors often express this as

a spread over a Treasury rate, usually the 10-year note. The treasury yield is a proxy for the risk-free rate.

It is appropriate to use an option-adjusted spread (OAS) for a fixed income security that embeds options. For

example, a bond may include an option for the investor to sell it back to the issuer on a specific date at a set

price. Or the issuer may have the option to call back, or redeem, the bond at a predetermined time and price.

Some companies finance themselves predominantly with short-term debt. In this case, it may appear appropriate

to use the short-term rates as the cost of debt, but the problem is that short-term rates do not reflect expectations

about long-term inflation. The time horizon for estimating the cost of capital should match the time horizon of

forecasted cash flows, which is rarely less than ten years.

The long-term rate is a better approximation of interest costs over time even for companies that roll over their

short-term debt because long-term rates capture the expected cost of repeated borrowing. If a company

exclusively relies on short-term debt, use its credit rating to approximate the cost of long-term debt.

Free cash flow, or net operating profit after taxes (NOPAT) less investment needs, does not reflect financial

leverage. This is useful for comparing companies with different capital structures. But debt creates a valuable

tax shield free cash flow does not capture because some of the interest expense is generally tax deductible.

16

To capture the value of the tax shield, you must adjust debt from a pre-tax rate to an after-tax rate. To do this,

multiply the pre-tax cost of debt by one minus the marginal tax rate. The marginal tax rate is the tax rate a

company pays on its last dollar of taxable income. This is how the benefit of the tax shield that debt creates finds

its way into the calculation of WACC. The formula is:

After-tax cost of debt = pre-tax cost of debt × (1 – marginal tax rate)

Not all companies can take all of their interest expense as a deduction from taxes. For example, the Tax Cuts

and Jobs Act of 2017 sets a limit on the tax deductibility of interest at 30 percent of earnings before interest and

taxes (EBIT) for U.S. companies with sales of $25 million or more. This went into effect in 2022. We estimate

that this affected about 25 percent of the companies in the Russell 3000 that had positive EBIT in 2022. The

Russell 3000 tracks the largest stocks by market capitalization in the United States.

The effective rate is commonly lower than the marginal rate because companies have net operating losses

(NOLs), tax loss carrybacks, or investment tax credits.

The cost of debt should reflect the marginal rate, including state and local taxes, of the countries where the

company earns its operating profit. This can create a sizeable difference between the tax rate in a company’s

home country and the tax rate it must actually pay for firms with a large presence outside of their domicile.

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

10

For companies with tax loss carryforwards, it may make sense to value the company in two stages. First, assume

the company pays normal taxes in its free cash flows. This, of course, will lead to a value that is too low.

Second, calculate the present value of the tax savings. To do this, calculate the annual tax savings and discount

that savings at the cost of debt. Note that the company has to produce operating income to realize tax savings.

Add that amount back to the value of the firm assuming full tax payment. These two stages allow for

comparability to profitable peers and specify the value of the tax savings.

The Tax Cuts and Jobs Act of 2017 also changed the rules for NOLs. Prior to the act, companies could carry

back NOLs for two years, carry them forward for 20 years, and offset all taxable income when carried back or

forward. Starting in 2018, carrybacks were eliminated and companies are only allowed to use a net operating

loss carryforward for up to 80 percent of taxable income.

The book value of debt is in many cases a sensible proxy for the market value of debt. But make an adjustment

in your debt-to-total capital ratio if the debt is trading at a substantial premium or discount to par.

The yield to maturity is a reasonable proxy for the pre-tax cost of debt for companies with debt that is rated as

investment grade. That yield can be expressed as a spread over a risk-free rate.

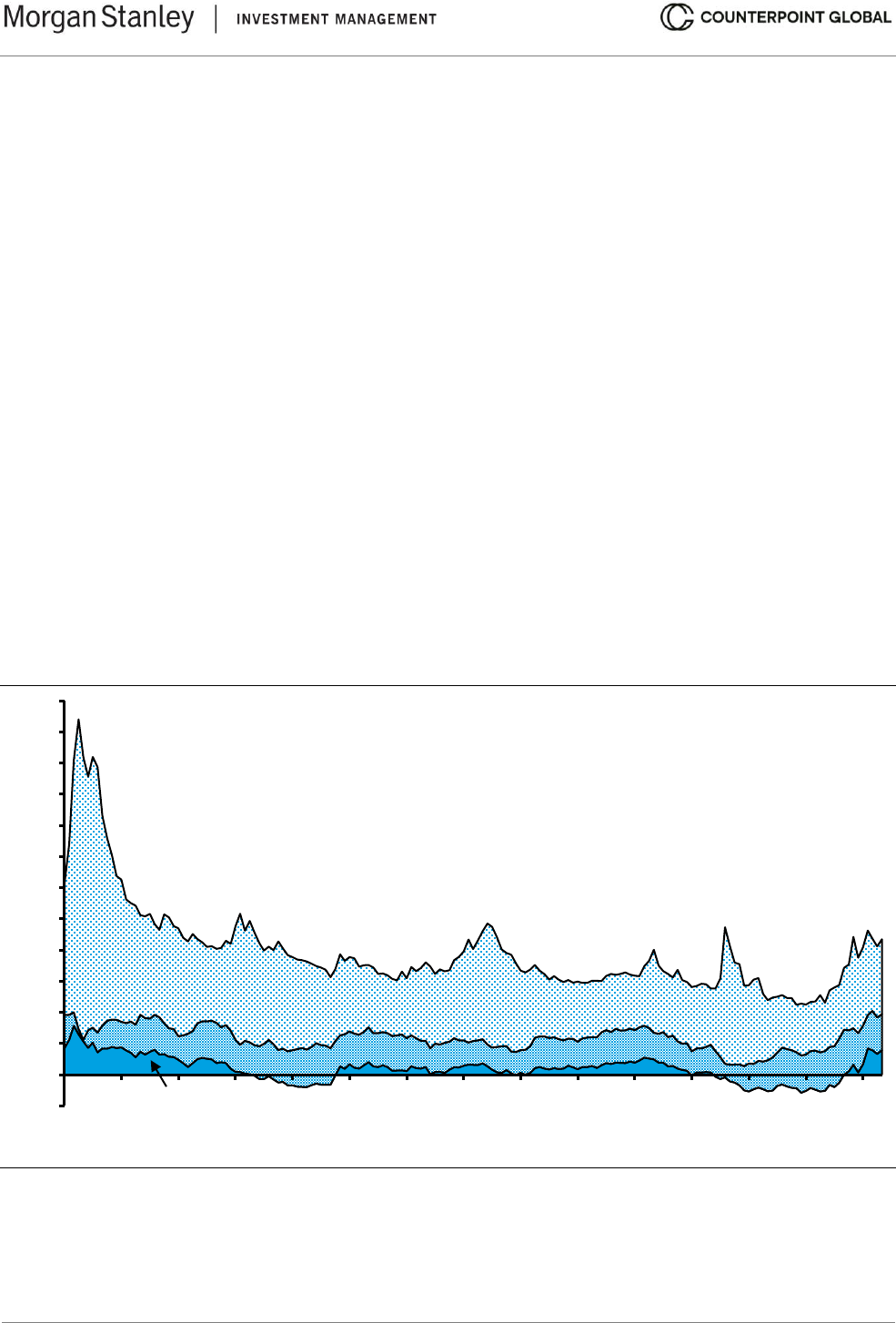

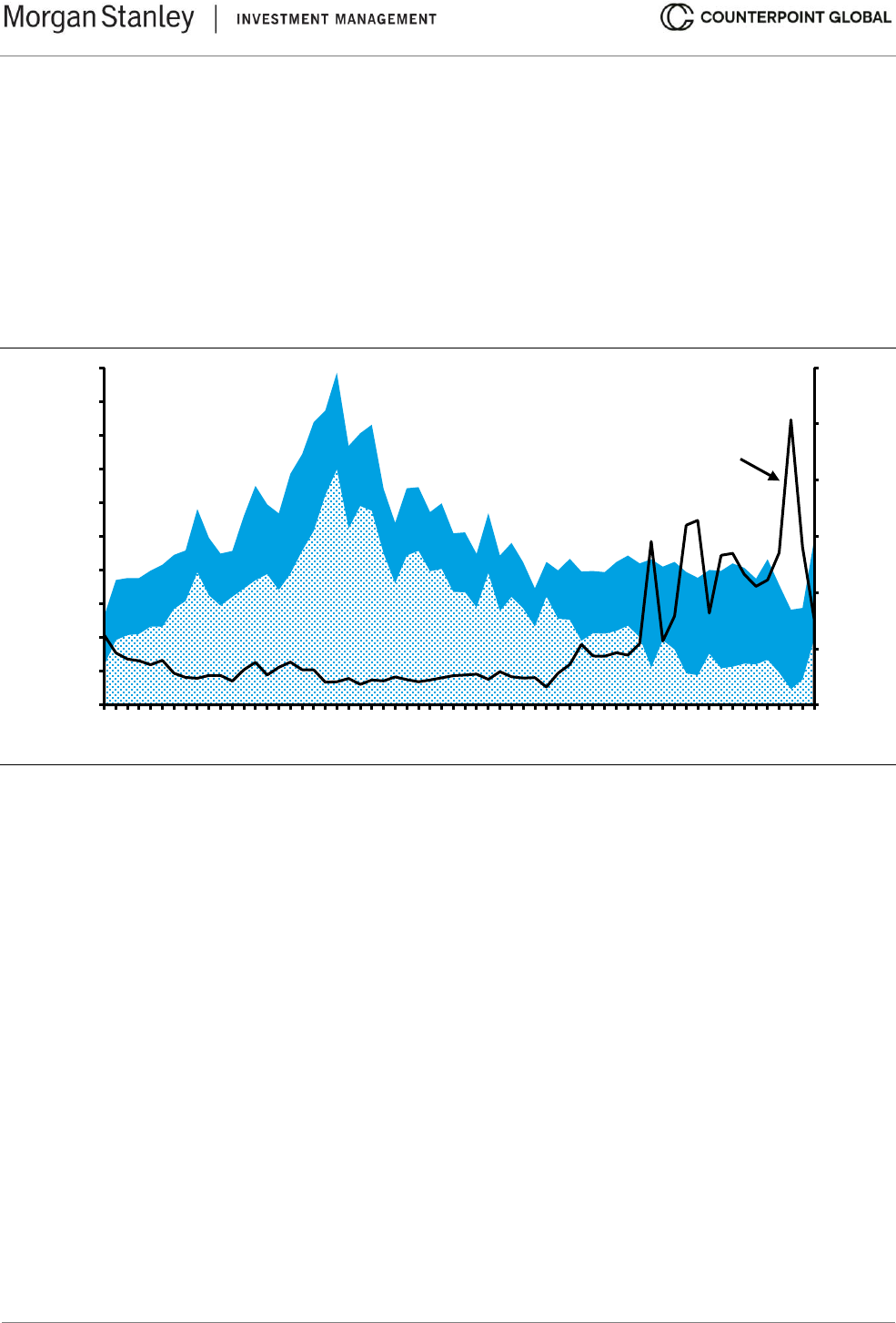

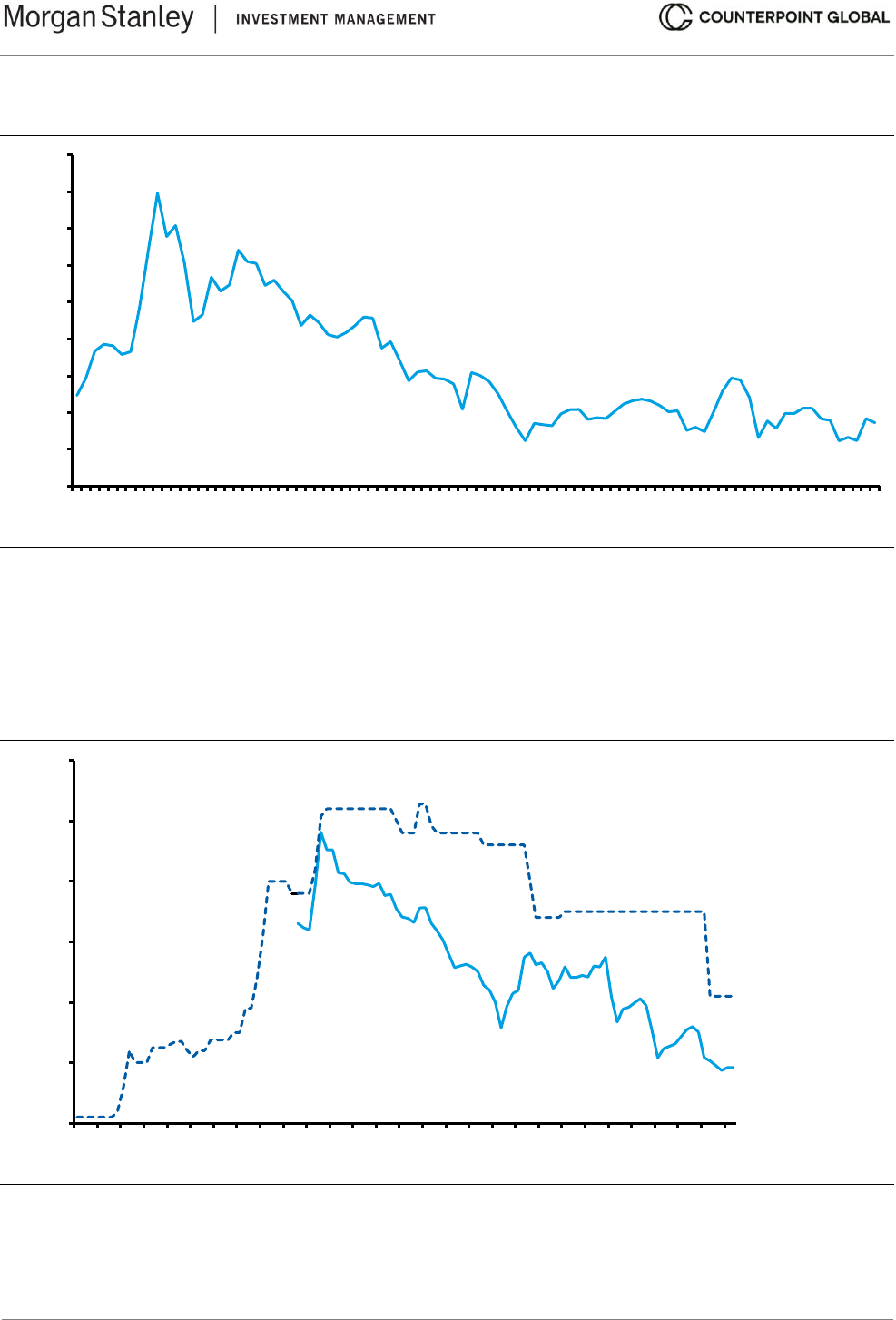

Exhibit 3 shows a decomposition of expected returns, calculated monthly, for BBB bonds from 2008 to 2022.

The components of the expected return include the real yield on the 10-year U.S. Treasury note, inflation

expectations, and the BBB credit spread. The nominal yield on the 10-year U.S. Treasury note equals the real

yield plus inflation expectations.

Over this time, the spread peaked at 7.8 percentage points in December 2008 during the financial crisis and

troughed at 1.1 percentage points in June 2021 in the throes of COVID.

Exhibit 3: Expected Returns on BBB Bonds Calculated Monthly, 2008-2022

Source: Aswath Damodaran; FRED at the Federal Reserve Bank of St. Louis; Counterpoint Global.

Note: August 2008-December 2022; Treasury note=10-year U.S. Treasury note; BBB spread=ICE BofA BBB U.S. corporate

index option-adjusted spread.

-2

0

2

4

6

8

10

12

14

16

18

20

22

24

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Percent

BBB Credit Spread

Inflation Expectations

Treasury Note Real Yield

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

11

Yield to maturity overstates the pre-tax cost of debt for companies issuing high-yield debt, or debt that is rated

below investment grade.

17

The reason is that high-yield bonds have a meaningful probability of default. For

example, the base rate of default over 10 years is about 2 percent for an investment-grade bond (BBB- or higher)

and 23 percent for a speculative-grade bond (BB+ or lower).

18

The following equation is relevant for all bonds:

Cost of debt = promised yield spread – lost yield due to default

The cost of debt is somewhere between the promised yield and the risk-free rate. Because the lost yield due to

default is negligible for companies that issue investment-grade bonds, the cost of debt and promised yield are

practically equivalent. That means the yield to maturity is a suitable proxy for the cost of debt for companies that

issue investment-grade bonds.

The lost yield due to default can be consequential for companies with non-investment grade ratings. As a

consequence, that yield to maturity may overstate materially the cost of debt. We will describe how to estimate

the lost yield due to default in a moment.

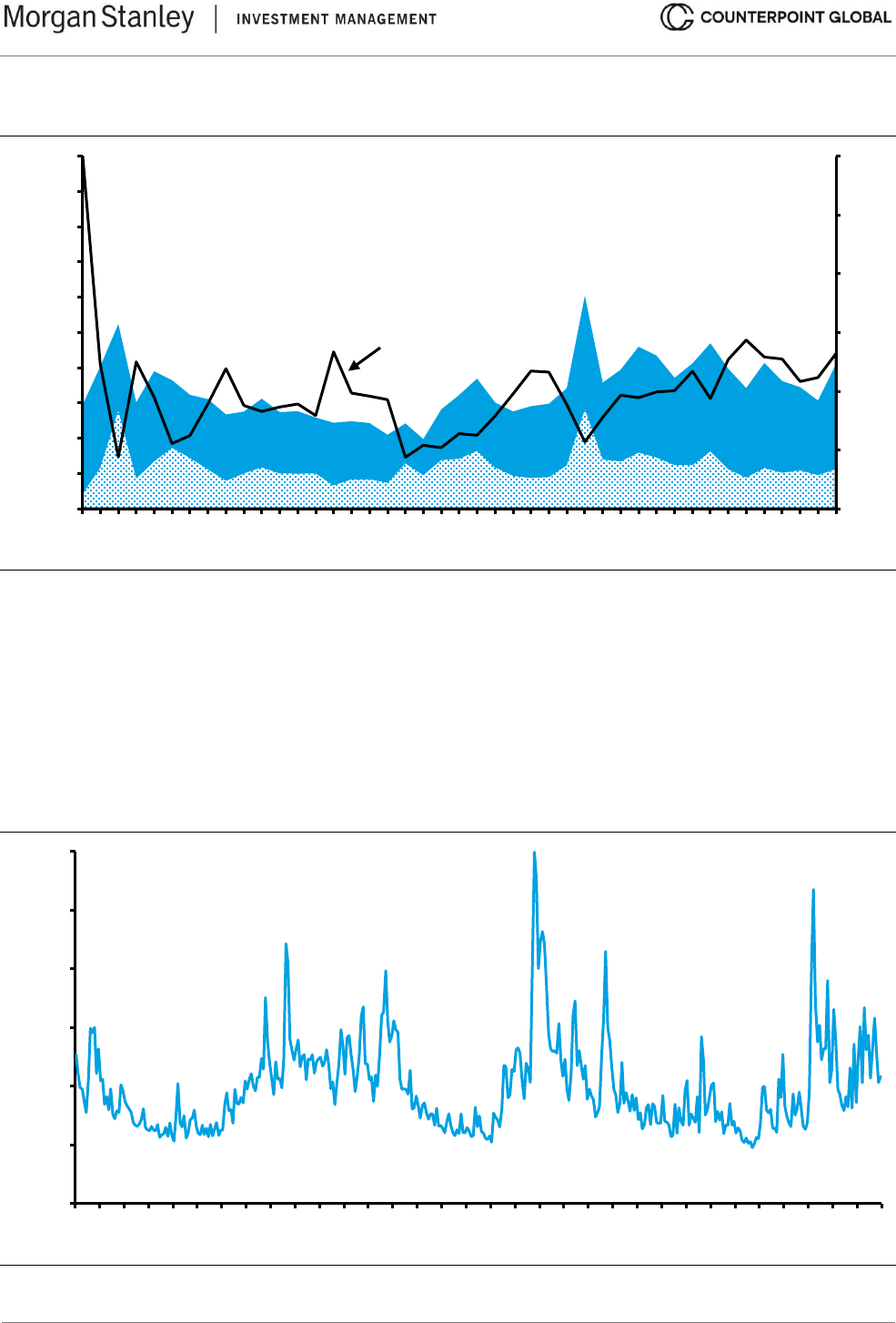

Exhibit 4 shows a decomposition of expected returns, calculated monthly, for high-yield bonds from 2008 to

2022. The spread peaked at 19.9 percentage points in November 2008, implying an expected return in excess

of 20 percent, near the climax of the financial crisis. It bottomed at 3.0 percentage points, or an expected return

of 4.5 percent, in June 2021 during COVID.

Exhibit 4: Expected Returns on High Yield Bonds Calculated Monthly, 2008-2022

Source: Aswath Damodaran; FRED at the Federal Reserve Bank of St. Louis; Counterpoint Global.

Note: August 2008-December 2022; Treasury note=10-year U.S. Treasury note; High yield spread=ICE BofA U.S. high-yield

index option-adjusted spread.

-2

0

2

4

6

8

10

12

14

16

18

20

22

24

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Percent

High Yield Credit Spread

Inflation Expectations

Treasury Note Real Yield

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

12

Robert Merton, a professor of finance who was also accorded the Nobel Memorial Prize in Economic Sciences,

developed a model that can provide insight into the risk of lost yield due to default.

19

The model values the equity

value of a company as a call option on its assets with a strike price equivalent to the notional value of the

liabilities. The key is that the distribution of option values provides insight into the default probability.

Ian Cooper and Sergei Davydenko, professors of finance, use the Merton model to estimate the lost yield due

to default. Their inputs include the debt-to-total capital ratio, credit spread, equity risk premium, and volatility of

the equity. They estimate, for example, that the proportion of the debt spread attributable to lost yield due to

default is 13 basis points, or 13 percent of the spread, for a firm with a 20 percent debt-to-total capital ratio, a

100 basis point credit spread over AAA-rated bonds, an equity risk premium of 6 percent, and a volatility of

equity of 30 percent. Accordingly, using the expected return results in a small error.

The picture is very different for a firm with high leverage. Assume a company has a 70 percent debt-to-total

capital ratio, a 400 basis point credit spread of AAA-rated bonds, an equity risk premium of 6 percent, and a

volatility of equity of 50 percent. The debt spread attributable to lost yield due to default rises to nearly 250 basis

points, or 62 percent of the spread. In this case, the promised yield spread greatly overstates the cost of debt.

Leases should also be considered debt. In 2019, new guidelines from the Financial Accounting Standards Board

(FASB), which establishes U.S. Generally Accepted Accounting Principles (GAAP), required most companies

to reflect leases longer than one year on the balance sheet.

20

Leases appear as a right-of-use asset on the asset

side of the balance sheet. This captures the lessee’s right to use the asset over the duration of the lease. About

three trillion dollars of leases were added to the balance sheets of U.S. companies as a result of this accounting

change.

21

In a quirk of accounting under GAAP, the entire lease payment, including embedded interest, is reflected in the

calculation of EBIT. With debt, the interest expense shows up below EBIT. As a result, a company that leases

an asset will have lower EBIT than a company that finances the asset with debt, even though pre-tax income

will be the same. By contrast, lease payments are appropriately allocated between depreciation and interest

expense under International Financial Reporting Standards (IFRS).

Total net debt should include leases and unfunded retirement benefits minus excess cash. Depending on the

business, you can treat cash and marketable securities above two to five percent of sales as excess.

For example, Amazon, a multinational technology company, had long-term lease liabilities of $73.0 billion as of

December 31, 2022. This liability was comprised of $11.4 billion in capital leases and $61.6 billion in operating

leases. Total debt was $70.1 billion, including short-term debt of $3.0 billion and long-term debt of $67.1 billion.

Total lease liabilities plus debt equaled $143.1 billion.

The combination of cash and marketable securities was $70.0 billion, and sales for 2022 were $514 billion.

Assuming the company requires 2 percent of sales to operate, excess cash was $59.7 billion ($59.7 = $70.0 –

[$514 × .02]). Total net debt was $83.4 billion ($83.4 = $73.0 in leases + $70.1 in debt - $59.7 in excess cash).

The company’s equity value on that date was $860 billion ($860 = $84.00 stock price × 10.2 billion shares

outstanding).

Estimating the cost of debt is a reasonably straightforward process for most companies. The calculation is more

challenging for companies that have debt that is rated below investment grade or substantial leases or other

liabilities.

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

13

Estimating the Cost of Equity

The cost of equity is the expected total return on a company’s stock.

The cost of equity is higher than the cost of debt because equity is a junior claim on the value of a firm. In

addition, debt is an even cheaper source of financing because some percentage of the interest expense on debt

is tax deductible. An estimate of the cost of equity should never be lower than that of debt.

The cost of equity is difficult to estimate because we cannot observe it directly. For example, when a company

issues debt the cost is relatively transparent. The same company offering equity can only approximate the cost.

As a consequence, an estimate of the cost of equity requires an asset-pricing model.

The best known of these are the capital asset pricing model (CAPM), developed by a handful of economists,

including William Sharpe, and the three-factor model, advanced by Eugene Fama and Kenneth French,

professors of finance.

22

Sharpe and Fama were also awarded the Nobel Memorial Prize in Economic Sciences.

Academics have continued to add factors in an effort to explain returns more effectively than the CAPM or three-

factor model can. This has led to a “zoo” of factors seeking to explain hundreds of purported anomalies.

23

Financial executives rely heavily on the CAPM but the investment community, led by quantitative funds, uses

six factors widely. These include beta (stocks of companies with high betas earn higher returns than those with

low betas), size (stocks of companies with small capitalizations generate higher returns than stocks of

companies with large capitalizations),

24

value (stocks with low multiples outperform those with high multiples),

25

momentum (stocks that have done well continue to do well in the short term),

26

quality (companies of high quality

provide higher returns than companies of low quality),

27

and asset growth (companies with low asset growth

outperform those with high asset growth).

28

Fama and French now recommend a five-factor model that includes all of the factors above except for

momentum. We will focus on the CAPM because it is the model most practitioners use. See appendix B for a

discussion of the three-factor model.

The CAPM estimates the expected return of a security by adding the risk-free rate to the security’s beta (β) times

the equity risk premium (ERP). The ERP equals the difference between the expected return for the market and

the risk-free rate and is similar conceptually to a credit spread.

Expected return = Risk-free rate + β(Market return – Risk-free rate)

The ERP is the same for all stocks in the CAPM because it captures what is known as “systematic risk,” or risk

that cannot be diversified away. Beta measures how a company’s risk contributes to portfolio risk. “Unsystematic

risk” can be reduced through portfolio diversification.

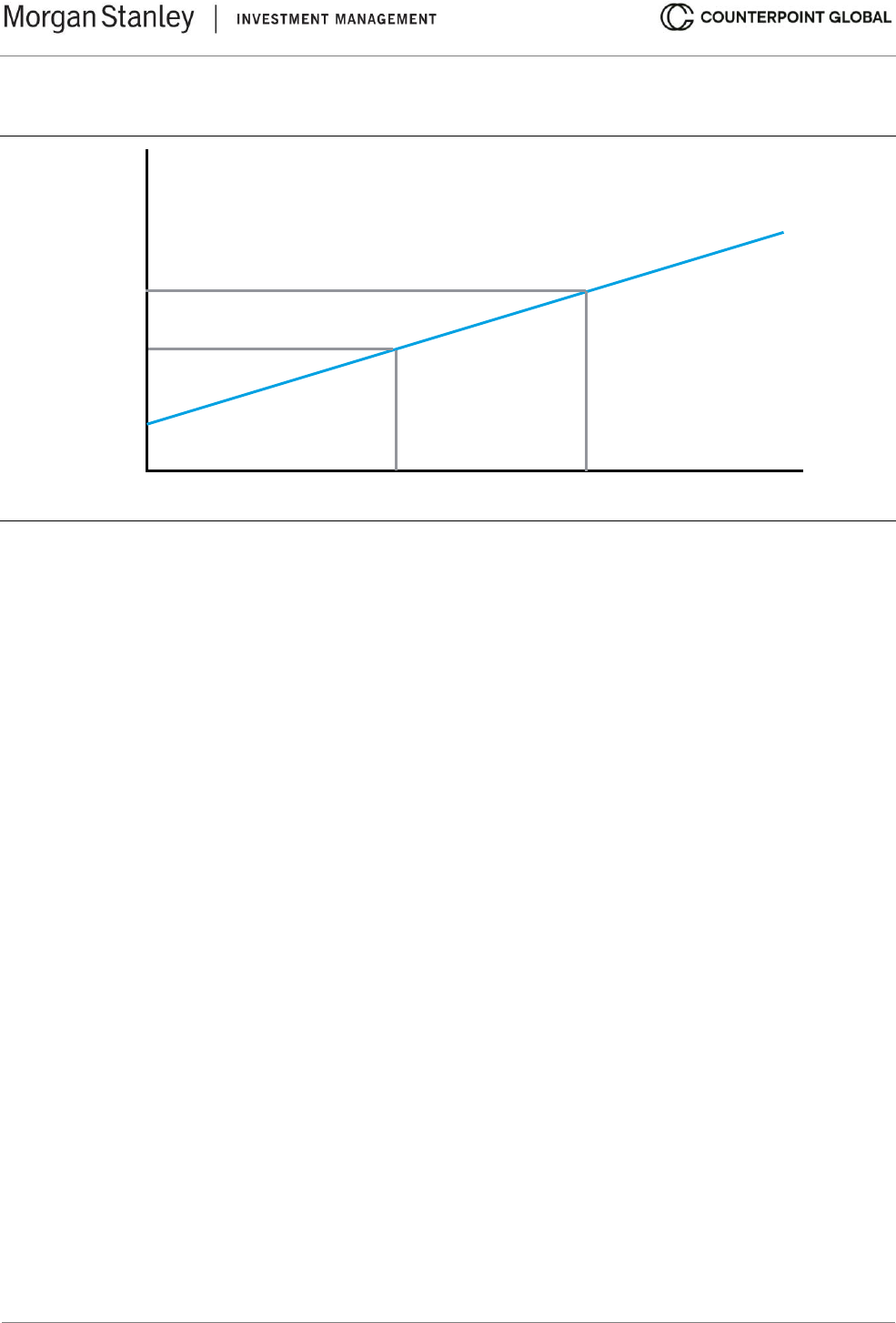

Exhibit 5 shows the security market line, which reflects a linear relationship between risk and reward. Beta

measures how much a stock moves relative to a benchmark index.

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

14

Exhibit 5: The Security Market Line

Source: Counterpoint Global.

The CAPM was developed in the early 1960s, and empirical tests of the model made it clear pretty early on that

it is better in theory than in practice. Even before introducing additional factors, practitioners have to use

judgment to answer questions about three of the model’s key drivers:

• What is the appropriate risk-free rate?

• How should the equity risk premium be estimated?

• What is the best method to estimate beta?

Risk-Free Rate. The best proxy for the risk-free rate is a yield on a long-term, default-free government fixed-

income security. The yield on the 10-year U.S. Treasury note is appropriate for businesses based in the United

States. This yield is easy to find, is sufficiently long-dated, and has a relatively low risk of default.

Outside of the United States, you can adjust the government borrowing rate in local currencies by the estimated

default spread. Aswath Damodaran, a professor of finance at the Stern School of Business at New York

University, shares these estimates on his website based on local currency ratings.

29

Ideally, the security that reflects the risk-free rate should have no covariance with the market, or a beta of zero.

Exhibit 6 shows that the 10-year Treasury note has a beta of 0.03 when compared to the S&P 500, an index

that tracks the stocks of 500 large companies in the U.S. These are monthly returns for the 60 months ending

in December 2022.

Security Market Line (SML)

Rate of Return

Risk (Beta Coefficient)

Risk-

Free

Rate

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

15

Exhibit 6: Beta for 10-Year U.S. Treasury Note versus the S&P 500, 2018 to 2022

Source: FactSet and Counterpoint Global.

Note: Returns for 10-Year Note represented by the Bloomberg U.S. Treasury 7-10 Year TR Index.

Equity Risk Premium. The ERP is the difference between the return of the equity market and the return of the

risk-free asset.

30

The ERP is higher than credit spreads in general because equity is riskier than debt. Observing

the historical ERP is easy but estimating the premium going forward is a challenge. For example, one survey of

150 finance and valuation textbooks that were written over 3 decades revealed a range of estimated ERPs from

3 to 10 percent, and one-third of the books used different ERPs in various places within the same book.

31

Leading academics and practitioners who convened a meeting in 2001 to discuss the ERP provided a range of

estimates for the ERP at that time from 0 to 7 percent, with an average just under 4 percent.

32

The realized ERP

for the following 10 years was minus 4.1 percent.

Determinants of the ERP include collective risk aversion, the perceived level of economic risk, the degree of

liquidity in markets, and tax policy.

33

The ERP moves around because these factors change. In fact, academic

research suggests the ERP is probably a series that has unstable statistical properties.

34

The practical objective

is to come up with an intelligent forecast of the ERP to assess expected returns.

There are three common approaches to estimating the ERP. The first is to look at historical results and assume

the future will be similar to the past. The second is to survey investors about their expectations. The third is to

estimate a rate the market implies by reverse-engineering assumptions to solve for the market price.

Each approach has its pros and cons. Historical results are supported by lots of data but are highly sensitive to

the time period selected, include survivorship bias, and are different whether calculated using arithmetic or

geometric averages.

35

Surveys, which include forecasts by academics, financial executives, and individual and institutional investors,

provide snapshots of attitudes at a specific moment but are imperfect because of a strong tendency to

extrapolate recent results. The structures of the surveys are not always ideal.

36

-5

-4

-3

-2

-1

0

1

2

3

4

5

-15 -10 -5 0 5 10 15

10-Year Note Monthly Returns (Percent)

S&P 500 Monthly Returns (Percent)

Slope = 0.03

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

16

An ERP implied by the market uses current prices but requires forecasts for drivers such as cash flow growth

and return on capital. Aswath Damodaran posts an updated estimate of the equity risk premium on his website

every month. He also shares a spreadsheet with his assumptions that offers the flexibility to change the variables.

Damodaran has annual estimates for the equity risk premium going back to 1961. The range is from a low of 2.1

percent in 1999 to a high of 6.5 percent in 1979. The estimates are not adjusted for inflation.

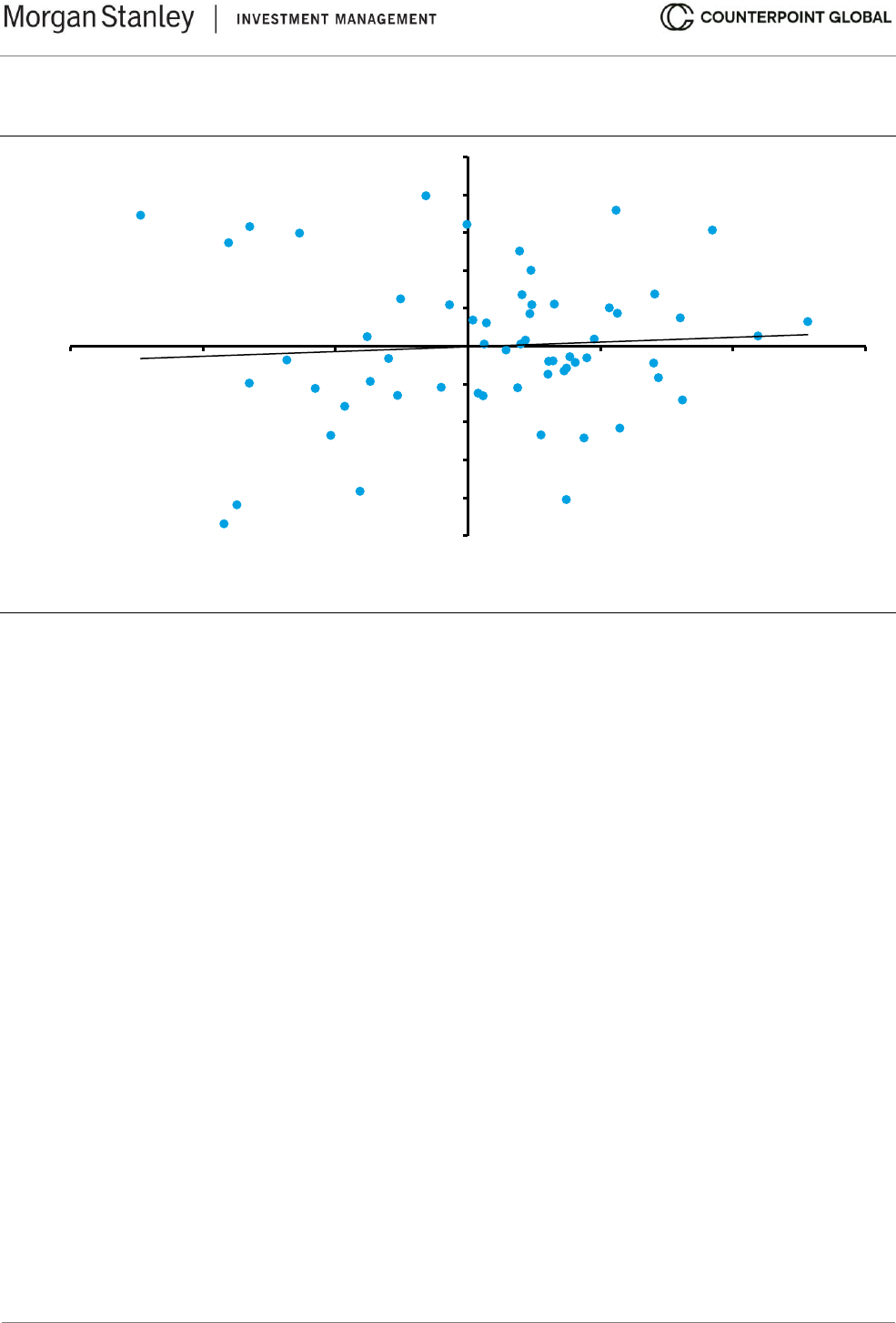

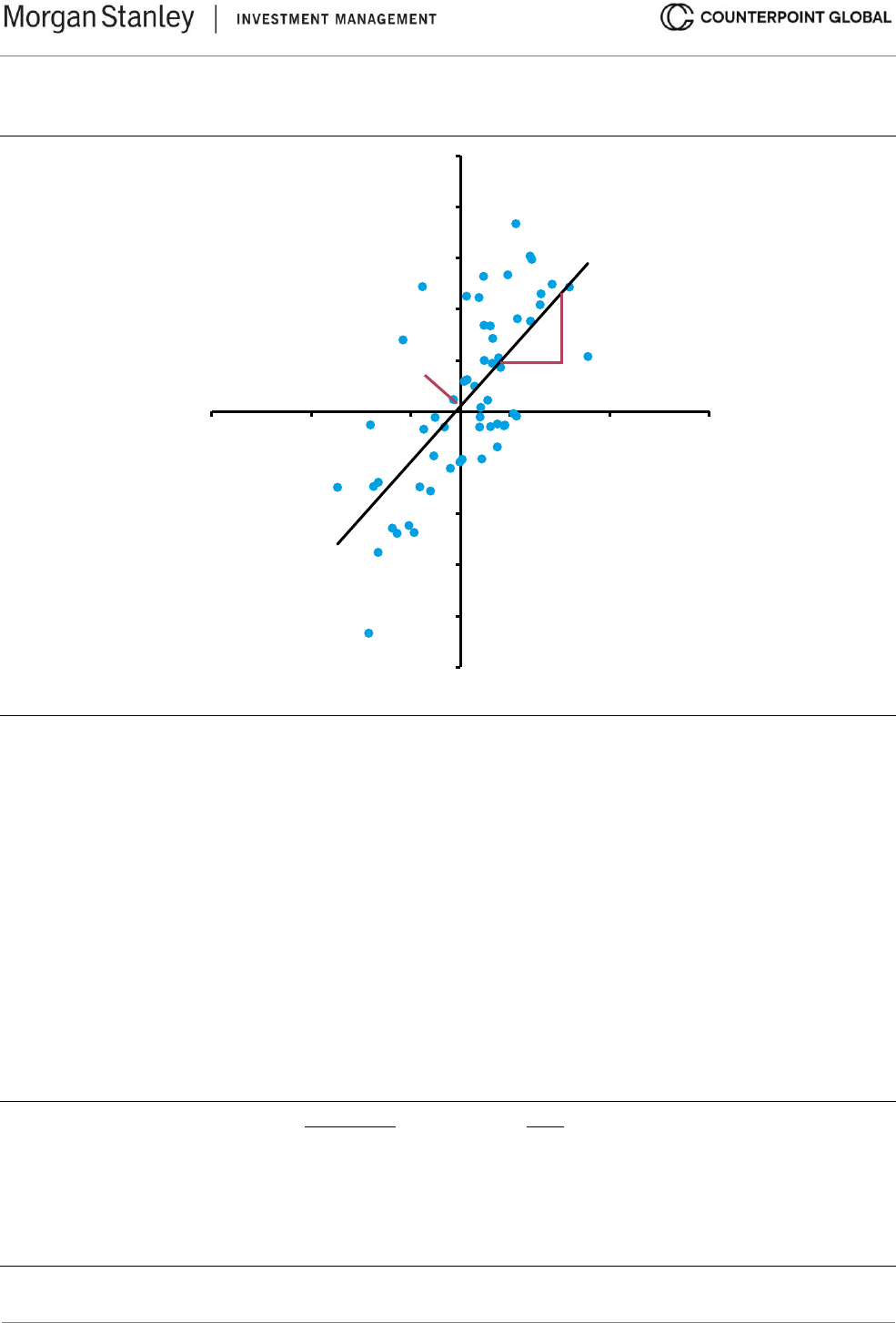

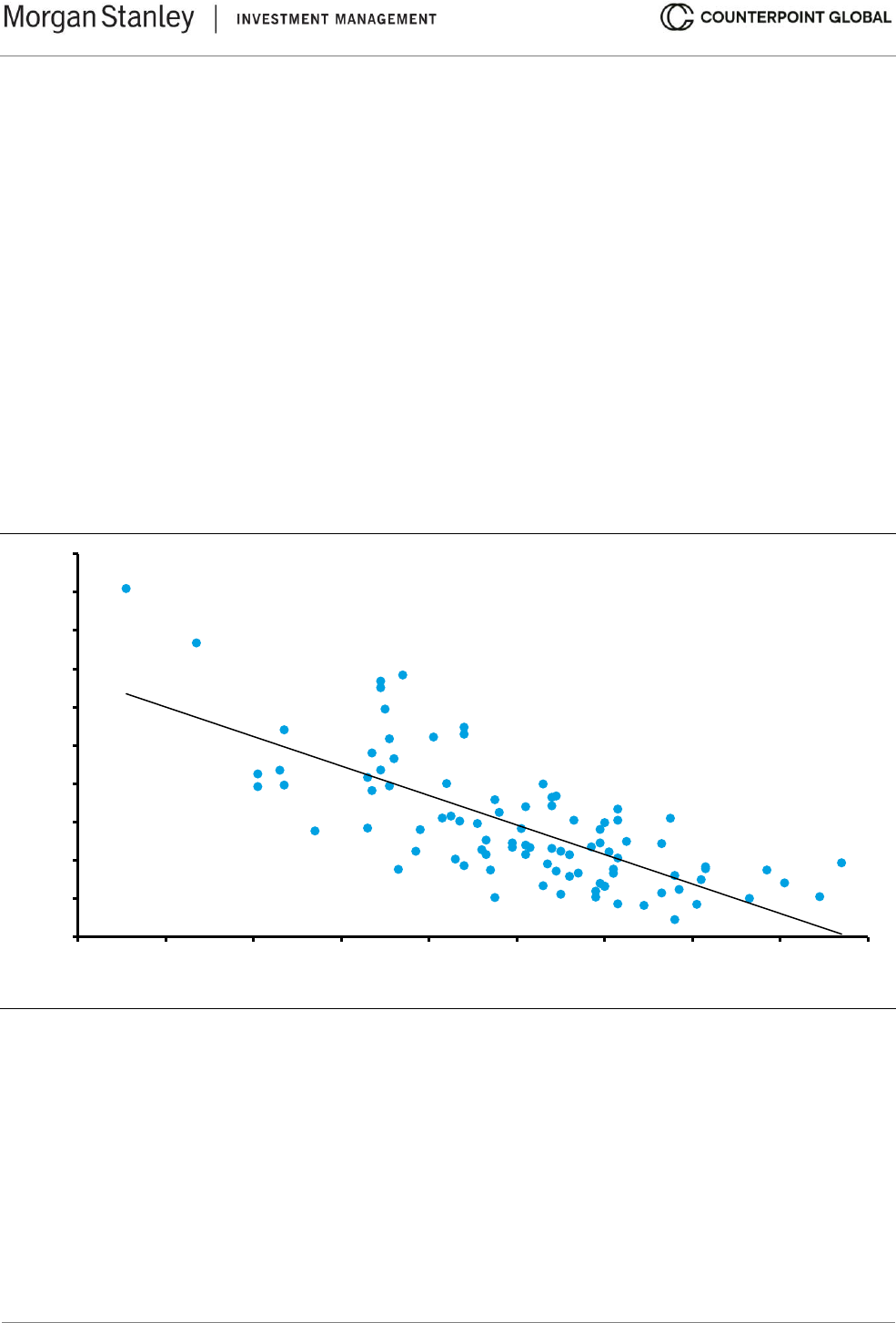

Exhibit 7 shows the relationship between Damodaran’s cost of equity estimates (x-axis) and the subsequent

total returns for the S&P 500 over the following 10 years (y-axis). While not perfect, there is a distinct association

between expected and realized returns.

We find Damodaran’s estimates to be sensible and note that FactSet uses his equity risk premium as the default

in their calculations of the cost of capital.

Exhibit 7: Cost of Equity and Future TSRs, S&P 500, 1961-2022

Source: FactSet; Aswath Damodaran; Counterpoint Global.

We ultimately want an ERP that looks forward, but understanding historical averages is helpful to place current

conditions in context. Calculating the historical ERP might appear straightforward, but it requires judgment about

the appropriate risk-free rate, the time period over which to measure results, and the choice of an arithmetic or

geometric average. Damodaran finds that the historical ERP can fall in the range of 3 to 12 percent based on

the various combinations of alternatives.

37

The total return on the 10-year Treasury note works well as a proxy for the risk-free rate. Using returns from

Treasury bills or bonds requires a commensurate adjustment to the ERP.

The issue of time horizon is thornier. The argument in favor of shorter time horizons is that they better capture

present conditions. The argument against a short time frame is that it may not accurately reflect the full

distribution of outcomes. An estimate’s accuracy can be measured with the standard error, which is calculated

as the observed standard deviation divided by the square root of the sample size.

In plain words, using a small sample of a large distribution of outcomes increases the possibility that your

estimate is wrong because you fail to capture a lot of relevant data. For example, returns for the S&P 500 since

-2%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20%

S&P 500 TSR,

Next 10 Years (Annualized)

Cost of Equity

r = 0.66

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

17

1928 have had a standard deviation of just under 20 percent. That series includes more than 90 years, which

gets the standard error down to about 2.0 percent (0.02 = 0.197 ÷ 94^

0.5

). That the standard errors are as large

or larger than the ERP for periods of fewer than 20 years supports the case for a longer time period.

Historical averages to estimate the ERP can be calculated using arithmetic or geometric returns. The difference

between the two is material. The arithmetic mean is the average of the annual ERPs (equity market - risk-free

rate). The geometric mean is the compound annual rate of return. The geometric return is always less than or

equal to the arithmetic return and can be approximated by taking one-half of the variance of returns. Variance is

the square of the standard deviation.

The difference between arithmetic and geometric returns grows as the standard deviation of the results in the

time series increases. For equity less bond returns in the U.S. from 1928-2022, the arithmetic return was 6.6

percent and the geometric mean was 5.1 percent. The difference, 1.5 percentage points, is a large percentage

of the value of both totals.

The arithmetic average is appropriate if the objective is to estimate the equity risk premium over the next year.

The geometric average is proper over multiple time periods.

The second approach is an estimate of the ERP implied by market prices. The idea is that the key drivers of

value, including earnings and dividends, follow long-term trends that are somewhat predictable. With a sense of

future cash flows and knowledge of the prevailing price, it is possible to solve for the discount rate that equates

the present value of future free cash flows to today’s price.

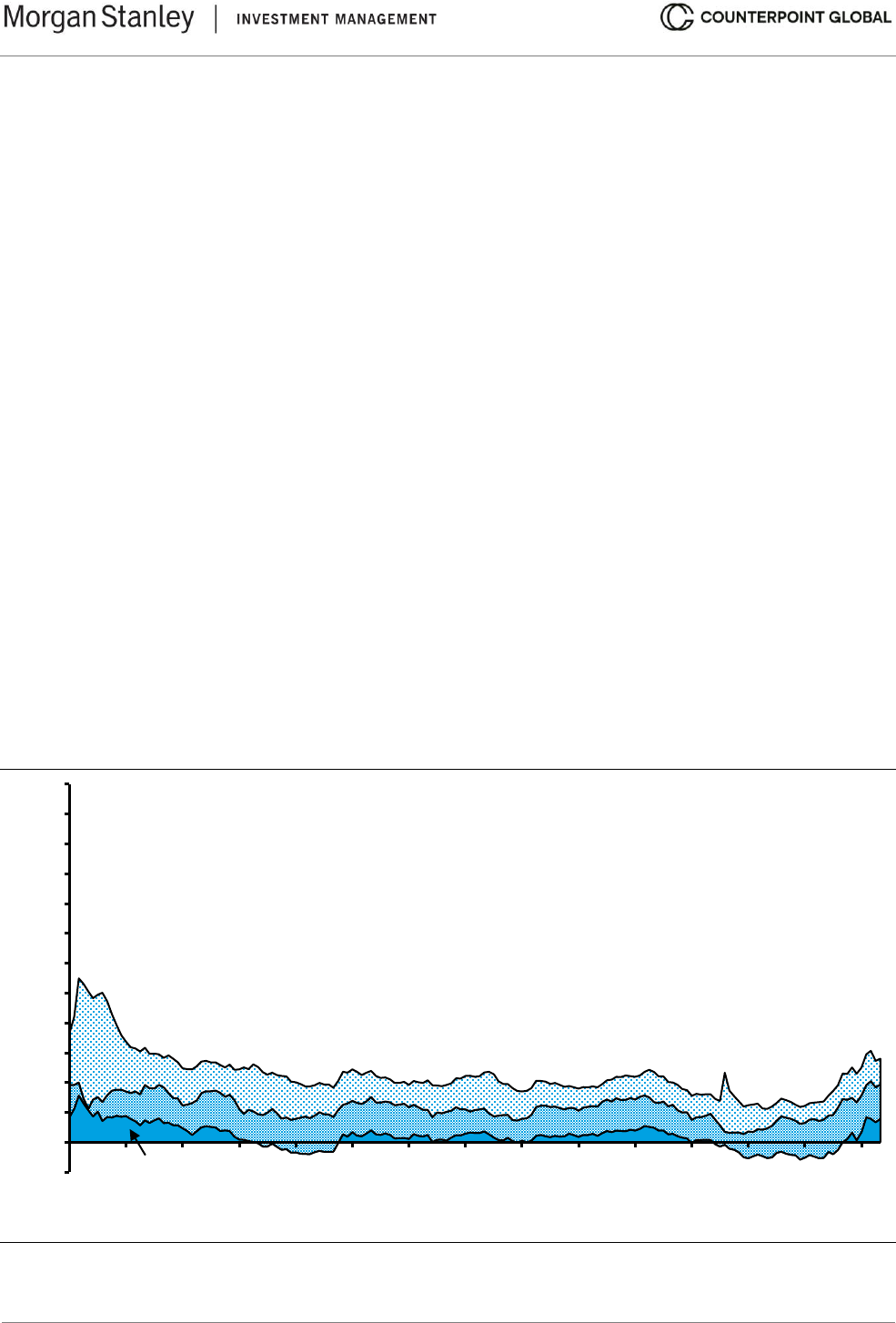

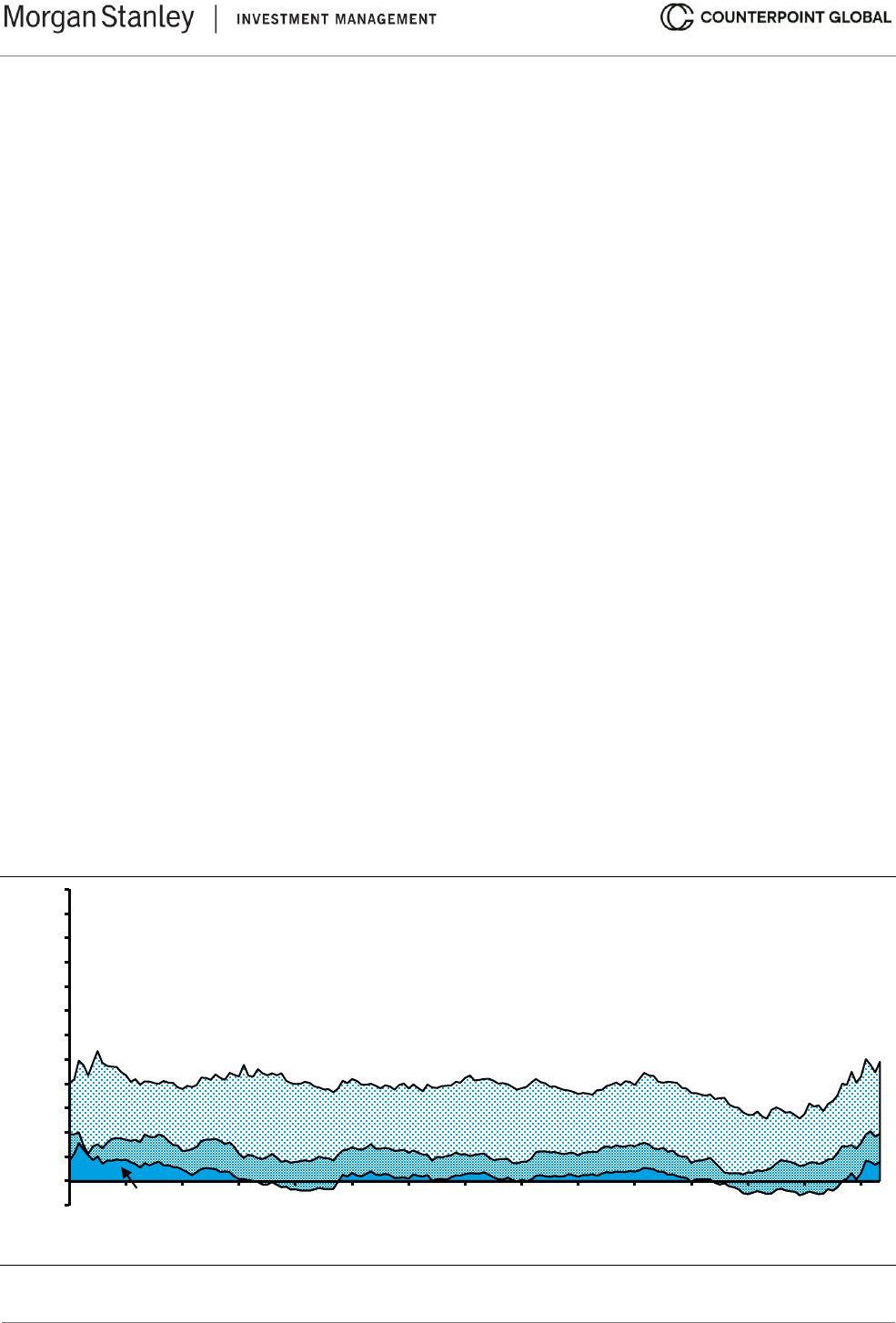

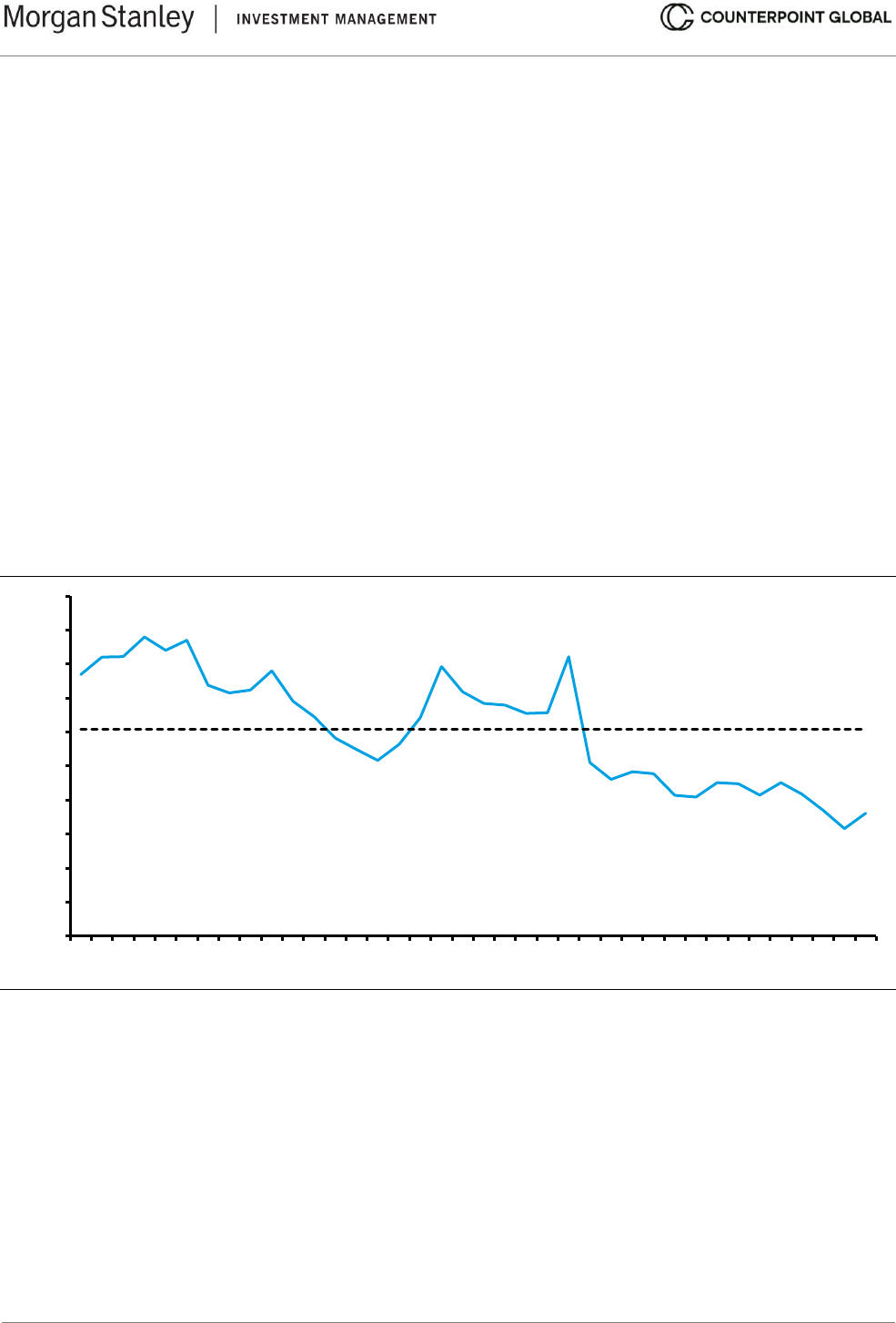

Exhibit 8 shows the expected returns for the U.S. stock market from August 2008 through 2022 using the 10-

year Treasury note as the risk-free rate and Damodaran’s estimate of the ERP. The average ERP over this

period was 5.5 percent, with a high of 7.7 percent in February 2009 and a low of 3.9 percent in July 2021.

Expected return, which adds the yield on the 10-year U.S. Treasury note to the ERP, peaked at 10.7 percent in

February 2009 and bottomed at 5.1 percent in December 2020. All of these figures are unadjusted for inflation.

In 2022, expected returns jumped from 5.8 percent at the beginning of the year to 9.8 percent at the end.

Exhibit 8: Expected Return on U.S. Equities Calculated Monthly, 2008-2022

Source: Aswath Damodaran; FRED at the Federal Reserve Bank of St. Louis; Counterpoint Global.

Note: August 2008-December 2022; Treasury note=10-year U.S. Treasury note.

-2

0

2

4

6

8

10

12

14

16

18

20

22

24

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Percent

Equity Risk Premium

Inflation Expectations

Treasury Note Real Yield

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

18

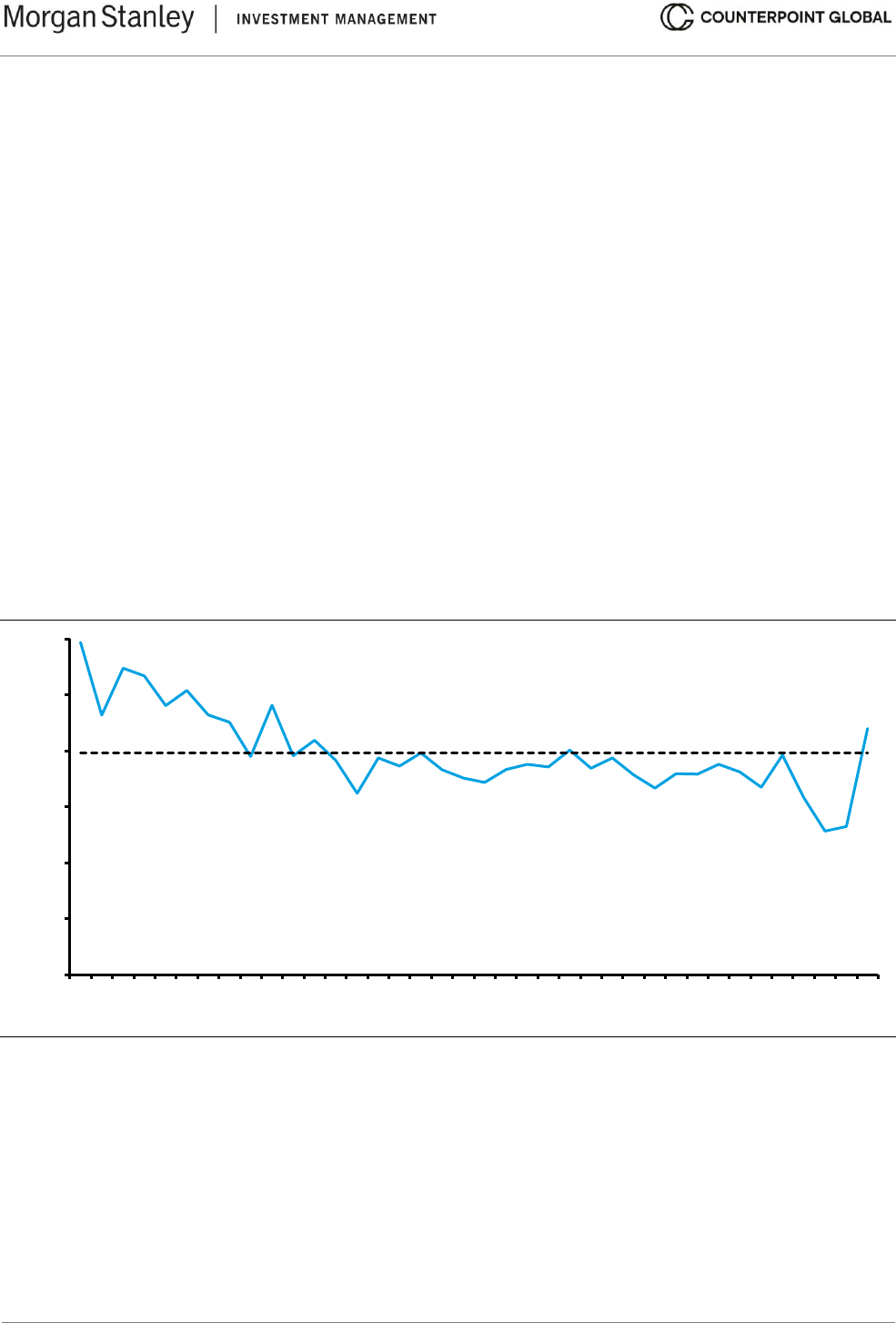

Exhibit 9 shows the risk-free rate, the implied ERP, and the ratio between the two from 1961 to 2022. This

provides a sense of the sources of return. From 1961 through about 2000, the ratio of the ERP to the risk-free

yield was about 0.6, which means that the ERP was consistently below the risk-free rate.

That ratio started rising following the dot-com bust, jumped after the financial crisis, and spiked to more than five

times with the actions taken to deal with COVID. In 2022, the estimated ERP increased 170 basis points and

the yield on the risk-free rate rose 230 basis points, lowering the ratio between the ERP and risk-free rate to

about 1.5 times. The current ratio is in line with those in the 2000s, while still far from the average of 1961-1999.

Exhibit 9: Equity Risk Premium and the Risk-Free Rate, 1961-2022

Source: Aswath Damodaran; FRED at the Federal Reserve Bank of St. Louis; Counterpoint Global.

Note: Data reflect end of year; Treasury note=10-year U.S. Treasury note.

Comparing the ERP to credit spreads is another way to assess whether it is calibrated sensibly. We can use

expected fixed income returns, which are observable, as a benchmark to estimate expected equity returns,

which are unobservable.

The ERP is higher than the credit spread because stocks are riskier than bonds. However, there have been

periods of very high valuations in the equity markets that implied low future equity returns. The peak of the

market in March 2000 is an example.

38

Returns for large-capitalization stocks were poor for the following decade

relative to history.

Exhibit 10 shows the relationship between the ERP and the spread between bonds rated Baa by Moody’s and

the risk-free rate from 1980 through 2022. On average, the ERP has averaged around 2.0 times the credit

spread. A ratio above the average suggests that stocks are attractive relative to investment-grade bonds, and a

ratio below the average implies that bonds look good relative to stocks. The ratio was 3.0 at the end of 2022.

0

1

2

3

4

5

6

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

1961

1964

1967

1970

1973

1976

1979

1982

1985

1988

1991

1994

1997

2000

2003

2006

2009

2012

2015

2018

2021

Equity Risk Premium /

Treasury Note Yield

Equity Risk Premium and

Treasury Note Yield

ERP /

Treasury

Note Yield

Equity Risk

Premium

Treasury

Note Yield

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

19

Exhibit 10: Equity Risk Premium and Baa Spread, 1980-2022

Source: Aswath Damodaran; FRED at the Federal Reserve Bank of St. Louis; Counterpoint Global.

Note: Data reflect end of year; Baa spread=Moody's Seasoned Baa Corporate Bond Yield minus yield on 10-year U.S.

Treasury note.

The Cboe Volatility Index (VIX) is a measure of the implied annual volatility of options on the S&P 500 Index and

is considered a gauge of collective risk aversion (see exhibit 11).

39

Generally, a rising VIX indicates an increase

in fear among investors and is consistent with poor stock market returns, and a decline in the VIX suggests a

decrease in fear and goes with good market results. Note the spikes in March 2009 as a result of the financial

crisis and in 2020 because of COVID.

Exhibit 11: Cboe Volatility Index (VIX), Monthly, 1990-2022

Source: FRED at the Federal Reserve Bank of St. Louis and Counterpoint Global.

Note: Data reflect end of month.

0

1

2

3

4

5

6

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Equity Risk Premium / Baa Spread

Equity Risk Premium and Baa Spread

ERP /

Baa Spread

Equity Risk

Premium

Baa Spread

0

10

20

30

40

50

60

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Price

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

20

Credit spreads and the level of the VIX provide a proxy for collective risk aversion independent of the ERP. Low

spreads and volatility imply that investors are seeking risk, and high readings indicate fear of risky assets.

Low risk aversion translates into higher asset prices, holding constant the prospects for future cash flow. High

asset prices are associated with less upside and more downside in equity returns. Asset prices are often

vulnerable to decline when risk is perceived to be low. Examples include the spring of 2000, summer of 2007,

and fall of 2021. Asset prices are often very attractive when risk appears to be high, as we saw in March 2009

and March 2020.

The market places a price on other measures of risk that can be informative when considering the ERP. The

signals are strongest when the ERP, credit spreads, and VIX all indicate similar levels of extreme fear or greed.

Beta. Despite the CAPM’s popularity among practitioners, the concept of beta has been challenged on empirical

and intellectual grounds. The empirical problem is that beta does not predict expected returns the way it is meant

to. Specifically, stocks with low betas generate higher returns, and stocks with high betas deliver lower returns,

than the model predicts. The intellectual objection is that volatility in general, and beta in particular, are poor

ways to measure risk. Value investors generally define risk as potential permanent loss of capital and argue that

the volatility of asset prices does a poor job of capturing that risk.

We discuss methods to improve the measurement of beta and also review alternative approaches to estimating

the cost of equity. The objective is to come up with an estimate that captures the opportunity cost of equity

investors in a portfolio setting and that makes business, economic, and common sense.

Beta measures the return of an individual security relative to the return on the market index. It reflects financial

elasticity. You calculate a historical beta by doing a regression analysis with the market’s total returns as the

independent variable (x-axis) and the asset’s total returns as the dependent variable (y-axis). The slope of the

best-fit line is the beta.

40

The slope of the regression line is the rise (up or down) over the run (left to right). The beta is 1.0 for a security

that goes up and down the same as the market. The beta is 2.0 for an asset that goes up or down at a percentage

twice that of the market. That asset is considered to be riskier than the market. The beta is 0.5 if the security

rises and falls at a rate that is one-half of the market’s percentage. That security is less risky than the market.

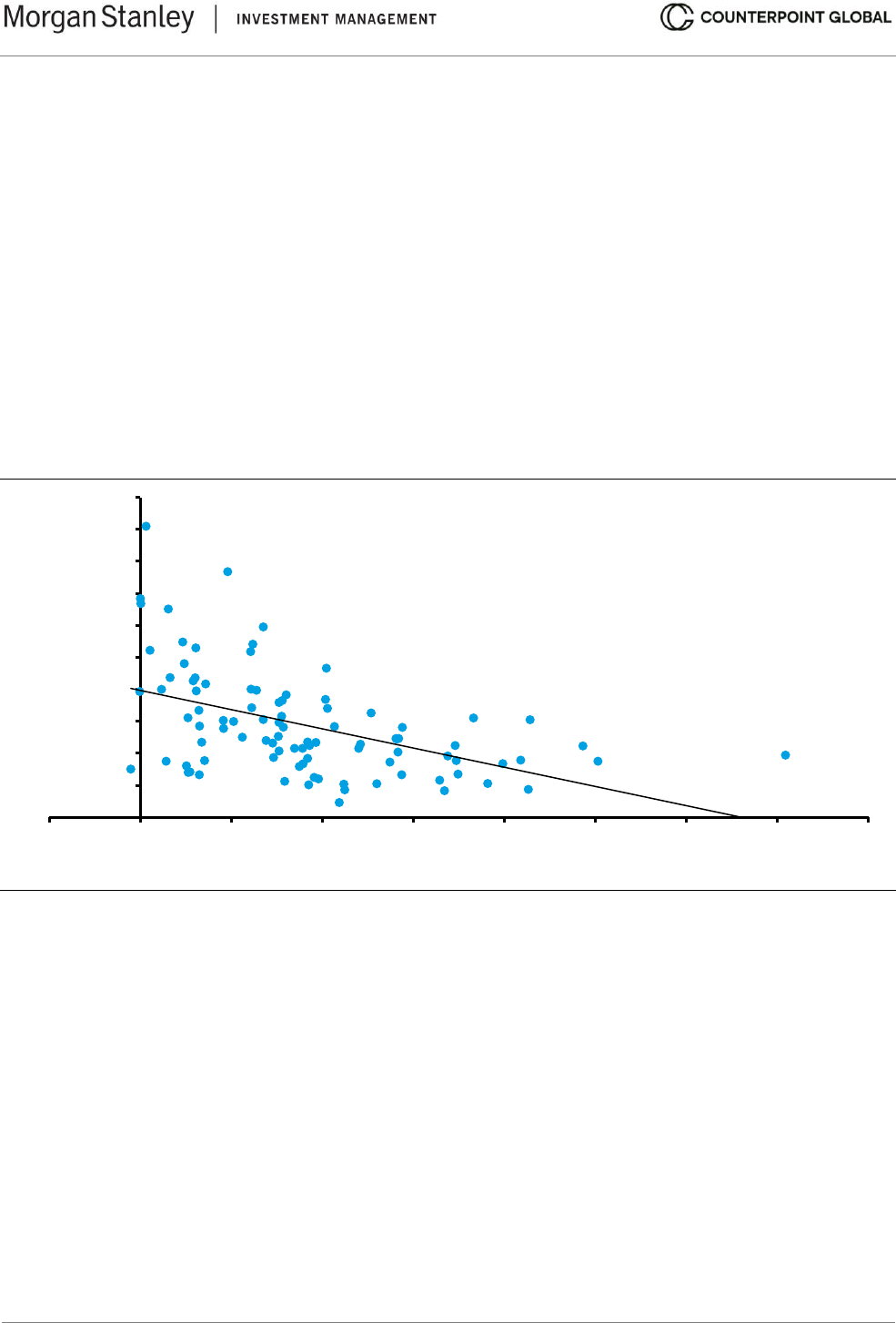

Exhibit 12 shows the beta for Nike, a sportswear company, using monthly returns over the 60 months ended

2022, and the S&P 500 as the index. The beta is 1.09. The equation for the “slope intercept form” of a straight

line is y = mx + b. In this equation, which appears in the top right corner of exhibit 12, “m” equals beta (slope)

and “b” is alpha (intercept). Alpha is the y-intercept of a regression line and as such captures the excess return.

If you combine all of the assets in an index and correlate it versus the index itself, you will get a beta of 1.0 and

an alpha of zero before consideration of any costs.

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

21

Exhibit 12: Beta and Alpha for the Stock of Nike, 60 Months Through 2022

Source: FactSet.

Similar to the ERP, beta should be a measure that looks forward but is unobservable. As a result, to estimate it

we have to examine historical relationships and make adjustments to remove some of the noise.

Calculating beta requires a number of judgments. These include which index to compare to, how far back in

history to go, and whether to measure frequency on a daily, weekly, monthly, quarterly, or yearly basis.

The benchmark the marginal buyer of the security is likely to use is a good way to think about the appropriate

index for comparison. The S&P 500 is a sensible candidate for investors in the United States as it is by far the

most common benchmark. The beta will vary based on the benchmark. Exhibit 13 shows the beta for Nike (60-

month, using monthly returns) calculated for four indexes. The betas are clustered for the indexes based in the

U.S., but the figure increases to 1.25 using the MSCI ACWI, a global equity index captures the performance of

nearly 3,000 large- and mid-capitalization stocks in 23 developed and 24 emerging markets.

Exhibit 13: Nike’s Beta Using Four Benchmarks

Relative to: Beta

S&P 500 1.09

Russell 1000 1.07

Dow Jones 1.07

MSCI ACWI 1.25

Source: FactSet and Counterpoint Global.

Note: Monthly returns over the 60 months ended 2022.

y = 1.09x + 0.50

-25

-20

-15

-10

-5

0

5

10

15

20

25

-25 -15 -5 5 15 25

Nike Monthly Returns (Percent)

S&P 500 Monthly Returns (Percent)

Intercept = Alpha

Slope = Beta

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

22

Another decision is how far back to go in time. The benefit of going back further is that there are more data and

the regression result is more reliable as a result. The drawback is that the company may have changed its

business model, business mix, or levels of financial leverage. Or it may have simply matured. Longer is better

for companies with stable business models and capital structures. Calculate a rolling beta if you sense that data

from the past fail to reflect the present. You can consider a shorter period if the beta changes materially during

the period you measure.

Exhibit 14 shows the betas for Nike using the S&P 500 and monthly returns over four different time horizons.

Here again, the figures for three to seven years are close to one another. There is a modest drop only at 10

years. The exhibit also shows the strength of the correlation, R-squared, between the returns for the market and

the stock in each period. The correlations weaken the further you look back.

Exhibit 14: Nike’s Beta Using Four Time Periods

Measurement period Beta R-squared

Three years 1.10 49%

Five years 1.09 49%

Seven years 1.06 43%

Ten years 1.00 37%

Source: FactSet and Counterpoint Global.

Note: Monthly returns over the 60 months ended 2022.

The frequency of the measurement is the last choice. More frequent measurement creates more data. However,

McKinsey’s book on valuation and work by Aswath Damodaran both suggest biases associated with daily or

weekly data for beta estimation.

41

McKinsey recommends monthly data, and Damodaran recommends using

high-frequency data only with certain adjustments. A good place to start is monthly returns over 60 months.

Exhibit 15 shows Nike’s beta relative to the S&P 500 using daily, weekly, monthly, quarterly, and yearly

frequencies over five years. The results are in the range of 1.03 to 1.09 except for the quarterly measure. Also

included are the standard errors.

Exhibit 15: Nike’s Beta Relative to the S&P 500 Using Five Measurement Frequencies

Frequency Beta Standard error

Daily 1.07 0.03

Weekly 1.09 0.07

Monthly 1.09 0.15

Quarterly 1.28 0.26

Yearly 1.03 0.45

Source: FactSet and Counterpoint Global.

Note: Returns over the 5 years ended 2022.

The process is imprecise even with thoughtful choices in calculating the historical beta. For instance, Amazon’s

60-month raw beta versus the S&P 500 based on monthly returns is 1.22 with an R

2

of 44 percent and a standard

error of 0.18. These figures suggest you can be 95 percent confident that Amazon’s beta is somewhere between

0.86 and 1.58, which reveals the imprecision of a single number. There are a few ways to improve the estimate

of beta.

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

23

Adjusted Beta. The first method regresses the beta toward 1.0 to create an adjusted beta. Bloomberg and

Value Line use this technique. Here’s the formula that is commonly used:

Adjusted beta = Raw beta (0.67) + 1.0 (0.33)

So, for example, Amazon’s adjusted beta is 1.15 ([1.22*.67]) + [1.0*.33]).

The justification for this adjustment is the empirical evidence that betas tend toward 1.0 over time.

42

This makes

economic and intuitive sense. The value of a company can be broken down into a steady-state value and the

present value of growth opportunities (PVGO).

43

The steady-state value comes from assets in place and reflects

the cash flows the business currently generates. The PVGO reflects the expected value of future investments

that create value.

The value of most companies is a combination of the two, and as a company matures the steady-state

contributes more to value and the PVGO adds less. Research shows that the investments in the PVGO are

riskier than the assets in place. That means they have higher betas. As the mix of firm value shifts from PVGO

toward steady-state, the beta drifts lower.

44

This adjustment is reasonable but applying proper weights is a challenge. The rate at which betas converge to

1.0 is different from one company to the next. But overall, some regression in the beta toward 1.0 generally

improves the estimate of a beta that seeks to reflect future risk.

Acknowledging that betas regress is especially important in calculating a continuing value. In a DCF model, the

continuing value is an estimate of the value beyond the explicit forecast period. Healthy businesses tend to

become larger, more profitable, and more stable as they mature. That means that the cost of capital used to

estimate the continuing value should reflect the business characteristics in the future versus what they are today.

Industry Beta. Another way to improve beta is to use an industry beta rather than the beta of an individual

company. The economic rationale is that business risk, or variability of cash flows, will be similar for all

companies within an industry. An industry beta can reduce error by using a larger sample, potentially cancelling

the noise that appears in the estimation of beta for individual companies.

The calculation of an industry beta has three steps:

1. Unlever the beta. A company’s beta combines business risk and financial risk. We want to measure business

risk first, so we need to remove the effect of financial leverage from the beta. The equation to unlever the beta

is based on M&M’s invariance proposition:

45

β

U

= β

L

/[1 + (1 – T) D/E)]

Where:

β

U

= Beta unlevered

β

L

= Beta levered

T = Tax rate

D = Market value of debt

E = Market value of equity

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

24

To illustrate, consider the stock of a company with a raw beta of 1.2, a 25 percent tax rate, and 20 percent debt

and 80 percent equity (note that D/E is not the ratio of debt to total capital but of debt to equity):

β

U

= 1.2/[1 + (1 – .25) .20/.80)]

= 1.2/[1 + .75(.25)]

= 1.2/1.1875

β

U

= 1.0

2. Calculate the average beta for the industry. The trick here is defining the industry. Ideally, it is a group of

companies with similar business risk because they are exposed to the same markets, create comparable

products, and deal with similar customers. The average can be weighted by market capitalization, and

calculating the median helps check for potential outliers that might distort the average.

3. Relever the beta for the specific company. Unlevering the beta isolates business risk, which is considered

uniform for companies within the same industry. We must now reintroduce financial risk, which can vary for

companies within the same industry. Financial risk is estimated using a company’s expected long-term capital

structure. The formula to relever the beta is:

β

L

= β

U

[1 + (1 – T) D/E]

Take for example a company that has an industry beta of 1.05, a 20 percent tax rate, and 25 percent debt and

75 percent equity:

β

L

= 1.05 [1 + (1 – .20) .25/.75)]

= 1.05 [1 + .80(.333)]

= 1.05 [1.267]

β

U

= 1.33

The motivation to calculate an industry beta is to come up with a more accurate and stable estimate of a

company’s risk. But there is not a great deal of evidence that industry betas are much better than firm-specific

betas as they face a lot of the same analytical issues.

46

Further, many companies operate in multiple lines of

business and estimating the risk for each is cumbersome, even if it provides an improved estimate of beta.

47

Aswath Damodaran provides his estimates of levered and unlevered betas for dozens of industries and includes

a correction for industries with lots of cash. When cash exceeds debt, a company has negative financial risk.

This dampens the volatility of cash flows and lowers the risk for shareholders.

Winsorized Beta. Ivo Welch, a professor of finance, finds the predictive value of beta improves when past

returns are winsorized.

48

Winsorizing removes extreme values in a data series to reduce the impact of non-

representative outliers.

Using daily returns, data are cut off at -2 times and +4 times the market’s return. For instance, if the market’s

return on one day is +5 percent, the stock’s returns are winsorized at -10 and +20 percent. If the market is down

5 percent, the returns are winsorized at -20 to +10 percent. This process changes the slope of the regression

and hence the beta.

Welch finds that this modification produces a beta that better predicts future betas than does a simple regression

or a regression combined with an adjustment.

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

25

The cost of equity is an opportunity cost that is implicit and therefore difficult to pin down with precision. But all

is not lost. There are procedures, including comparing figures to other measures that are set by the market and

applying business sense, that can allow for a useful calculation. Remember, too, that what determines a great

investment is how the expectations for future cash flows change over time. The biggest driver of expectations is

business results.

To summarize this section, we recommend using the 10-year Treasury note as the risk-free rate, an equity risk

premium that looks forward, and a 60-month, monthly beta that is adjusted as appropriate. Each calculation is

open to debate but this is a good starting point. Estimates for the cost of equity should also be checked by

examining other forms of risk priced by the market.

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

26

Weighted Average Cost of Capital

The weighted average cost of capital (WACC) combines the opportunity cost of the sources of capital with the

relative contribution of those sources based on target weights.

We can start with the simple example of a company funded solely with debt and equity. Assume an after-tax

cost of debt of 5 percent and a cost of equity of 10 percent that is financed with 20 percent debt and 80 percent

equity. The weighted average cost of capital would be 9.0 percent, calculated as follows:

WACC = (cost of debt × weighting of debt) + (cost of equity × weighting of equity)

= (5% × 20%) + (10% × 80%)

= 1.0% + 8.0%

= 9.0%

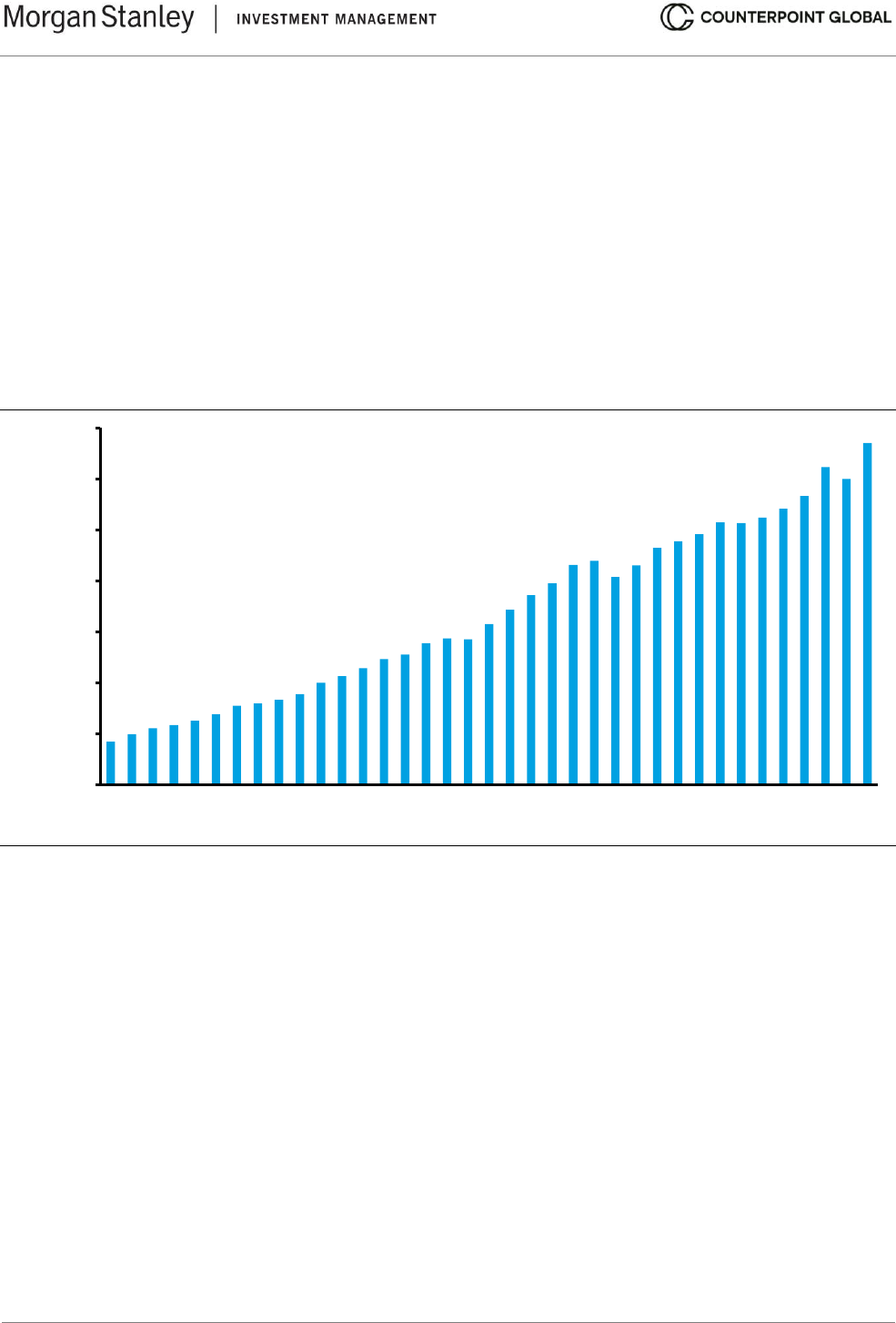

Exhibit 16 shows an estimate of WACC for companies in the Russell 3000, a good proxy for the overall U.S.

equity market, from 1985 to 2022. We use Aswath Damodaran’s estimates for the cost of equity, the yield on

Baa-rated bonds as a proxy for the pre-tax cost of debt, the overall effective corporate tax rate, and the aggregate

debt-to-total capital ratio from each year. The average WACC over the full period was 7.9 percent, and the

estimate at the end of 2022 was 8.8 percent.

Exhibit 16: Weighted Average Cost of Capital for the Russell 3000, 1985-2022

Source: FactSet; Moody’s; Aswath Damodaran; FRED at the Federal Reserve Bank of St. Louis; Counterpoint Global

estimates.

Note: Excludes financials and real estate; Capital structure reflects book value of total long- and short-term debt and market

value of equity; cost of debt is the Moody's Seasoned Baa Corporate Bond Yield; cost of equity = yield on 10-year U.S.

Treasury note + equity risk premium.

The weighted average cost of capital is the appropriate rate at which to discount the future free cash flows

attributable to the firm to determine their present value. This is called free cash flow to the firm (FCFF).

When discounting cash flows attributable to equity holders, which is common practice for financial services firms,

the correct discount rate is the cost of equity capital. This is called free cash flow to equity (FCFE). Practitioners

report that they use the FCFF model roughly twice as frequently as the FCFE model.

49

0

2

4

6

8

10

12

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Percent

Average

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

27

There are a number of items to bear in mind when estimating the WACC:

• Weighting of debt and equity should be based on market values and not book values. The reason is that

opportunity cost is based on the prevailing asset price rather than the level at which the company reflects

debt or equity on the balance sheet. Indeed, some companies have negative equity as the result of the

vagary of accounting.

50

Companies sometimes share a target for the debt-to-total capital ratio based on book values. In those

instances, you should translate the target into one based on market values. Most companies try to stay

close to their target capital structures. But use the target weights of debt and equity even if the current

weights are different because you want the best estimate of what the capital structure will look like over

time.

Exhibit 17 shows the debt-to-total capital ratio for the Russell 3000 from 1985 to 2022. The 2022 figure

was 18 percent, below the 30 percent average over the full period. The decline in leverage levels since

2008 notwithstanding, the trend in the U.S. over the last century has been to increase leverage.

51

There

is also evidence that companies adjust their capital structures in reaction to changes in tax rates.

52

Exhibit 17: Debt-to-Total Capital Ratio for the Russell 3000, 1985-2022

Source: FactSet and Counterpoint Global estimates.

Note: Excludes financials and real estate; Capital structure reflects the book value of total long- and short-term debt and the

market value of equity.

• The WACC is the discount rate a company should use for investments that have risk consistent with the

underlying business. Companies and investors sometimes evaluate the attractiveness of an investment

using the cost of funding rather than the cost of capital, especially in cases where the investment is

expected to add to earnings per share. This is incorrect.

However, the discount rate for an investment that is more or less risky than that of the company should

be higher or lower than the company’s overall WACC to reflect that difference. Empirically, companies

commonly stick to one cost of capital, which introduces the risk of overinvesting in high-risk investments

and underinvesting in low-risk investments.

53

0

5

10

15

20

25

30

35

40

45

50

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Percent

Average

© 2024 Morgan Stanley. All rights reserved.

6422586 Exp. 2/28/2025

28

• Don’t adjust your WACC to do scenario analysis. The discount rate should be consistent. You reflect

the range of values by considering different potential outcomes for cash flows.

The expectations infrastructure is an analytical tool that can help create scenarios. It starts with “value

triggers,” including sales growth, operating costs, and investments, and considers how changes in those

triggers ultimately affect sales, operating profit margin, and investment rate. The key is the value triggers

are refined by considering “value factors,” six microeconomic determinants of the ultimate value drivers.

The expectations infrastructure guides analysis of how potential changes in value triggers flow through

value factors in order to determine value.

54

A careful examination of the probabilities and values of the various scenarios is the way to capture and